he purchase price of a front vith its purchase, is $117,450. The life of the loader is 6 years, at which time it will have an estimated salvage value of $11,500. The replacement cost of the tires is $7,500 for all tires on ti oader and is not to be included in the depreciation and interest cost. The loader is expected to tir apeor used 1.200 hours per year. Determine the annual depreciation and interest cost of the loader us an interest rate of 7%. o $15.97/hr O $18.37/hr O $17.88/hr O $14.75/hr

he purchase price of a front vith its purchase, is $117,450. The life of the loader is 6 years, at which time it will have an estimated salvage value of $11,500. The replacement cost of the tires is $7,500 for all tires on ti oader and is not to be included in the depreciation and interest cost. The loader is expected to tir apeor used 1.200 hours per year. Determine the annual depreciation and interest cost of the loader us an interest rate of 7%. o $15.97/hr O $18.37/hr O $17.88/hr O $14.75/hr

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 4EB: Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is...

Related questions

Question

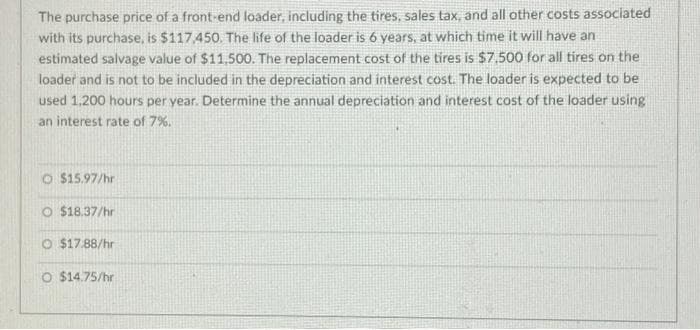

Transcribed Image Text:The purchase price of a front-end loader, including the tires, sales tax, and all other costs associated

with its purchase, is $117,450. The life of the loader is 6 years, at which time it will have an

estimated salvage value of $11,500. The replacement cost of the tires is $7,500 for all tires on the

loader and is not to be included in the depreciation and interest cost. The loader is expected to be

used 1,200 hours per year. Determine the annual depreciation and interest cost of the loader using

an interest rate of 7%.

O $15.97/hr

O $18.37/hr

O $17.88/hr

O $14.75/hr

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning