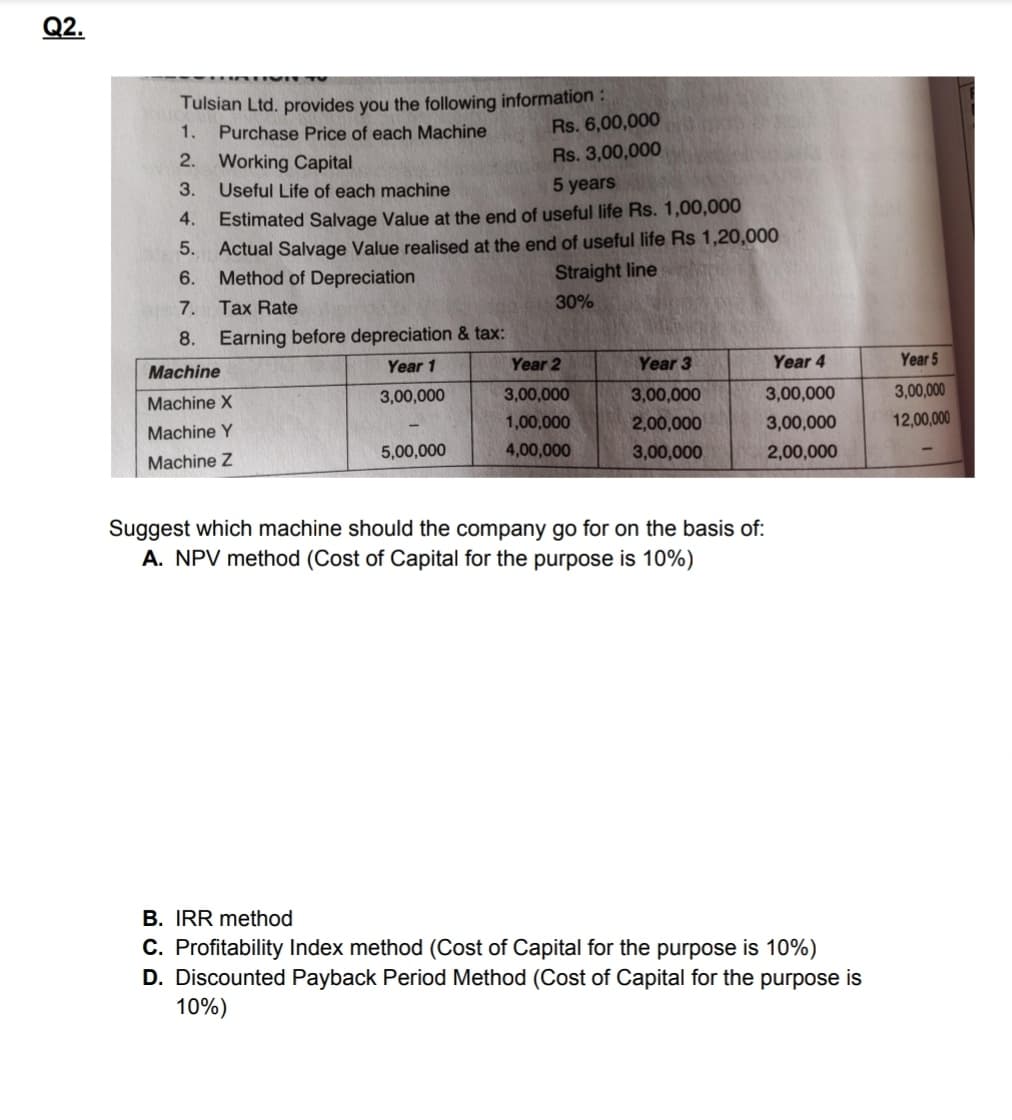

Q2. Tulsian Ltd. provides you the following information : Rs. 6,00,000 1. Purchase Price of each Machine 2. Working Capital Rs. 3,00,000 3. Useful Life of each machine 5 years Estimated Salvage Value at the end of useful life Rs. 1,00,000 5. Actual Salvage Value realised at the end of useful life Rs 1,20,000 6. Method of Depreciation 4. Straight line 7. Tax Rate 30% 8. Earning before depreciation & tax: Year 1 Year 2 Year 3 Year 4 Year 5 Machine 3,00,000 12,00,000 3,00,000 3,00,000 3,00,000 3,00,000 Machine X 1,00,000 2,00,000 3,00,000 Machine Y 5,00,000 4,00,000 3,00,000 2,00,000 Machine Z Suggest which machine should the company go for on the basis of: A. NPV method (Cost of Capital for the purpose is 10%) B. IRR method C. Profitability Index method (Cost of Capital for the purpose is 10%) D. Discounted Payback Period Method (Cost of Capital for the purpose is 10%)

Q2. Tulsian Ltd. provides you the following information : Rs. 6,00,000 1. Purchase Price of each Machine 2. Working Capital Rs. 3,00,000 3. Useful Life of each machine 5 years Estimated Salvage Value at the end of useful life Rs. 1,00,000 5. Actual Salvage Value realised at the end of useful life Rs 1,20,000 6. Method of Depreciation 4. Straight line 7. Tax Rate 30% 8. Earning before depreciation & tax: Year 1 Year 2 Year 3 Year 4 Year 5 Machine 3,00,000 12,00,000 3,00,000 3,00,000 3,00,000 3,00,000 Machine X 1,00,000 2,00,000 3,00,000 Machine Y 5,00,000 4,00,000 3,00,000 2,00,000 Machine Z Suggest which machine should the company go for on the basis of: A. NPV method (Cost of Capital for the purpose is 10%) B. IRR method C. Profitability Index method (Cost of Capital for the purpose is 10%) D. Discounted Payback Period Method (Cost of Capital for the purpose is 10%)

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 8PA: Referring to PA7 where Kenzie Company purchased a 3-D printer for $450,000, consider how the...

Related questions

Question

100%

Proper solution with working notes of (C) &(D)

Transcribed Image Text:Q2.

Tulsian Ltd. provides you the following information:

Purchase Price of each Machine

1.

Rs. 6,00,000

2. Working Capital

Rs. 3,00,000

3.

Useful Life of each machine

5 years

Estimated Salvage Value at the end of useful life Rs. 1,00,000

Actual Salvage Value realised at the end of useful life Rs 1,20,000

Method of Depreciation

4.

5.

6.

Straight line

7.

Tax Rate

30%

8.

Earning before depreciation & tax:

Year 1

Year 2

Year 3

Year 4

Year 5

Machine

3,00,000

3,00,000

3,00,000

3,00,000

3,00,000

Machine X

1,00,000

2,00,000

3,00,000

12,00,000

Machine Y

5,00,000

4,00,000

3,00,000

2,00,000

Machine Z

Suggest which machine should the company go for on the basis of:

A. NPV method (Cost of Capital for the purpose is 10%)

B. IRR method

C. Profitability Index method (Cost of Capital for the purpose is 10%)

D. Discounted Payback Period Method (Cost of Capital for the purpose is

10%)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College