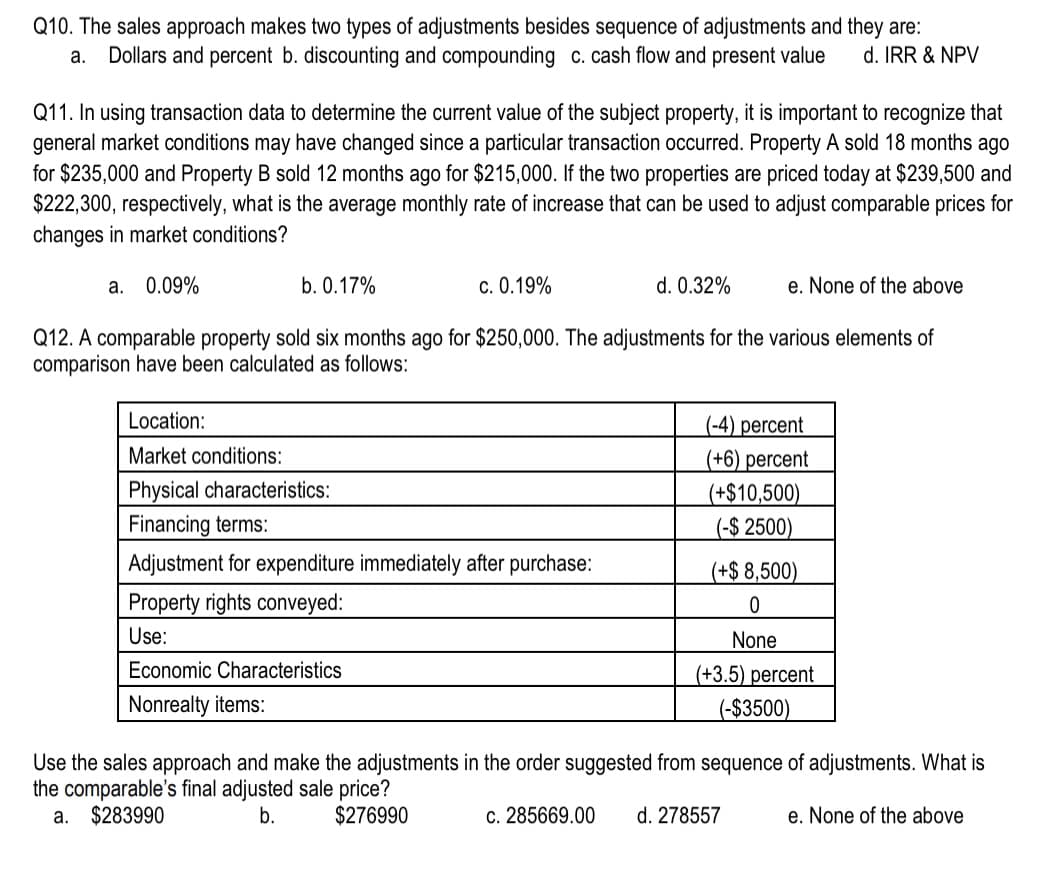

Q10. The sales approach makes two types of adjustments besides sequence of adjustments and they are: a. Dollars and percent b. discounting and compounding c. cash flow and present value d. IRR & NPV Q11. In using transaction data to determine the current value of the subject property, it is important to recognize that general market conditions may have changed since a particular transaction occurred. Property A sold 18 months ago for $235,000 and Property B sold 12 months ago for $215,000. If the two properties are priced today at $239,500 and $222,300, respectively, what is the average monthly rate of increase that can be used to adjust comparable prices for changes in market conditions? a. 0.09% b. 0.17% c. 0.19% d. 0.32% e. None of the above

Q10. The sales approach makes two types of adjustments besides sequence of adjustments and they are: a. Dollars and percent b. discounting and compounding c. cash flow and present value d. IRR & NPV Q11. In using transaction data to determine the current value of the subject property, it is important to recognize that general market conditions may have changed since a particular transaction occurred. Property A sold 18 months ago for $235,000 and Property B sold 12 months ago for $215,000. If the two properties are priced today at $239,500 and $222,300, respectively, what is the average monthly rate of increase that can be used to adjust comparable prices for changes in market conditions? a. 0.09% b. 0.17% c. 0.19% d. 0.32% e. None of the above

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 90PSB

Related questions

Question

Answer all questions

Transcribed Image Text:Q10. The sales approach makes two types of adjustments besides sequence of adjustments and they are:

a. Dollars and percent b. discounting and compounding c. cash flow and present value d. IRR & NPV

Q11. In using transaction data to determine the current value of the subject property, it is important to recognize that

general market conditions may have changed since a particular transaction occurred. Property A sold 18 months ago

for $235,000 and Property B sold 12 months ago for $215,000. If the two properties are priced today at $239,500 and

$222,300, respectively, what is the average monthly rate of increase that can be used to adjust comparable prices for

changes in market conditions?

a. 0.09%

b. 0.17%

c. 0.19%

Location:

Market conditions:

Physical characteristics:

Financing terms:

Adjustment for expenditure immediately after purchase:

Property rights conveyed:

Use:

Economic Characteristics

Nonrealty items:

d. 0.32%

Q12. A comparable property sold six months ago for $250,000. The adjustments for the various elements of

comparison have been calculated as follows:

e. None of the above

(-4) percent

(+6) percent

(+$10,500)

(-$2500)

(+$ 8,500)

0

None

(+3.5) percent

(-$3500)

Use the sales approach and make the adjustments in the order suggested from sequence of adjustments. What is

the comparable's final adjusted sale price?

a. $283990

b.

$276990

c. 285669.00 d. 278557

e. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College