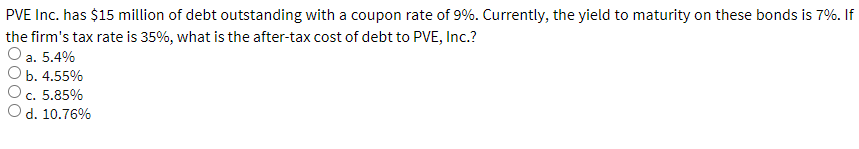

PVE Inc. has $15 million of debt outstanding with a coupon rate c the firm's tax rate is 35%, what is the after-tax cost of debt to PVE, O a. 5.4% O b. 4.55% O c. 5.85% O d. 10.76%

Q: Describe the basic requirements for an individual to be classified as an employer or an employee…

A: Federal Unemployment Tax Act (FUTA) is defined as the payroll taxes that are borne by employers on…

Q: The Winchester Company estimates that its overhead costs will amount to $523,600 and the company's…

A: Overhead is defined as under-applied when the actual amount of overhead incurred is more than the…

Q: On January 1, Year 1, Friedman Company purchased a truck that cost $48,000. The truck had an…

A: Solution: Cost of truck = $48,000 Expected salvage value = $8,000 Useful life = 8 years

Q: n December 15, 2006, Rigsby Sales Co. sold a tract of land that cost $3,600,000 for $4,500,000.…

A: Gross profit is profit earned above the cost and before interest and tax and one of basic parameter…

Q: The following information is available for Sandbill Corporation for the year ended December 31,…

A: Income Statement of Sandhill Corporation for the year ended December 31,2022 Particular…

Q: ! Required information CP9-1 (Algo) Computing Acquisition Cost and Recording Depreciation under…

A: Introduction: As per straight line method of depreciation, depreciation on assets is calculated…

Q: adjusting some transactions before Final Accounts are prepared?

A: The final accounts are prepared after making adjustments. Adjustments are very much required for the…

Q: On December 1, 2022, Blossom Company had the following account balances. Cash Notes Receivable…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: Washington Company made the following estimates for the current accounting period: Overhead costs:…

A: Predetermined Overhead Rate :— It is calculated by dividing total estimated overhead cost by total…

Q: the allocation of dividends to each class of stock, assuming the preferred stock dividend is 6%

A: Answer : Show allocation of dividend to each class of stock, assuming the preferred stock dividend…

Q: preciation by two methods A storage tank acquired at the beginning of the fiscal year at a cost of…

A: In the straight line method of depreciation there is uniform depreciation over the period of…

Q: Hoover Company acquired Burgess Company for $1,200,000 cash. The fair value of Burgess' assets was…

A: Goodwill refers to the concept of determine the extra sum of money value paid by the buyer to the…

Q: 20 11 Received $1,200 cash advance from Bob Carow for an implant. Received $2,100 cash for dental…

A:

Q: Discuss the main investment decision techniques and why government decisions are not only based on…

A: Answer:- Investment decision meaning:- Investing choice, it has to do with how a company's funds…

Q: At the beginning of December 2016, Caribbean Productions Ltd had 700 units of product BMR400 in…

A: There are two different methods for valuing inventory: marginal costing and absorption costing. In…

Q: Chicago Heights company has 2 year contract to construct a warehouse. The contract value is 2949 and…

A:

Q: Solve (2A-2C) Smith Manufacturing currently allocates manufacturing overhead costs by plantwide…

A: The total manufacturing costs comprises of direct materials, direct labor and manufacturing overhead…

Q: Amada Company's standard cost system reports this information from its December operations. $…

A: Direct material: - This are the products which are used to manufacture a product. Direct labor: -…

Q: er. The owners are excited about the future profits that the business will generate. They have…

A: Cash Budget - The estimate of cash inflow and outflow for the specified time period is referred to…

Q: are considering the purchase of a hybrid vehicle. Let's assume the following facts. The hybrid will…

A: Unit variable cost can be calculated using following formula: Cost of gas per gallon / miles…

Q: Last year, Mountain Top, Incorporated, purchased a coal mine at a cost of $900,000. The salvage…

A: Solution: Cost of coal mine = $900,000 Estimated salvage value = $100,000 Estimated life (in tons)…

Q: "Blast it!" said David Wilson, president of Teledex Company. "We've just lost the bid on the Koopers…

A: Since you have posted a question with multiples sub-parts, we will do the first three sub-parts for…

Q: Cash Accounts receivable (net) Inventories Prepaid expenses Equipment.. Accumulated…

A: Cash flow statement shows the cash inflow and outflow from operating, investing and financing…

Q: On January 1, Year 1, Milton Manufacturing Company purchased equipment with a list price of $29,000.…

A: DEPRECIATION Depreciation is the Decrease in the Value of Assets over the time due to use, wear…

Q: 5) Use linear interpolation to find the indicated value. A vehicle purchased for $ 33,000…

A: The value of vehicle depreciate with use of vehicle over the period of time but there are many…

Q: A company purchased $2,000 of merchandise on August 15 with terms 1/10, n/30. On August 17, it…

A: Net Purchase :— It is purchase price less purchase return less purchase discounts. Purchase…

Q: In 2020, Henry Jones (Social Security number 123-45-6789) works as a freelance driver, finding…

A: Every country has its taxation law about deductions, taxable income, etc. Individuals, firms, and…

Q: A manufacturing company that produces a single product has provided the following data concerning…

A: Variable Cost :— It is the cost that changes with change in units. It is constant in per unit for…

Q: The breakdown of the $3,675,000 cost follows: Salaries: Sales manager Salespersons Travel and…

A: Operating Leverage Operating leverage is a cost-accounting method that quantifies how much a…

Q: SE3.Sunburn Fitness Center purchased a new step machine for $8,250. The apparatus is expected to…

A: DEPRECIATION Depreciation Means Loss on Value of Assets Due to Use, Wear, Tear &…

Q: Tom Door Corp. purchased machinery for $300,000 on May 1, 2019. It is estimated that it would have a…

A: Depreciation is charged against the value of fixed assets. It can be calculated by using the…

Q: to make a part are: direct material, $15; direct labor, $27; variable overhead, $15; and applied…

A: Overhead refers to all the expenses that are not directly linked to the production process of…

Q: Domino Company ages its accounts receivable to estimate uncollectible accounts expense. Domino began…

A: Uncollectible accounts expense is the charge made to the books when a customer defaults on a…

Q: The opportunity cost of making a component part in a factory with excess capacity for which there is…

A: The opportunity cost of making a component part in a factory with excess capacity for which there is…

Q: Saratoga Company manufactures jobs to customer specifications. The company is conducting a…

A: Job costing can help businesses determine the cost of specific projects or products, and compare…

Q: SIM Company has computed the following unit costs for the year just ended: Direct material used…

A:

Q: Please answer parts 1-4, I have used another question to get 5-8. Highland Company produces a…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: Munoz Company and Perez Company both apply overhead to the Work in Process Inventory account using…

A: Predetermined Overhead Rate :— It is calculated by dividing total estimated overhead cost by…

Q: In a manufacturing company where the Procurement Department largely buys items for production, the…

A: Solution: To start the procurement activity, procurement department should received requirement…

Q: On January 1, 2022. Carla Vista Corporation had retained earnings of $549,000. During the year.…

A:

Q: The following information is available for the two production departments, machining and assembly,…

A: COST ALLOCATION Cost allocation is the Process of identifying, Aggregating & Assigning Cost to…

Q: how to plan for a new enterprise-wide system that will have 500 operational users and 50 which will…

A: Introductions: For maintenance of 500 operational users there should be a system to manage the users…

Q: Grant's Ironhorse Company manufactures model railroad cars. At the end of October, 2019 the…

A: Income statement also know as profit and loss statement is one of the financial statements. It is…

Q: Four grams of musk oll are required for each bottle of Mink Caress, a very popular perfume made by a…

A: Direct Material Budget :— This budget is prepared to estimate the number of units and cost of direct…

Q: Estimated cost of goods sold Estimated gross margin

A: Given in the question: Budgeted Selling Price Per unit $65 Month Sales Units June…

Q: In-class exercise 19-3 Diluted EPS In order to calculate EPS for the current year, Ajax Corporation…

A: Earnings per share or EPS gives a picture of earnings that each share in the company generates. It…

Q: A machine shop in a factory is working to its full capacity and earning a contribution of RO 50 per…

A: The question is related to accepting an order. In this case the order Price is higher than cost of…

Q: On January 1, Year 1, the Accounts Receivable balance was $29,000 and the balance in the Allowance…

A: Accounts receivables (AR) are defined as the assets that represent the amount to be received from…

Q: Morganton Company makes one product and it provided the following information to help prepare the…

A: The budgeted direct labor cost for July can be calculated by using the following formula: Budgeted…

mc attached

Step by step

Solved in 2 steps

- Bond Yield and After-Tax Cost of Debt A companys 6% coupon rate, semiannual payment, 1,000 par value bond that matures in 30 years sells at a price of 515.16. The companys federal-plus-state tax rate is 40%. What is the firms after-tax component cost of debt for purposes of calculating the WACC? (Hint: Base your answer on the nominal rate.). ABC Co. has $15 million of debt outstanding with a coupon rate of 9%. Currently, the yield to maturity on these bonds is 7%. If the firm’s tax rate is 35%, what is the after-tax cost of debt? A. 10.76% B. 5.85% C. 4.55% D. 5.40%Company B has $50 million of bonds outstanding (face value). These are 10-year bonds, and they are currently selling at 98% of par. The annual coupon rate on the bond issue is 4%. What would be Company B’s before-tax component cost of debt? If company B has a tax-rate of 25%, what is their after-tax cost of debt?

- Electronic Products has 70,000 bonds outstanding that are currently quoted at 105.8. The bonds mature in 15 years and carry a 8.5 percent annual coupon. What is the firm's aftertax cost of debt if the applicable tax rate is 34 percent? Aftertax cost of debt = %NU Inc. has 80 semi-annual bonds outstanding that are selling at $1,033 each. The coupon rate is 3%. The maturity is 25 years. The firm has 5,000 shares of common stock outstanding at a market price of $20 a share. The stock has a beta of 1.4. The U.S. T-bill is yielding 4 percent. The market risk premium is 8 percent. If the tax rate is 21 percent, what is the weighted average cost of capital, assuming all interest is tax deductibleLugget Corp. has one bond issue outstanding with an annual coupon of 4.4%, a face value of $1,000 and a price of $1,119.42, which matures in 10 years. The company's tax rate is 30%. 1. What is Lugget's pre-tax cost of debt? 2. What is the company's after-tax cost of debt?

- Rappaport Industries has 6,250 perpetual bonds outstanding with a face value of $2,000 each. The bonds have a coupon rate of 6.0 percent and a yield to maturity of 6.3 percent. The tax rate is 35 percent. What is the present value of the interest tax shield?A company has outstanding 20-year noncallable bonds with a face value of $1,000,an 11% annual coupon, and a market price of $1,294.54. If the company was to issuenew debt, what would be a reasonable estimate of the interest rate on that debt? Ifthe company’s tax rate is 40%, what is its after-tax cost of debt?Luther Industries has 25 million shares of common stock outstanding, trading at $18 per share. In addition, Luther has bonds with a total face value of $150 million. The bonds have 20 years to maturity, semi-annual coupon payments, an annual coupon rate of 7.5%, and each bond has a market price of $570. If Luther has a corporate tax rate of 21%, what is their effective (or "after-tax") cost of debt?

- Lugget Corp. has one bond issue outstanding with an annual coupon of 4%, a face value of $1,000 and a price of $1,179.65, which matures in 10 years. The company's tax rate is 25%. What is the company's after-tax cost of debt?Mint Industries has a target debt-equity ratio of 0.60, a cost of equity of 10%, and one issue of bonds that are offering a yield to maturity of 7.67%. If Minder’s tax rate is 40%, what is the company’s WACC?Consider the following information for Federated Junkyards of America. Debt: $65,000,000 book value outstanding. The debt is trading at 86% of book value. The yield to maturity is 9%. Equity: 1,500,000 shares selling at $32 per share. Assume the expected rate of return on Federated’s stock is 18%. Taxes: Federated’s marginal tax rate is Tc = 0.21. Calculate the weighted-average cost of capital (WACC).