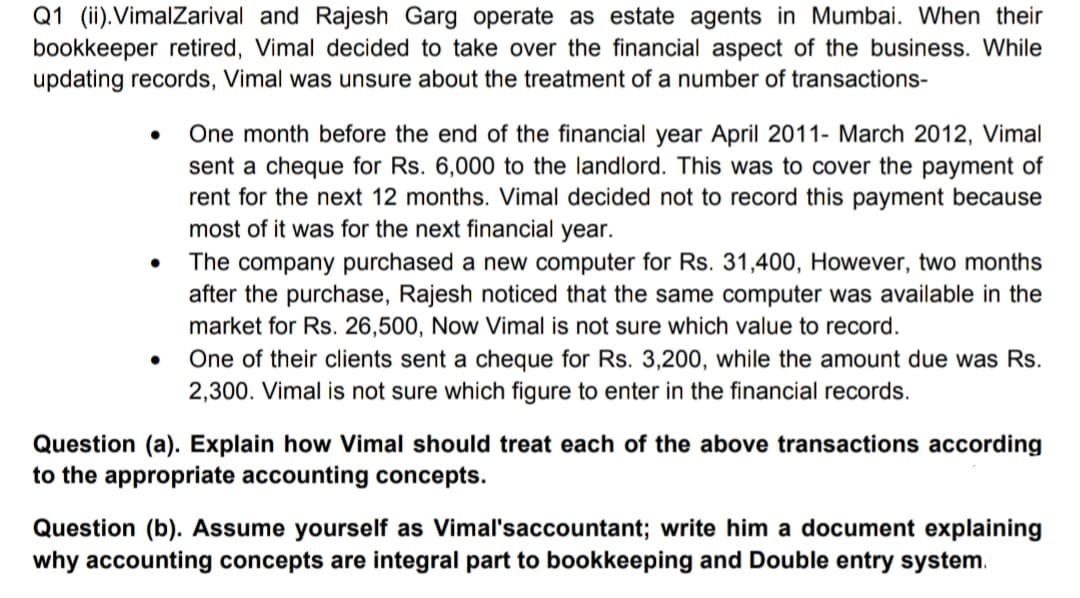

Q1 (ii).VimalZarival and Rajesh Garg operate as estate agents in Mumbai. When their bookkeeper retired, Vimal decided to take over the financial aspect of the business. While updating records, Vimal was unsure about the treatment of a number of transactions- One month before the end of the financial year April 2011- March 2012, Vimal sent a cheque for Rs. 6,000 to the landlord. This was to cover the payment of rent for the next 12 months. Vimal decided not to record this payment because most of it was for the next financial year. • The company purchased a new computer for Rs. 31,400, However, two months after the purchase, Rajesh noticed that the same computer was available in the market for Rs. 26,500, Now Vimal is not sure which value to record. • One of their clients sent a cheque for Rs. 3,200, while the amount due was Rs. 2,300. Vimal is not sure which figure to enter in the financial records. Question (a). Explain how Vimal should treat each of the above transactions according to the appropriate accounting concepts. Question (b). Assume yourself as Vimal'saccountant; write him a document explaining why accounting concepts are integral part to bookkeeping and Double entry system.

Q1 (ii).VimalZarival and Rajesh Garg operate as estate agents in Mumbai. When their bookkeeper retired, Vimal decided to take over the financial aspect of the business. While updating records, Vimal was unsure about the treatment of a number of transactions- One month before the end of the financial year April 2011- March 2012, Vimal sent a cheque for Rs. 6,000 to the landlord. This was to cover the payment of rent for the next 12 months. Vimal decided not to record this payment because most of it was for the next financial year. • The company purchased a new computer for Rs. 31,400, However, two months after the purchase, Rajesh noticed that the same computer was available in the market for Rs. 26,500, Now Vimal is not sure which value to record. • One of their clients sent a cheque for Rs. 3,200, while the amount due was Rs. 2,300. Vimal is not sure which figure to enter in the financial records. Question (a). Explain how Vimal should treat each of the above transactions according to the appropriate accounting concepts. Question (b). Assume yourself as Vimal'saccountant; write him a document explaining why accounting concepts are integral part to bookkeeping and Double entry system.

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 14DQ

Related questions

Question

100%

Answer of both the parts of question

Transcribed Image Text:Q1 (ii).VimalZarival and Rajesh Garg operate as estate agents in Mumbai. When their

bookkeeper retired, Vimal decided to take over the financial aspect of the business. While

updating records, Vimal was unsure about the treatment of a number of transactions-

One month before the end of the financial year April 2011- March 2012, Vimal

sent a cheque for Rs. 6,000 to the landlord. This was to cover the payment of

rent for the next 12 months. Vimal decided not to record this payment because

most of it was for the next financial year.

The company purchased a new computer for Rs. 31,400, However, two months

after the purchase, Rajesh noticed that the same computer was available in the

market for Rs. 26,500, Now Vimal is not sure which value to record.

One of their clients sent a cheque for Rs. 3,200, while the amount due was Rs.

2,300. Vimal is not sure which figure to enter in the financial records.

Question (a). Explain how Vimal should treat each of the above transactions according

to the appropriate accounting concepts.

Question (b). Assume yourself as Vimal'saccountant; write him a document explaining

why accounting concepts are integral part to bookkeeping and Double entry system.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub