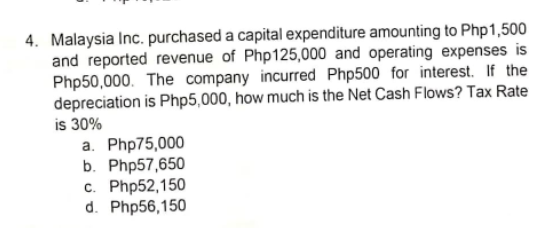

4. Malaysia Inc. purchased a capital expenditure amounting to Php1,500 and reported revenue of Php125,000 and operating expenses is Php50,000. The company incurred Php500 for interest. If the depreciation is Php5,000, how much is the Net Cash Flows? Tax Rate is 30% a. Php75,000 b. Php57,650 c. Php52,150 d. Php56,150

Q: Required: 1. Prepare the Production Department's planning budget for the month. 2. Prepare the…

A: Planning budget is the estimated costs and revenues at planning level. Flexible budget shows…

Q: Clarke Corporation placed in service the following assets over the last 6 years. The company didn’t…

A: The maximum amount of depreciation for any asset is the total sum of depreciation that should have…

Q: 1. From the following Trial balance, you are require to prepare the final accounts for the year…

A: Balance sheet: A balance sheet is an accounting record that tells about the company's overall…

Q: A taxpayer elects to take a bunch of different assets which would normally be capitalized and…

A: The de minimis rule is a rule that is provided by IFRS. This rule is related to the capitalization…

Q: Calculate COGS from the following? Opening stock - OMR 12,000 Closing stock - OMR 8,000 Purchases -…

A: Formula used: Cost of goods sold = Opening stock + Purchases - Closing stock

Q: The regression line in a scatterplot is also known as a(n): O A. R-squared line. O B. high-low line.…

A: A regression line seems to be a line that is used to define how a set of data behaves. In other…

Q: Cash Budget Friendly Freddie's is an independently owned major appliance and electronics discount…

A: Cash Budget shows the cash inflow and cash outflow for a particular period. It starts with beginning…

Q: 4. Which of the following statements about promissory notes is incorrect? a. Interest is the revenue…

A: A promissory note is a financial instrument that contains a written promise by one party to pay…

Q: 11. Biscoe. has historically used FIFO inventory costing method. In year 4 the company decided to…

A: The process of recording business transactions in the books of accounts for the first time is…

Q: The difference between the federal minimum wage and the tipped wage involves: Muitiple Choice An…

A: Federal government set required minimum wages for the worker who receives the tips on a regular…

Q: ash Budget Friendly Freddie’s is an independently owned major appliance and electronics discount…

A: Cash budget is one of the important budget being prepared in business. It shows expected cash…

Q: Calculate Cost of Goods sold from the following? Opening stock OMR 20000, Carriage outwards OMR…

A: Formula: Cost of goods sold = Opening stock + Purchases - Closing stock

Q: Current GAAP recommends that the fair value method be used to account for compensatory stock option…

A: The answer for the theory question on the Fair value method to account for the Compensatory stock…

Q: Bonneau Company had the following transactions relating to investments in available-for-sale…

A: Journal Entry is the primary step to record the transaction in the books of account. Journal entry…

Q: Fuzzy Monkey Technologies, Inc., purchased as a long-term investment $120 million of 6% bonds, dated…

A: Solution 1 to 3: Journal Entries - Fuzzy Monkey Technologies Inc. Event Date Particulars…

Q: Fred is considering three job offers in advertising. • A full-time position as a coordinator that…

A: For the calculation of net monthly income, let's calculate the monthly gross income as below:-…

Q: Budgeted Income Statement Coral Seas Jewelry Company makes and sells costume jewelry. For the…

A: Budgeted income statement budgeted revenues and budgeted expenses of the business and at the end it…

Q: From a corporation’s point of view, how does preferred stock differ from common stock?

A: Ownership of an organization can be broken down into small parts or units also known as Shares.…

Q: To match revenues and expenses properly, should the expense for employee vacation pay be recorded in…

A: Accrual-based accounting is one of the accounting principle followed by the business. The expenses…

Q: The board of directors of Northshore plc decided to make a takeover bid for South Shore plc. After…

A: Insider trading is defined as the trading of a company's shares by individuals who, as a result of…

Q: Describe the factors that a retailer should take into account while selecting a location for a…

A: The location of the shopping area is a strategic choice for any enterprise. As it affects the…

Q: Bonneau Corporation declares a cash dividend of $100,000 on July 1 for any shareholder on record on…

A: Introduction: Journals: Recording of a business transactions in a chronological order. Each and…

Q: Compute the following ratios for 2022. (Round Debt to total assets ratio to 1 decimal place, e.g 1.8

A: Introduction:- Debt total asset ratio indicates total amount of debt of a company holds to finance…

Q: On January 16, Gee Company accepted a P600,000, 10%, 90-day note from a customer. On February 15,…

A: Comment- Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: Describe the two-stage allocation process for assigning support service costs to products in…

