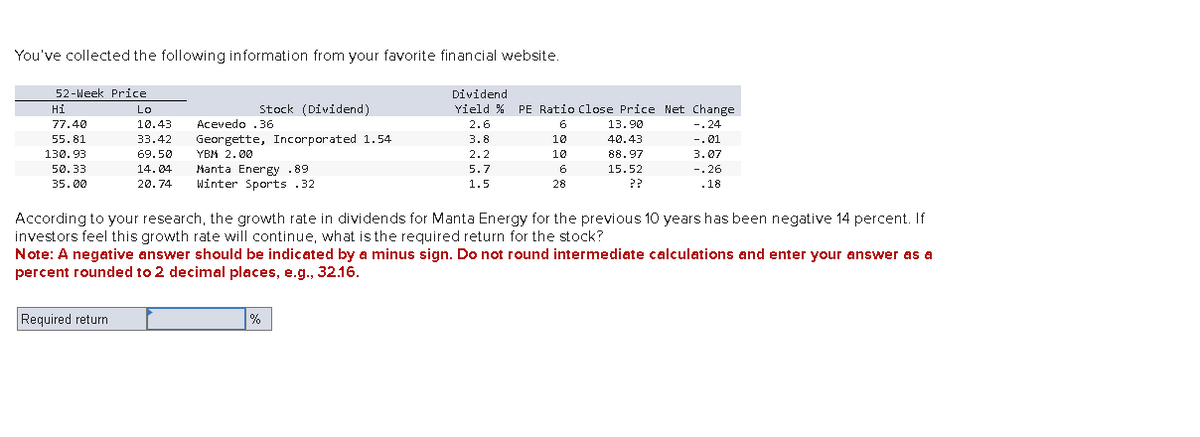

You've collected the following information from your favorite financial website. 52-Week Price Dividend Hi Lo Stock (Dividend) Yield % PE Ratio Close Price Net Change 77.40 10.43 Acevedo .36 2.6 6 13.90 -.24 55.81 33.42 Georgette, Incorporated 1.54 3.8 10 40.43 -.01 130.93 69.50 YBM 2.00 2.2 10 88.97 3.07 50.33 35.00 14.04 Manta Energy .89 5.7 6 20.74 Winter Sports .32 1.5 28 15.52 ?? -.26 .18 According to your research, the growth rate in dividends for Manta Energy for the previous 10 years has been negative 14 percent. If investors feel this growth rate will continue, what is the required return for the stock? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

You've collected the following information from your favorite financial website. 52-Week Price Dividend Hi Lo Stock (Dividend) Yield % PE Ratio Close Price Net Change 77.40 10.43 Acevedo .36 2.6 6 13.90 -.24 55.81 33.42 Georgette, Incorporated 1.54 3.8 10 40.43 -.01 130.93 69.50 YBM 2.00 2.2 10 88.97 3.07 50.33 35.00 14.04 Manta Energy .89 5.7 6 20.74 Winter Sports .32 1.5 28 15.52 ?? -.26 .18 According to your research, the growth rate in dividends for Manta Energy for the previous 10 years has been negative 14 percent. If investors feel this growth rate will continue, what is the required return for the stock? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 55E: Rebert Inc. showed the following balances for last year: Reberts net income for last year was...

Related questions

Question

vvk.1

Transcribed Image Text:Hi

Lo

You've collected the following information from your favorite financial website.

52-Week Price

Stock (Dividend)

Dividend

Yield % PE Ratio Close Price Net Change

77.40

10.43

Acevedo .36

2.6

6

13.90

-.24

55.81

33.42

Georgette, Incorporated 1.54

3.8

10

40.43

-.01

130.93

50.33

35.00

69.50

YBM 2.00

2.2

10

88.97

3.07

14.04

Manta Energy .89

20.74

Winter Sports .32

5.7

1.5

6

15.52

-.26

28

??

.18

According to your research, the growth rate in dividends for Manta Energy for the previous 10 years has been negative 14 percent. If

investors feel this growth rate will continue, what is the required return for the stock?

Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a

percent rounded to 2 decimal places, e.g., 32.16.

Required return

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning