Q1: Zeal Corporation is thinking about the dropping of its product Z. Sales of the product total Rs.400.000 per year; variable expenses total Rs. 270,000 per year. Fixed expenses charged to the product total Rs. 150,000 per year. The company estimates that Rs. 70,000 of these fixed expenses are not avoidable even if the product is dropped. If Product Z is dropped, what will be the net increase or decrease in profit of the company?

Q1: Zeal Corporation is thinking about the dropping of its product Z. Sales of the product total Rs.400.000 per year; variable expenses total Rs. 270,000 per year. Fixed expenses charged to the product total Rs. 150,000 per year. The company estimates that Rs. 70,000 of these fixed expenses are not avoidable even if the product is dropped. If Product Z is dropped, what will be the net increase or decrease in profit of the company?

Chapter14: Capital Structure Management In Practice

Section14.A: Breakeven Analysis

Problem 6P

Related questions

Question

Please let me the answer to these questions.

Thanks

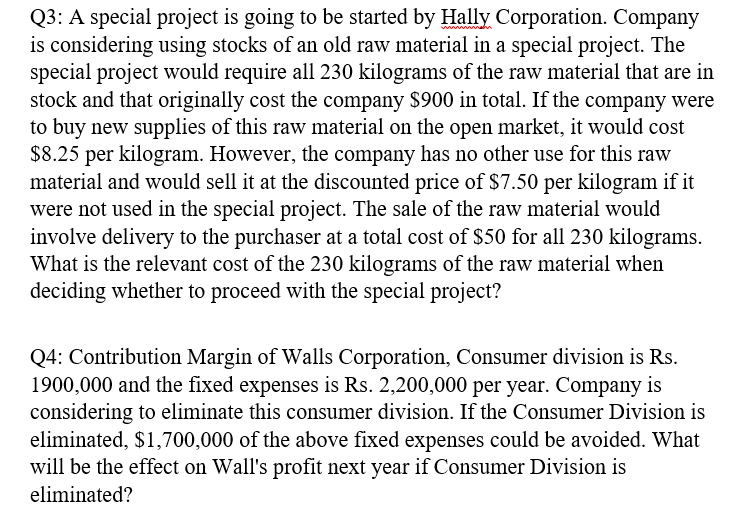

Transcribed Image Text:Q3: A special project is going to be started by Hally Corporation. Company

is considering using stocks of an old raw material in a special project. The

special project would require all 230 kilograms of the raw material that are in

stock and that originally cost the company $900 in total. If the company were

to buy new supplies of this raw material on the open market, it would cost

$8.25 per kilogram. However, the company has no other use for this raw

material and would sell it at the discounted price of $7.50 per kilogram if it

were not used in the special project. The sale of the raw material would

involve delivery to the purchaser at a total cost of $50 for all 230 kilograms.

What is the relevant cost of the 230 kilograms of the raw material when

deciding whether to proceed with the special project?

Q4: Contribution Margin of Walls Corporation, Consumer division is Rs.

1900,000 and the fixed expenses is Rs. 2,200,000 per year. Company is

considering to eliminate this consumer division. If the Consumer Division is

eliminated, $1,700,000 of the above fixed expenses could be avoided. What

will be the effect on Wall's profit next year if Consumer Division is

eliminated?

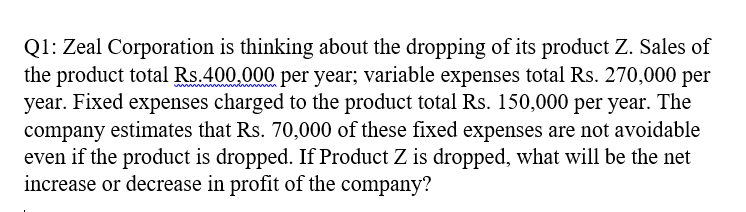

Transcribed Image Text:Q1: Zeal Corporation is thinking about the dropping of its product Z. Sales of

the product total Rs.400.000 per year; variable expenses total Rs. 270,000 per

year. Fixed expenses charged to the product total Rs. 150,000 per year. The

company estimates that Rs. 70,000 of these fixed expenses are not avoidable

even if the product is dropped. If Product Z is dropped, what will be the net

increase or decrease in profit of the company?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College