A: The method involves identifying and allocating costs to multiple cost objects known as cost…

Q: On 1/1/21, Elliott Company leased machinery with a fair value of $1,185,000 from Greene Corporation.…

A: The lease is an agreement in which the owner of the property referred to as the lessor transfers the…

Q: An entity purchased an investment property on January 1,2020 at a cost of P4,000,000. The property…

A: As per IAS 40 "Investment property", for recording investment property in books of account, one of…

Q: At the end of the month, the schedule of accounts payable (a list of ending amounts

A: In schedule of accounts payable, name of vendor, invoice number, date of sale, due date of bills ,…

Q: 10 Kingeade Corporation keeps careful track of the time required to fill orders. Data concerning a…

A: Formula used: Manufacturing cycle efficiency = Process Time / Throughput time.

Q: Dr. Alyx Hemmings is employed by Mesa Dental. Mesa Dental recently installed a computerized…

A: Given as, 1-Surface 2-Surface 3-Surface 4-SurfaceTime 20 minutes 30…

Q: using the fixed ratio method. 1 - extinction in the third year 2 - cumulative extinction at the end…

A: “Since you have posted a question with many sub-parts, we will solve three sub-parts for you. To get…

Q: PROBLEM NO. 1 Magnanimous Corporation was organized in late 2019 to manufacture and sell hosiery. At…

A: Accounting errors mean any mistake or discrepancy in the records of an entity done with an intention…

Q: Messla, Inc. manufactures solar-powered vehicles. Some of the costs from the past year include:

A: 1. Janitor means care taker or door keeper. So, he is not direct involved in production. That's why…

Q: The condensed financial statements of Ivanhoe Company for the years 2016 and 2017 are presented as…

A: Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: Triple J business has installed prepaid electricity unit equipment. At the end of the accounting…

A: Lets understanding the basics. Adjusting entry is passed at the year end to record correct amount of…

Q: Dexter Industries purchased packaging equipment on January 8 for $392,400. The equipment was…

A: Depreciation: - Depreciation is the reduction in the value of asset as its use or wear and tear…

Q: You are called in as a financial analyst to appraise the bonds of Olsen's Clothing Stores. The…

A: Current Price of Bond: The present discounted value of a future cash stream provided by a bond is…

Q: Friendly Freddie’s is an independently owned major appliance and electronics discount chain with…

A: Cash budget is one of the important budget being prepared by the business. It shows estimated cash…

Q: Compute for the net income/(loss) under absorption, variable and throughput costing Franz began…

A: Absorption costing : In this method ,all manufacturing costs are taken as product costs,regardless…

Q: On January 1,2016 , Coke Company insured the life of its president for P4,000,000, with an annual…

A: Given: - Cash surrender value at the end of 2019= 49,000 Cash surrender value at the end 2020=…

Q: Prob current year: 5,250,000 150,000 250,000 Purchases Purchase returns and allowances Rental income…

A: An income statement is a financial report that indicates the revenue and expenses of a business. It…

Q: Black Company adds materials in the beginning of the process in Department 1, which is the first of…

A: Total material cost = P3000 + P25560 = P28560 Total number of units = 6000 + 50000 =56000 Average…

Q: On January 1, 2018, Thomas Company issued $100,000, 5-year, 12% bonds, with interest payable…

A: A bond refers to a type of security under which the issuer owes the holder a debt, and is…

Q: Roberts Company produces two weed eaters: basic and advanced. The company has four activi- ties:…

A: Activity-based costing (ABC) is a way of allocating overhead expenses more precisely by attributing…

Q: On January 1, 2021, Pine Company owns 40 percent (76,000 shares) of Seacrest, Ic., which it…

A: If a company have ownership in another company, its assets and liabilities are subject to…

Q: What amount should be reported as inventory on December 31, 2021? Fundador Company reported that…

A:

Q: Pass Journal Entries: Recording Cost of Goods Sold in a Perpetual System: • Daisy's sells a pair of…

A: Periodic inventory method: It is a inventory valuation method in which inventory is updated at the…

Q: explain the five corporate governance guidelines issues by the capital market authority

A: Corporate Governance: It is the set of rules, practices, or laws that govern how enterprises run,…

Q: Cash Budget Janet Wooster owns a retail store that sells new and used sporting equipment. Janet has…

A: Cash Budget A cash budget is a budget prepared to estimate the expected payments and receipts of…

Q: Use the percent-of-sales method to prepare a pro forma income statement for the year ended December…

A: A pro forma income statement is a document that shows a company's adjusted income after certain…

please do not use excel function/formula in solving this, I need a manual and whole computation and solution

Step by step

Solved in 2 steps

- Talbot Enterprises recently reported an EBITDA of $8 million and net income of $2.4 million. It had $2.0 million of interest expense, and its corporate tax rate was 40%. What was its charge for depreciation and amortization?Malaysia Inc. purchased a capital expenditure amounting to Php1,500 and reported revenue of Php125,000 and operating expenses is Php50,000. The company incurred Php500 for interest. If the depreciation is Php5,000, how much is the Net Cash Flows? Tax Rate is 30% Answer: 57,650 Pls provide solutionJannah Company has sales of P1,000,000, cost of goods sold ofP700,000, depreciation expenses of P250,000 and interest expenses ofP55,000. If Jannah’s tax rate is 34% and the income statement iscomplete, what is Jannah's operating cash flow? A. P283,000B. P246,700C. P33,000D. P300,000

- 1. Given the following information, compute for the net profit after taxes: GROSS SALES: Php 600,480 COSTS OF GOODS SOLD: Php 374,789 TOTAL OPERATING EXPENSES: Php 132,916 TOTAL TAXES: Php 17,113 2. Company X has investments of Php 3,000,000 and net income after taxes of Php 1,250,000 a year. How many years will it take for the company to recover the investment? 3. Company A incurred a loss of Php 3,000. If its revenue is Php 19,500, how much is its total expenses? 4. A1 Company's net profit after taxes is Php 94,000. If Return on Assets is 40%, what are the total assets? 5. A compnay's net profit after taxes is Php 94,000. If sales are Php 376,000, what is the Return of Sales?Tater and Pepper Corp. reported free cash flows for 2021 of $53.1 million and investment in operating capital of $36.1 million. Tater and Pepper incurred $15.0 million in depreciation expense and paid $25.7 million in taxes on EBIT in 2021. Calculate Tater and Pepper’s 2021 EBIT. (Enter your answer in millions of dollars rounded to 1 decimal place.) EBIT = $_______millionRaj Ltd arrived at a net profit of Rs 100000 for the year ended 31st March, 2022. Depreciation for the year is Rs 10000, Loss on sale of Asset is Rs 20000, Interest paid on loan is Rs10000, Gain on sale of assets is Rs 20000. Tax is 20%. Calculate cash flow from operating activity using indirect method. Additional information: Particulars 31-Mar-21 31-Mar-22 Creditors 50000 40000 Debtors 40000 30000 Inventory 25000 35000 Bills Receivables 30000 50000 Bills Payable 25000 40000

- Tater and Pepper Corp. reported free cash flows for 2021 of $52.1 million and investment in operating capital of $35.1 million. Tater and Pepper incurred $14.9 million in depreciation expense and paid $25.5 million in taxes on EBIT in 2021. Calculate Tater and Pepper’s 2021 EBIT. (Enter your answer in millions of dollars rounded to 1 decimal place.)Refer to the following financial information of Scholz Company: NOPAT 8.250.000.00 EBITDA 17,725.000.00 Net Income 5,050,000.00 Capital Expenditures 6,820,000.00 After tax capital costs 6,280.000.00 Tax rate 40% 1. Calculate the Company's depreciation and amortization expense 2. calculate its interest expense. Use 2 decimal places for your final answer. 3. calculate its EVA. Use 2 decimal places for your final answer.10. If the net income after tax of the company is P4,000,000, starting balance of assets is P500,000 and the ending balance of assets is P700,000, what is the return of assets? *a. 8b. 5.71c. 6.6667d. 3.3333 2. If the quick assets of the company amounted to P90,000, and the quick ratio is 9, how much is the current liabilities of the entity? *a. P810,000b. P89,997c. P90,009d. P10,000 7. If net sales amounted to P200,000, net income before tax is P80,000 and the income tax rate is 30%, how much is the profit margin ratio? *a. 0.40b. 0.28c. 2.5d. 3.57 8. Interest expense for the year amounted to P90,000. Income tax expense is P100,000. If net income after tax is P620,000, what is the times interest earned ratio? *a. 6.2b. 9c. 6.888d. P720,000 1. If current assets amounted to P600,000 and current liabilities amounted to P200,000, what is the current ratio of the entity? *a. P800,000b. P400,000c. 3d. 1/3 3. If net sales is P200,000 and the average accounts receivable is P50,000, what is…

- Refer to the following financial information of Scholz Company: NOPAT 8,250,000.00 EBITDA 17,725,000.00 Net Income 5,050,000.00 Capital Expenditures 6,820,000.00 After tax capital costs 6,280,000.00 Tax rate 40% Calculate the Company’s depreciation and amortization expense1. SSSSS’ operating income (EBIT) is P500,000. The company’s tax rate is 40 percent, and its operating cash flow is P450,000. The company’s interest expense is P100,000. What is the company’s net cash flow? (Assume that depreciation is the only non-cash item in the firm’s financial statements.) 2. Calculate a firm's free cash flow if it has net operating profit after taxes of P60,000, depreciation expense of P10,000, net fixed asset investment requirement of P40,000, a net current asset requirement of P30,000 and a tax rate of 30%2) Susco had the following items this year: Gross receipts $700,000 Operating expenses 500,000 Long-term capital gain 40,000 Long-term capital loss (20,000) Short-term capital gain 16,000 Short-term capital loss (44,000) What is Susco’s taxable income and does it have any carrybacks/carryovers?