Q.4.1 Cashbook Receipts (Cash is banked on the day of receipt.) Q.4.2 Create individual columns for Debtors Control, Sales, and Output VAT. Petty Cash Create individual columns for Stationery, Input VAT and Staff Entertainment.

Q.4.1 Cashbook Receipts (Cash is banked on the day of receipt.) Q.4.2 Create individual columns for Debtors Control, Sales, and Output VAT. Petty Cash Create individual columns for Stationery, Input VAT and Staff Entertainment.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:·

●

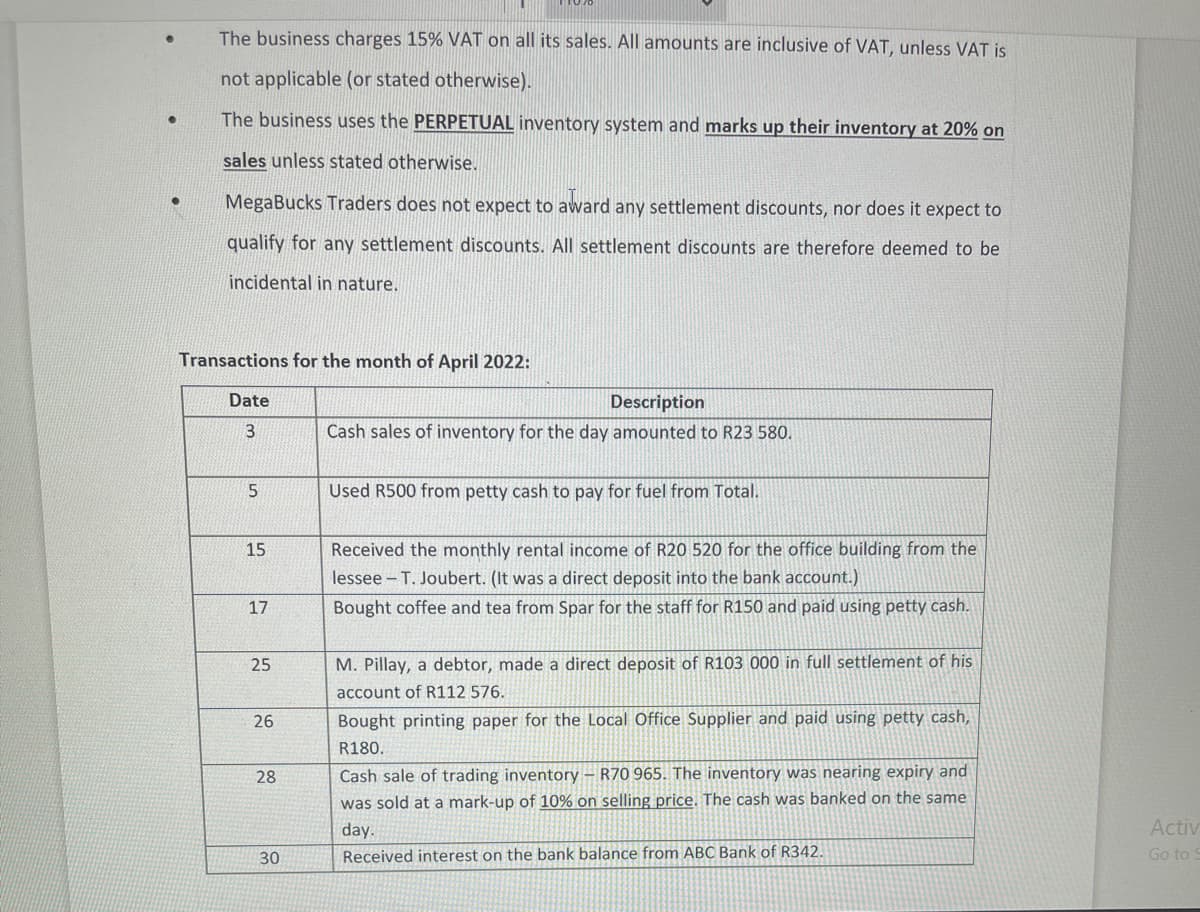

The business charges 15% VAT on all its sales. All amounts are inclusive of VAT, unless VAT is

not applicable (or stated otherwise).

The business uses the PERPETUAL inventory system and marks up their inventory at 20% on

sales unless stated otherwise.

MegaBucks Traders does not expect to award any settlement discounts, nor does it expect to

qualify for any settlement discounts. All settlement discounts are therefore deemed to be

incidental in nature.

Transactions for the month of April 2022:

Date

3

5

15

17

25

26

28

30

Description

Cash sales of inventory for the day amounted to R23 580.

Used R500 from petty cash to pay for fuel from Total.

Received the monthly rental income of R20 520 for the office building from the

lessee - T. Joubert. (It was a direct deposit into the bank account.)

Bought coffee and tea from Spar for the staff for R150 and paid using petty cash.

M. Pillay, a debtor, made a direct deposit of R103 000 in full settlement of his

account of R112 576.

Bought printing paper for the Local Office Supplier and paid using petty cash,

R180.

Cash sale of trading inventory - R70 965. The inventory was nearing expiry and

was sold at a mark-up of 10% on selling price. The cash was banked on the same

day.

Received interest on the bank balance from ABC Bank of R342.

Activ

Go to S

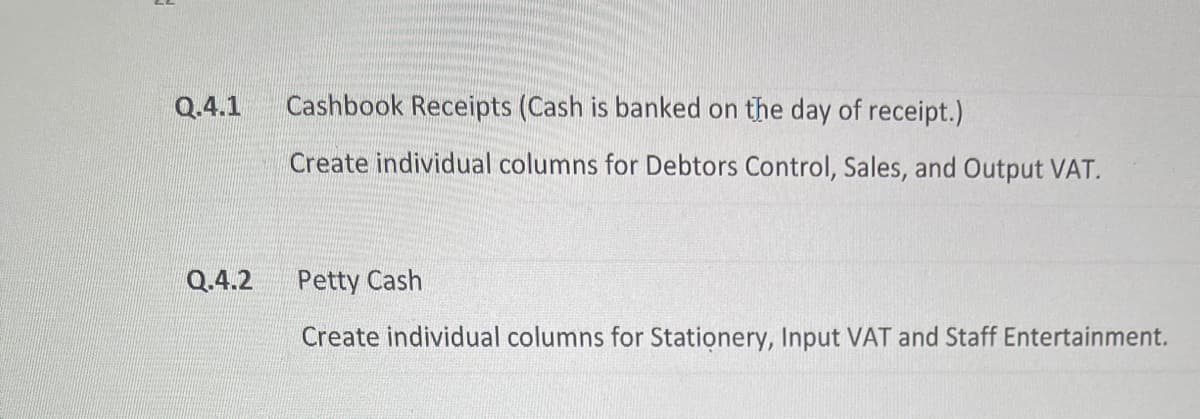

Transcribed Image Text:Q.4.1

Q.4.2

Cashbook Receipts (Cash is banked on the day of receipt.)

Create individual columns for Debtors Control, Sales, and Output VAT.

Petty Cash

Create individual columns for Stationery, Input VAT and Staff Entertainment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education