Q) Susan is 22 years old and today she opened a savings account that offers an interest rate of 12% per year, with an initial deposit of 15000 KD. For the following years she plans to deposit the same amount but with an increase of 150 KD every year until she retires at age 61. a) How much will Susan have available when she retires? b) Calculate the annual equivalent of Susan’s savings plan.

Q) Susan is 22 years old and today she opened a savings account that offers an interest rate of 12% per year, with an initial deposit of 15000 KD. For the following years she plans to deposit the same amount but with an increase of 150 KD every year until she retires at age 61. a) How much will Susan have available when she retires? b) Calculate the annual equivalent of Susan’s savings plan.

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 8EA: You put $250 in the bank for S years at 12%. A. If interest is added at the end of the year, how...

Related questions

Question

Q) Susan is 22 years old and today she opened a savings account that offers an interest rate of 12% per year, with an initial deposit of 15000 KD. For the following years she plans to deposit the same amount but with an increase of 150 KD every year until she retires at age 61.

a) How much will Susan have available when she retires?

b) Calculate the annual equivalent of Susan’s savings plan.

Solve it early but correctly.

Typed or handwriting answer gives not solve in excel.

Expert Solution

Step 1 Part A

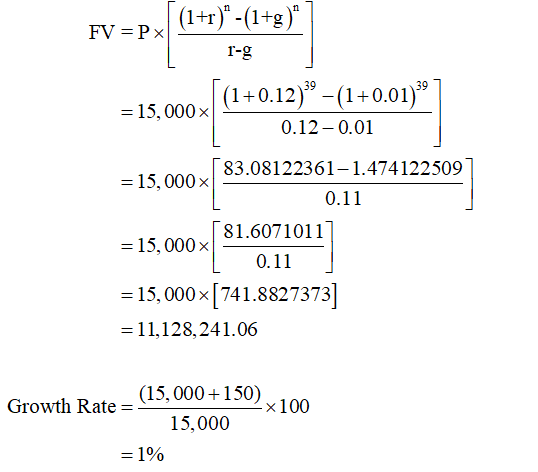

The amount that Susan will receive will be calculated by determining the period for the investment as well as the rate earned and growth rate.

Step 2

The amount Susan have available when retires is shown:

Hence, the amount at retirement is $11,128,241.06.

Note: The amount is in KD.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning