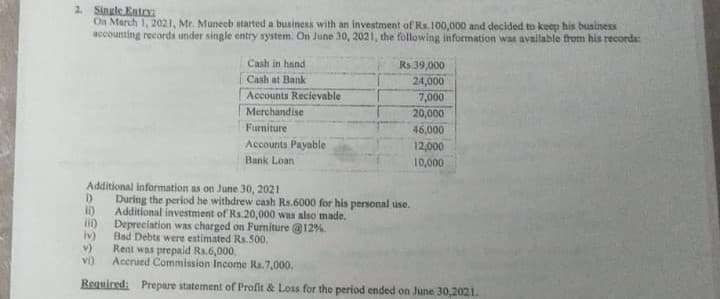

On March 1, 2021, Mr. Muneeb started a business with an investment of Rs.100,000 and decided to keep his business accounting records under single entry system. On June 30, 2021, the following information was available trom his records: Cash in hand Rs 39,000 Cash at Bank 24,000 Accounts Recievable 7,000 20,000 46,000 Merchandise Furniture Accounts Payable 12,000 Bank Loan 10,000 Additional information as on June 30, 2021 During the period he withdrew cash Rs.6000 for his personal use. Additional investment of Rs.20,000 was also made. Depreciation was charged on Furniture @12% Bad Debts were estimated Rs.500. (- Rent was prepaid Rs.6,000. Accrued Commission Income Rs.7,000.

On March 1, 2021, Mr. Muneeb started a business with an investment of Rs.100,000 and decided to keep his business accounting records under single entry system. On June 30, 2021, the following information was available trom his records: Cash in hand Rs 39,000 Cash at Bank 24,000 Accounts Recievable 7,000 20,000 46,000 Merchandise Furniture Accounts Payable 12,000 Bank Loan 10,000 Additional information as on June 30, 2021 During the period he withdrew cash Rs.6000 for his personal use. Additional investment of Rs.20,000 was also made. Depreciation was charged on Furniture @12% Bad Debts were estimated Rs.500. (- Rent was prepaid Rs.6,000. Accrued Commission Income Rs.7,000.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 2SEQ: On January 24, 20Y8, Niche Consulting collected $5,700 it had hilled its clients for services...

Related questions

Topic Video

Question

Transcribed Image Text:2. Single Entr

Oa March 1, 2021, Mr. Muneeb started a business with an investment of Rs.100,000 and decided to keep his business

accounting records under single entry system. On June 30, 2021, the following information was available from his records:

Cash in hand

Rs 39,000

Cash at Bank

24,000

Accounts Recievable

7,000

Merchandise

20,000

Furniture

46,000

Accounts Payable

12,000

10,000

Bank Loan

Additional information as on June 30, 2021

During the period he withdrew cash Rs.6000 for his personal use.

Additional investment of Rs.20,000 was also made.

Depreciation was charged on Furniture @12%

iv)

Bad Debts were estimated Rs.500,

v)

Rent was prepaid Rs.6,000.

vi)

Accrued Commission Income Ra.7,000.

Required: Prepare statement of Profit & Loss for the period ended on June 30,2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning