QS 24-23 (Algo) Internal rate of return LO P4 Perez Company is considering an investment of $30,490 that provides net cash flows of $8,800 annually for four years. (0) What is the internal rate of return of this investment? (PV of $1, EV of $1 PVA of $1, and EVA of S1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) (b) The hurdle rate is 5%. Should the company invest in this project on the basis of internal rate of return? Complete this question by entering your answers in the tabs below. Required A Required B What is the internal rate of return of this investment? Present value factor Internal rate of return

QS 24-23 (Algo) Internal rate of return LO P4 Perez Company is considering an investment of $30,490 that provides net cash flows of $8,800 annually for four years. (0) What is the internal rate of return of this investment? (PV of $1, EV of $1 PVA of $1, and EVA of S1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) (b) The hurdle rate is 5%. Should the company invest in this project on the basis of internal rate of return? Complete this question by entering your answers in the tabs below. Required A Required B What is the internal rate of return of this investment? Present value factor Internal rate of return

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter26: Capital Investment Analysis

Section: Chapter Questions

Problem 26.1APR: Average rate of return method, net present value method, and analysis for a service company The...

Related questions

Question

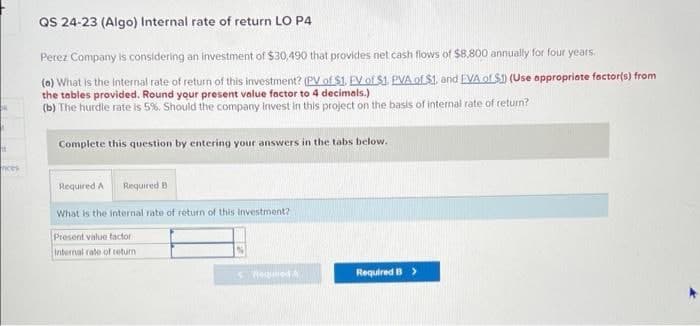

Transcribed Image Text:QS 24-23 (Algo) Internal rate of return LO P4

Perez Company is considering an investment of $30,490 that provides net cash flows of $8,800 annually for four years.

(a) What is the internal rate of return of this investment? (PV of $1. EV of $1. PVA of $1, and EVA of $1) (Use appropriate factor(s) from

the tables provided. Round your present value factor to 4 decimals.)

(b) The hurdle rate is 5%. Should the company invest in this project on the basis of internal rate of return?

Complete this question by entering your answers in the tabs below.

H

Required A

Required B

What is the internal rate of return of this investment?

Present value factor

Internal rate of return

< Required A

Required B >

nices

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,