Q4) a) Dimond 7 has been operating an excavation company in British Columbia for the last 20 years. The company has been successful in generating revenue and free cash flows (FCF). The company is planning to replace 7 excavators. The supplier will trade in old excavators and will deduct $95,000 from the total purchase price of new excavators. Each new excavator will cost $175,000. The corporate tax rate is 35%. The company beta (BA) is 1.15, risk-free return (R;) is 0.65%, and the expected rate of return on market portfolio is 6%. Based on the risk, the bank will charge 6.35% on the commercial loans/chattel mortgages granted for excavators. The company will use 90% equity financing and 10% debt financing. Based on the above information, please calculate the WACC. Please show all the calculations by which you came up with the final answer. b) Another excavation company called Diamond 12 has 50,000 shares of common stock outstanding with a market price of $50 per share. It has 1,500 bonds outstanding, each selling for $1,350. The bonds mature in 15 years, have a coupon rate of 6.95%, and pay coupons annually. The firm's beta is 1.95, the risk-free rate is 0.65%, and the expected rate of return on market portfolio is 6.50%. The tax rate is 34%. Based on the above information, please calculate the WACC. Please show all the calculations by which you came up with the final answer,

Q4) a) Dimond 7 has been operating an excavation company in British Columbia for the last 20 years. The company has been successful in generating revenue and free cash flows (FCF). The company is planning to replace 7 excavators. The supplier will trade in old excavators and will deduct $95,000 from the total purchase price of new excavators. Each new excavator will cost $175,000. The corporate tax rate is 35%. The company beta (BA) is 1.15, risk-free return (R;) is 0.65%, and the expected rate of return on market portfolio is 6%. Based on the risk, the bank will charge 6.35% on the commercial loans/chattel mortgages granted for excavators. The company will use 90% equity financing and 10% debt financing. Based on the above information, please calculate the WACC. Please show all the calculations by which you came up with the final answer. b) Another excavation company called Diamond 12 has 50,000 shares of common stock outstanding with a market price of $50 per share. It has 1,500 bonds outstanding, each selling for $1,350. The bonds mature in 15 years, have a coupon rate of 6.95%, and pay coupons annually. The firm's beta is 1.95, the risk-free rate is 0.65%, and the expected rate of return on market portfolio is 6.50%. The tax rate is 34%. Based on the above information, please calculate the WACC. Please show all the calculations by which you came up with the final answer,

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 3PROB

Related questions

Question

100%

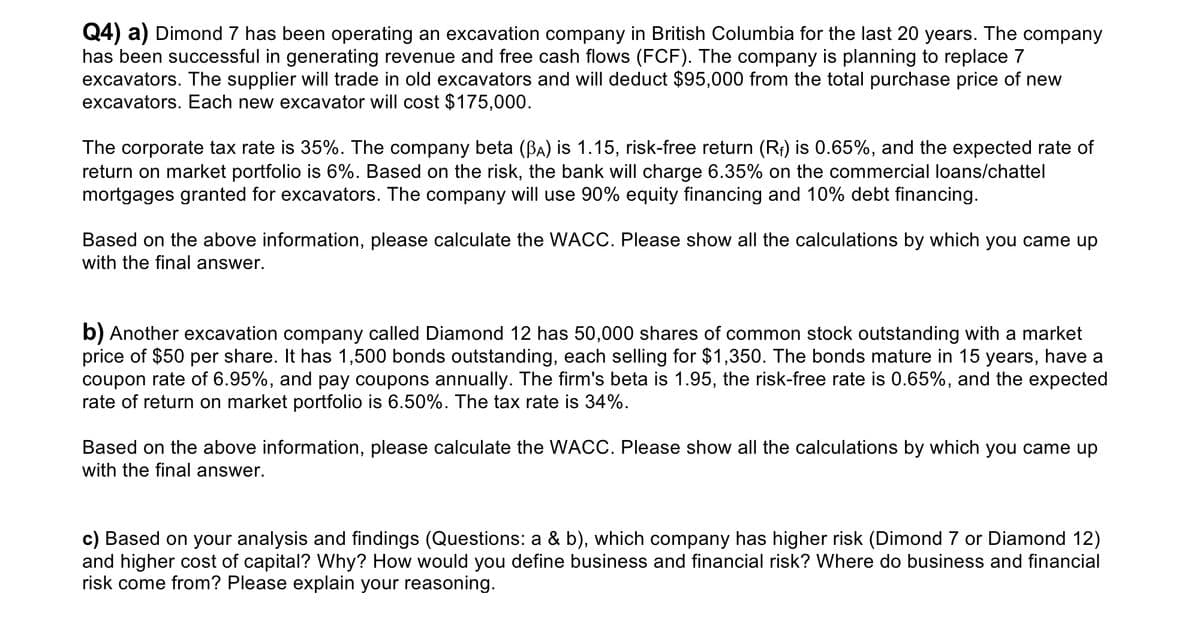

Transcribed Image Text:Q4) a) Dimond 7 has been operating an excavation company in British Columbia for the last 20 years. The company

has been successful in generating revenue and free cash flows (FCF). The company is planning to replace 7

excavators. The supplier will trade in old excavators and will deduct $95,000 from the total purchase price of new

excavators. Each new excavator will cost $175,000.

The corporate tax rate is 35%. The company beta (BA) is 1.15, risk-free return (Rf) is 0.65%, and the expected rate of

return on market portfolio is 6%. Based on the risk, the bank will charge 6.35% on the commercial loans/chattel

mortgages granted for excavators. The company will use 90% equity financing and 10% debt financing.

Based on the above information, please calculate the WACC. Please show all the calculations by which you came up

with the final answer.

b) Another excavation company called Diamond 12 has 50,000 shares of common stock outstanding with a market

price of $50 per share. It has 1,500 bonds outstanding, each selling for $1,350. The bonds mature in 15 years, have a

coupon rate of 6.95%, and pay coupons annually. The firm's beta is 1.95, the risk-free rate is 0.65%, and the expected

rate of return on market portfolio is 6.50%. The tax rate is 34%.

Based on the above information, please calculate the WACC. Please show all the calculations by which you came up

with the final answer.

c) Based on your analysis and findings (Questions: a & b), which company has higher risk (Dimond 7 or Diamond 12)

and higher cost of capital? Why? How would you define business and financial risk? Where do business and financial

risk come from? Please explain your reasoning.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you