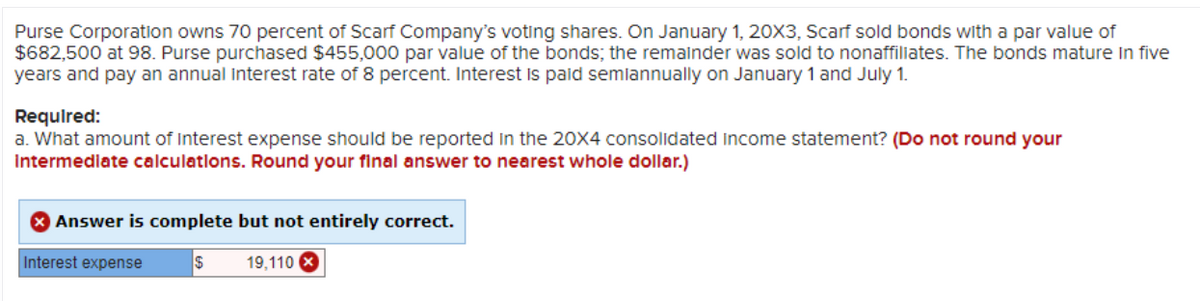

Purse Corporation owns 70 percent of Scarf Company's voting shares. On January 1, 20X3, Scarf sold bonds with a par value of $682,500 at 98. Purse purchased $455,000 par value of the bonds; the remainder was sold to nonaffiliates. The bonds mature in five years and pay an annual interest rate of 8 percent. Interest is paid semiannually on January 1 and July 1. Required: a. What amount of interest expense should be reported in the 20X4 consolidated income statement? (Do not round your Intermediate calculations. Round your final answer to nearest whole dollar.) X Answer is complete but not entirely correct. Interest expense $ 19,110 x

Purse Corporation owns 70 percent of Scarf Company's voting shares. On January 1, 20X3, Scarf sold bonds with a par value of $682,500 at 98. Purse purchased $455,000 par value of the bonds; the remainder was sold to nonaffiliates. The bonds mature in five years and pay an annual interest rate of 8 percent. Interest is paid semiannually on January 1 and July 1. Required: a. What amount of interest expense should be reported in the 20X4 consolidated income statement? (Do not round your Intermediate calculations. Round your final answer to nearest whole dollar.) X Answer is complete but not entirely correct. Interest expense $ 19,110 x

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 1E: Parilo Company acquired 170,000 of Makofske Co., 5% bonds on May 1, 2016, at their face amount....

Related questions

Question

Transcribed Image Text:Purse Corporation owns 70 percent of Scarf Company's voting shares. On January 1, 20X3, Scarf sold bonds with a par value of

$682,500 at 98. Purse purchased $455,000 par value of the bonds; the remainder was sold to nonaffiliates. The bonds mature in five

years and pay an annual interest rate of 8 percent. Interest is paid semiannually on January 1 and July 1.

Required:

a. What amount of Interest expense should be reported in the 20X4 consolidated Income statement? (Do not round your

Intermediate calculations. Round your final answer to nearest whole dollar.)

Answer is complete but not entirely correct.

$ 19,110 x

Interest expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning