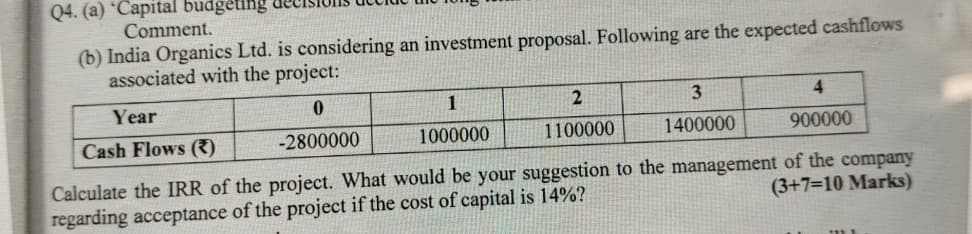

Q4. (a) 'Capital budgeting Comment. (b) India Organics Ltd. is considering an investment proposal. Following are the expected cashflows associated with the project: Year Cash Flows (2) 0 -2800000 1 2 1000000 1100000 3 4 1400000 900000 Calculate the IRR of the project. What would be your suggestion to the management of the company regarding acceptance of the project if the cost of capital is 14%? (3+7=10 Marks)

Q4. (a) 'Capital budgeting Comment. (b) India Organics Ltd. is considering an investment proposal. Following are the expected cashflows associated with the project: Year Cash Flows (2) 0 -2800000 1 2 1000000 1100000 3 4 1400000 900000 Calculate the IRR of the project. What would be your suggestion to the management of the company regarding acceptance of the project if the cost of capital is 14%? (3+7=10 Marks)

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 6EB: The management of Ryland International Is considering Investing in a new facility and the following...

Related questions

Question

a hata eraian is cures Graiki Rim nows an Com 106

Transcribed Image Text:Q4. (a) 'Capital budgeting

Comment.

(b) India Organics Ltd. is considering an investment proposal. Following are the expected cashflows

associated with the project:

Year

Cash Flows (2)

0

-2800000

1

2

1000000

1100000

3

4

1400000

900000

Calculate the IRR of the project. What would be your suggestion to the management of the company

regarding acceptance of the project if the cost of capital is 14%?

(3+7=10 Marks)

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,