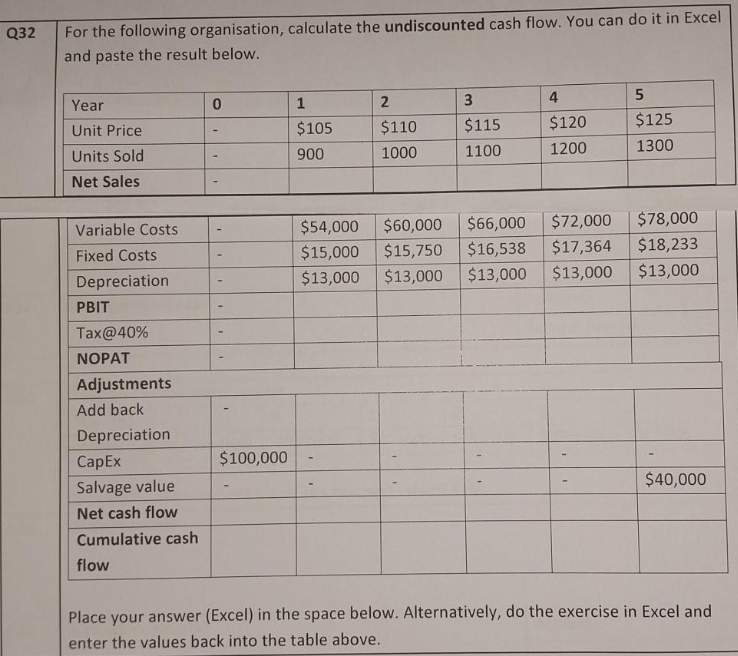

Q32 For the following organisation, calculate the undiscounted cash flow. You can do it in Excel and paste the result below. Year Unit Price Units Sold Net Sales Variable Costs Fixed Costs Depreciation PBIT Tax@40% NOPAT Adjustments Add back Depreciation CapEx Salvage value Net cash flow Cumulative cash flow 0 $100,000 1 $105 900 2 $110 1000 3 $115 1100 4 $120 1200 $54,000 $60,000 $15,000 $15,750 $13,000 $13,000 $13,000 5 $125 1300 $66,000 $72,000 $78,000 $16,538 $17,364 $18,233 $13,000 $13,000 $40,000 Place your answer (Excel) in the space below. Alternatively, do the exercise in Excel and enter the values back into the table above.

Q32 For the following organisation, calculate the undiscounted cash flow. You can do it in Excel and paste the result below. Year Unit Price Units Sold Net Sales Variable Costs Fixed Costs Depreciation PBIT Tax@40% NOPAT Adjustments Add back Depreciation CapEx Salvage value Net cash flow Cumulative cash flow 0 $100,000 1 $105 900 2 $110 1000 3 $115 1100 4 $120 1200 $54,000 $60,000 $15,000 $15,750 $13,000 $13,000 $13,000 5 $125 1300 $66,000 $72,000 $78,000 $16,538 $17,364 $18,233 $13,000 $13,000 $40,000 Place your answer (Excel) in the space below. Alternatively, do the exercise in Excel and enter the values back into the table above.

Chapter7: Valuation Of Stocks And Corporations

Section: Chapter Questions

Problem 23SP

Related questions

Question

Aa 89.

Transcribed Image Text:Q32

For the following organisation, calculate the undiscounted cash flow. You can do it in Excel

and paste the result below.

Year

Unit Price

Units Sold

Net Sales

Variable Costs

Fixed Costs

Depreciation

PBIT

Tax@40%

NOPAT

Adjustments

Add back

Depreciation

CapEx

Salvage value

Net cash flow

Cumulative cash

flow

0

$100,000

1

$105

900

2

$110

1000

3

$115

1100

4

$120

1200

$54,000

$60,000

$15,000 $15,750

$13,000 $13,000 $13,000

5

$125

1300

$66,000

$72,000

$78,000

$16,538 $17,364 $18,233

$13,000

$13,000

$40,000

Place your answer (Excel) in the space below. Alternatively, do the exercise in Excel and

enter the values back into the table above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT