The following information is available for Sandbill Corporation for the year ended December 31, 2022: sales revenue $810,000, other revenues and gains $86,500, operating expenses $105.000, cost of goods sold $466.000, other expenses and losses $30,500, and preferred stock dividends $46,000. The company's tax rate was 20%, and it had 55,000 common shares outstanding during the entire year. (a) Prepare a corporate income statement. (List other revenues before other expenses.) SANDHILL CORPORATION Income Statement eTextbook and Media V Attempts unlimited Submit Antwer

The following information is available for Sandbill Corporation for the year ended December 31, 2022: sales revenue $810,000, other revenues and gains $86,500, operating expenses $105.000, cost of goods sold $466.000, other expenses and losses $30,500, and preferred stock dividends $46,000. The company's tax rate was 20%, and it had 55,000 common shares outstanding during the entire year. (a) Prepare a corporate income statement. (List other revenues before other expenses.) SANDHILL CORPORATION Income Statement eTextbook and Media V Attempts unlimited Submit Antwer

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 1RE: Brandt Corporation had sales revenue of 500,000 for the current year. For the year, its cost of...

Related questions

Question

Help me be clear. Can you make the date and table

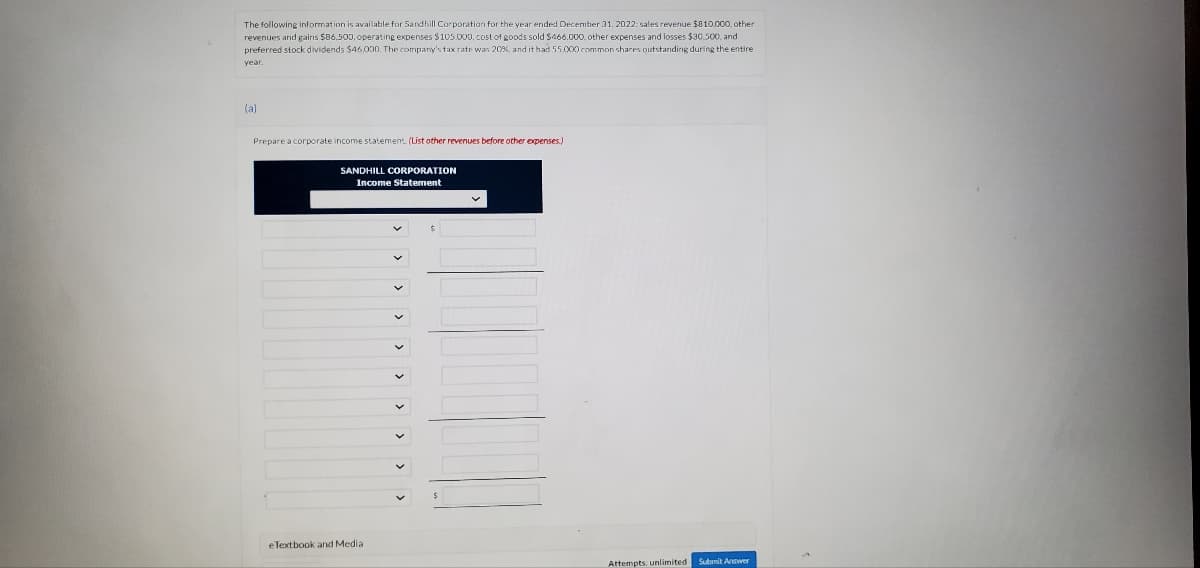

Transcribed Image Text:The following information is available for Sandhill Corporation for the year ended December 31, 2022: sales revenue $810,000, other

revenues and gains $86,500, operating expenses $105.000, cost of goods sold $466.000, other expenses and losses $30,500, and

preferred stock dividends $46,000. The company's tax rate was 20%, and it had 55,000 common shares outstanding during the entire

year.

(a)

Prepare a corporate income statement. (List other revenues before other expenses.)

SANDHILL CORPORATION

Income Statement

eTextbook and Media

Attempts, unlimited Submit Answer

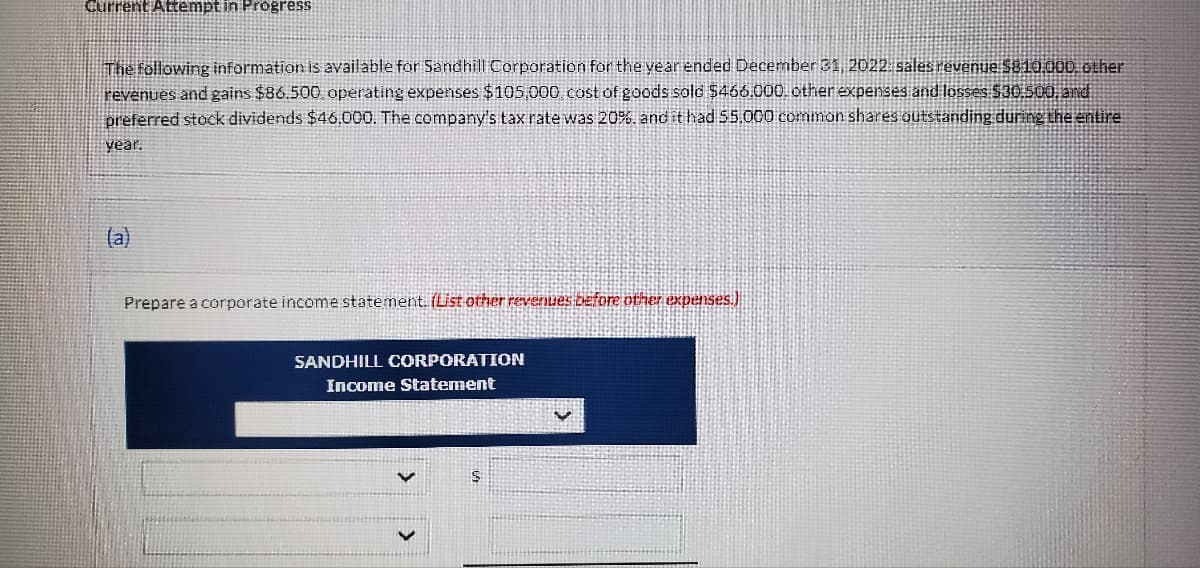

Transcribed Image Text:Current Attempt in Progress

The following information is available for Sandhill Corporation for the year ended December 31, 2022: sales revenue $810.000. other

revenues and gains $86.500, operating expenses $105,000 cost of goods sold $466.000, other expenses and losses $30.500, and

preferred stock dividends $46,000. The company's tax rate was 20%. and it had 55,000 common shares outstanding during the entire

year.

(a)

Prepare a corporate income statement. (List other revenues before other expenses.)

SANDHILL CORPORATION

Income Statement

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT