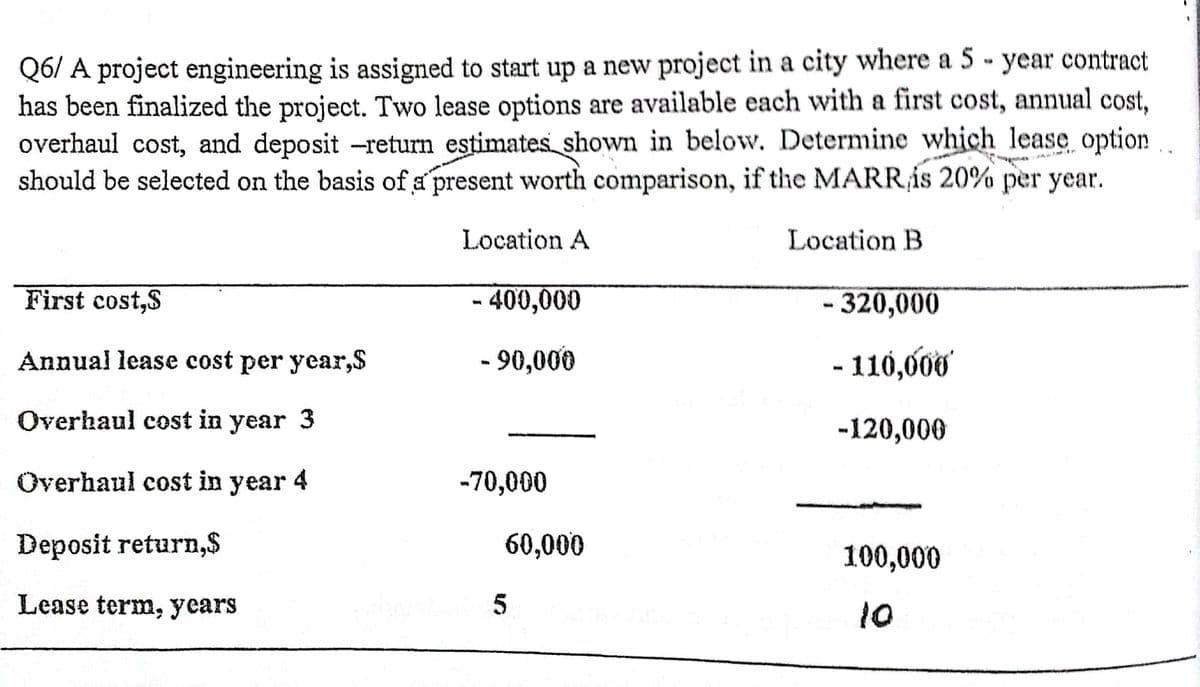

Q6/ A project engineering is assigned to start up a new project in a city where a 5-year contract has been finalized the project. Two lease options are available each with a first cost, annual cost, overhaul cost, and deposit -return estimates shown in below. Determine which lease option should be selected on the basis of a present worth comparison, if the MARR is 20% per year. Location A Location B First cost,S - 400,000 Annual lease cost per year,S - 90,000 Overhaul cost in year 3 Overhaul cost in year 4 Deposit return,$ Lease term, years -70,000 60,000 5 - 320,000 - 110,000 -120,000 100,000 10

Q6/ A project engineering is assigned to start up a new project in a city where a 5-year contract has been finalized the project. Two lease options are available each with a first cost, annual cost, overhaul cost, and deposit -return estimates shown in below. Determine which lease option should be selected on the basis of a present worth comparison, if the MARR is 20% per year. Location A Location B First cost,S - 400,000 Annual lease cost per year,S - 90,000 Overhaul cost in year 3 Overhaul cost in year 4 Deposit return,$ Lease term, years -70,000 60,000 5 - 320,000 - 110,000 -120,000 100,000 10

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 6P

Related questions

Question

Transcribed Image Text:Q6/ A project engineering is assigned to start up a new project in a city where a 5-year contract

has been finalized the project. Two lease options are available each with a first cost, annual cost,

overhaul cost, and deposit -return estimates shown in below. Determine which lease option

should be selected on the basis of a present worth comparison, if the MARRás 20% per year.

Location A

Location B

First cost,S

- 400,000

Annual lease cost per year,S

- 90,000

Overhaul cost in year 3

Overhaul cost in year 4

Deposit return,$

Lease term, years

-70,000

60,000

5

- 320,000

- 110,000

-120,000

100,000

10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning