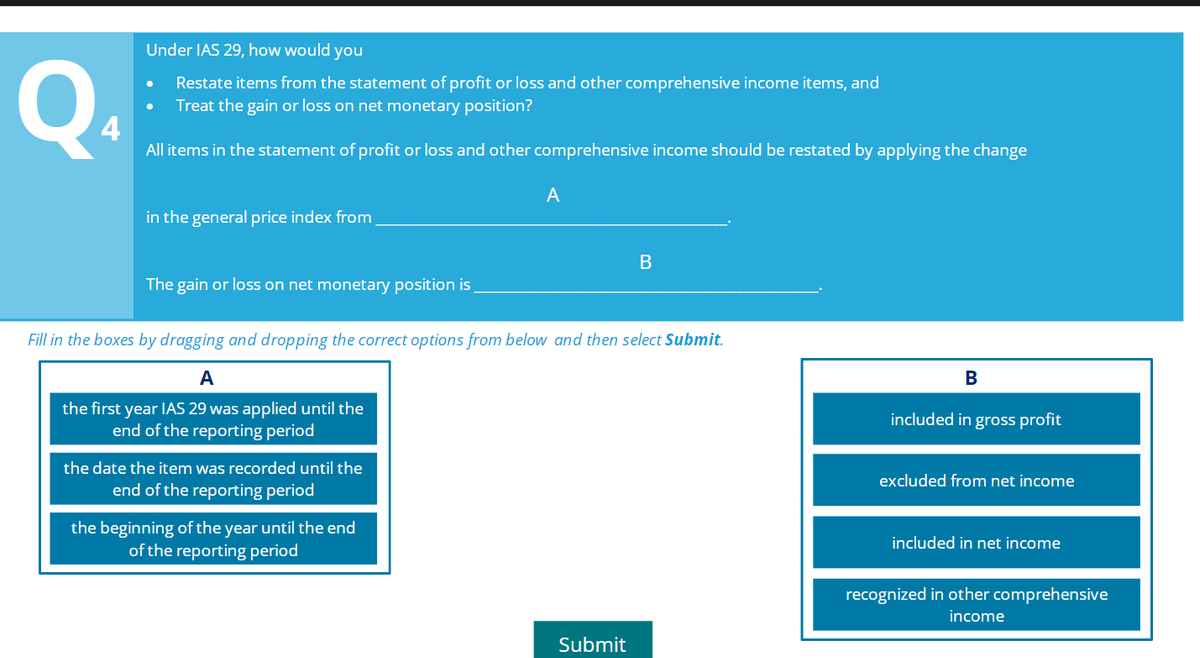

Q 4 Under IAS 29, how would you Restate items from the statement of profit or loss and other comprehensive income items, and Treat the gain or loss on net monetary position? All items in the statement of profit or loss and other comprehensive income should be restated by applying the change in the general price index from The gain or loss on net monetary position is the date the item was recorded until the end of the reporting period A Fill in the boxes by dragging and dropping the correct options from below and then select Submit. A the first year IAS 29 was applied until the end of the reporting period the beginning of the year until the end of the reporting period B Submit B included in gross profit excluded from net income included in net income recognized in other comprehensive income

Q 4 Under IAS 29, how would you Restate items from the statement of profit or loss and other comprehensive income items, and Treat the gain or loss on net monetary position? All items in the statement of profit or loss and other comprehensive income should be restated by applying the change in the general price index from The gain or loss on net monetary position is the date the item was recorded until the end of the reporting period A Fill in the boxes by dragging and dropping the correct options from below and then select Submit. A the first year IAS 29 was applied until the end of the reporting period the beginning of the year until the end of the reporting period B Submit B included in gross profit excluded from net income included in net income recognized in other comprehensive income

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 1EA: Match the correct term with its definition. A. cost principle i. if uncertainty in a potential...

Related questions

Question

Transcribed Image Text:Q

4

Under IAS 29, how would you

Restate items from the statement of profit or loss and other comprehensive income items, and

Treat the gain or loss on net monetary position?

All items in the statement of profit or loss and other comprehensive income should be restated by applying the change

in the general price index from

The gain or loss on net monetary position is

the date the item was recorded until the

end of the reporting period

A

Fill in the boxes by dragging and dropping the correct options from below and then select Submit.

A

the first year IAS 29 was applied until the

end of the reporting period

the beginning of the year until the end

of the reporting period

B

Submit

B

included in gross profit

excluded from net income

included in net income

recognized in other comprehensive

income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning