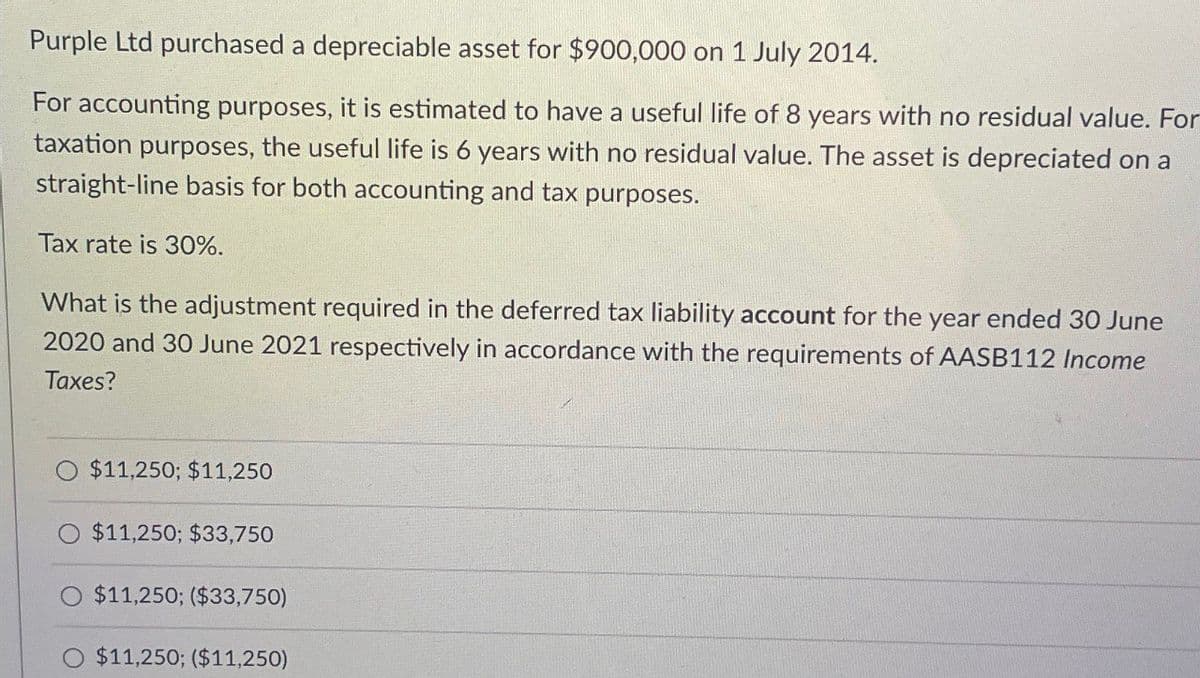

Purple Ltd purchased a depreciable asset for $900,000 on 1 July 2014. For accounting purposes, it is estimated to have a useful life of 8 years with no residual value. For taxation purposes, the useful life is 6 years with no residual value. The asset is depreciated on a straight-line basis for both accounting and tax purposes. Tax rate is 30%. What is the adjustment required in the deferred tax liability account for the year ended 30 June 2020 and 30 June 2021 respectively in accordance with the requirements of AASB112 Income Taxes? $11,250; $11,250 $11,250; $33,750 $11,250; ($33,750) $11,250; ($11,250)

Purple Ltd purchased a depreciable asset for $900,000 on 1 July 2014. For accounting purposes, it is estimated to have a useful life of 8 years with no residual value. For taxation purposes, the useful life is 6 years with no residual value. The asset is depreciated on a straight-line basis for both accounting and tax purposes. Tax rate is 30%. What is the adjustment required in the deferred tax liability account for the year ended 30 June 2020 and 30 June 2021 respectively in accordance with the requirements of AASB112 Income Taxes? $11,250; $11,250 $11,250; $33,750 $11,250; ($33,750) $11,250; ($11,250)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 5RE: Turnip Company purchased an asset at a cost of 10,000 with a 10-year life during the current year....

Related questions

Question

Transcribed Image Text:Purple Ltd purchased a depreciable asset for $900,000 on 1 July 2014.

For accounting purposes, it is estimated to have a useful life of 8 years with no residual value. For

taxation purposes, the useful life is 6 years with no residual value. The asset is depreciated on a

straight-line basis for both accounting and tax purposes.

Tax rate is 30%.

What is the adjustment required in the deferred tax liability account for the year ended 30 June

2020 and 30 June 2021 respectively in accordance with the requirements of AASB112 Income

Taxes?

$11,250; $11,250

$11,250; $33,750

$11,250; ($33,750)

$11,250; ($11,250)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT