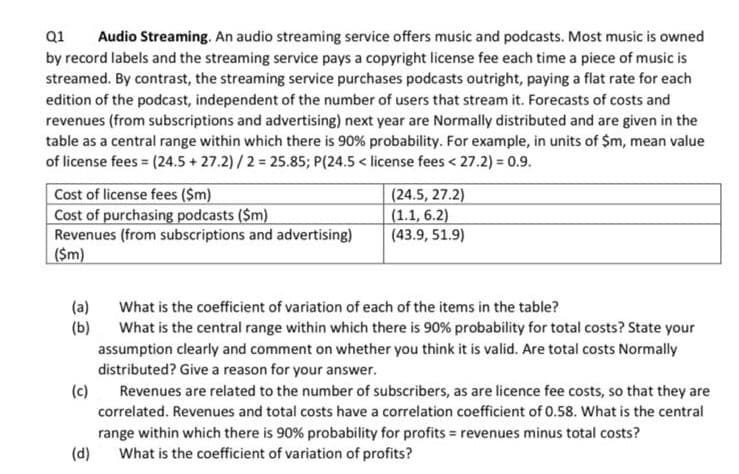

Q1 Audio Streaming. An audio streaming service offers music and podcasts. Most music is owned by record labels and the streaming service pays a copyright license fee each time a piece of music is streamed. By contrast, the streaming service purchases podcasts outright, paying a flat rate for each edition of the podcast, independent of the number of users that stream it. Forecasts of costs and revenues (from subscriptions and advertising) next year are Normally distributed and are given in the table as a central range within which there is 90% probability. For example, in units of $m, mean value of license fees (24.5 + 27.2)/2 25.85; P(24.5< license fees < 27.2) = 0.9. Cost of license fees ($m) Cost of purchasing podcasts ($m) Revenues (from subscriptions and advertising) |($m) (24.5, 27.2) (1.1, 6.2) (43.9, 51.9) (a) (b) assumption clearly and comment on whether you think it is valid. Are total costs Normally distributed? Give a reason for your answer. What is the coefficient of variation of each of the items in the table? What is the central range within which there is 90% probability for total costs? State your (c) Revenues are related to the number of subscribers, as are licence fee costs, so that they are correlated. Revenues and total costs have a correlation coefficient of 0.58. What is the central range within which there is 90% probability for profits = revenues minus total costs? (d) What is the coefficient of variation of profits?

Q1 Audio Streaming. An audio streaming service offers music and podcasts. Most music is owned by record labels and the streaming service pays a copyright license fee each time a piece of music is streamed. By contrast, the streaming service purchases podcasts outright, paying a flat rate for each edition of the podcast, independent of the number of users that stream it. Forecasts of costs and revenues (from subscriptions and advertising) next year are Normally distributed and are given in the table as a central range within which there is 90% probability. For example, in units of $m, mean value of license fees (24.5 + 27.2)/2 25.85; P(24.5< license fees < 27.2) = 0.9. Cost of license fees ($m) Cost of purchasing podcasts ($m) Revenues (from subscriptions and advertising) |($m) (24.5, 27.2) (1.1, 6.2) (43.9, 51.9) (a) (b) assumption clearly and comment on whether you think it is valid. Are total costs Normally distributed? Give a reason for your answer. What is the coefficient of variation of each of the items in the table? What is the central range within which there is 90% probability for total costs? State your (c) Revenues are related to the number of subscribers, as are licence fee costs, so that they are correlated. Revenues and total costs have a correlation coefficient of 0.58. What is the central range within which there is 90% probability for profits = revenues minus total costs? (d) What is the coefficient of variation of profits?

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 20P: Julie James is opening a lemonade stand. She believes the fixed cost per week of running the stand...

Related questions

Question

Part C D

I NEED IN words

not handwritten

Transcribed Image Text:Q1

Audio Streaming. An audio streaming service offers music and podcasts. Most music is owned

by record labels and the streaming service pays a copyright license fee each time a piece of music is

streamed. By contrast, the streaming service purchases podcasts outright, paying a flat rate for each

edition of the podcast, independent of the number of users that stream it. Forecasts of costs and

revenues (from subscriptions and advertising) next year are Normally distributed and are given in the

table as a central range within which there is 90% probability. For example, in units of $m, mean value

of license fees = (24.5 + 27.2) /2 = 25.85; P(24.5 < license fees < 27.2) = 0.9.

Cost of license fees ($m)

Cost of purchasing podcasts ($m)

Revenues (from subscriptions and advertising)

($m)

(24.5, 27.2)

(1.1, 6.2)

(43.9, 51.9)

(a)

(b)

What is the coefficient of variation of each of the items in the table?

What is the central range within which there is 90% probability for total costs? State your

assumption clearly and comment on whether you think it is valid. Are total costs Normally

distributed? Give a reason for your answer.

(c)

Revenues are related to the number of subscribers, as are licence fee costs, so that they are

correlated. Revenues and total costs have a correlation coefficient of 0.58. What is the central

range within which there is 90% probability for profits = revenues minus total costs?

(d)

What is the coefficient of variation of profits?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Production and Operations Analysis, Seventh Editi…

Operations Management

ISBN:

9781478623069

Author:

Steven Nahmias, Tava Lennon Olsen

Publisher:

Waveland Press, Inc.