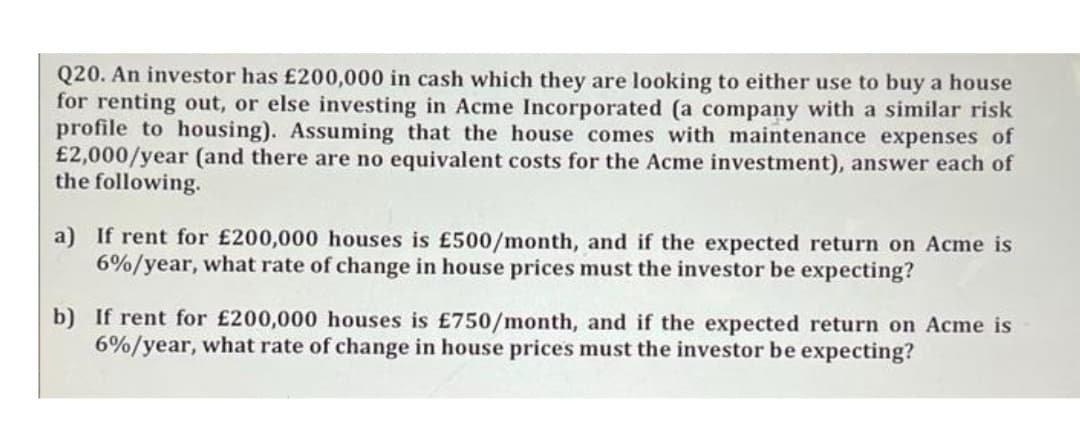

Q20. An investor has £200,000 in cash which they are looking to either use to buy a house for renting out, or else investing in Acme Incorporated (a company with a similar risk profile to housing). Assuming that the house comes with maintenance expenses of £2,000/year (and there are no equivalent costs for the Acme investment), answer each of the following. a) If rent for £200,000 houses is £500/month, and if the expected return on Acme is 6%/year, what rate of change in house prices must the investor be expecting? b) If rent for £200,000 houses is £750/month, and if the expected return on Acme is 6%/year, what rate of change in house prices must the investor be expecting?

Q20. An investor has £200,000 in cash which they are looking to either use to buy a house for renting out, or else investing in Acme Incorporated (a company with a similar risk profile to housing). Assuming that the house comes with maintenance expenses of £2,000/year (and there are no equivalent costs for the Acme investment), answer each of the following. a) If rent for £200,000 houses is £500/month, and if the expected return on Acme is 6%/year, what rate of change in house prices must the investor be expecting? b) If rent for £200,000 houses is £750/month, and if the expected return on Acme is 6%/year, what rate of change in house prices must the investor be expecting?

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 10PB: Bouvier Restaurant is considering an investment in a grill that costs $140,000, and will produce...

Related questions

Question

Transcribed Image Text:Q20. An investor has £200,000 in cash which they are looking to either use to buy a house

for renting out, or else investing in Acme Incorporated (a company with a similar risk

profile to housing). Assuming that the house comes with maintenance expenses of

£2,000/year (and there are no equivalent costs for the Acme investment), answer each of

the following.

a) If rent for £200,000 houses is £500/month, and if the expected return on Acme is

6%/year, what rate of change in house prices must the investor be expecting?

b) If rent for £200,000 houses is £750/month, and if the expected return on Acme is

6%/year, what rate of change in house prices must the investor be expecting?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning