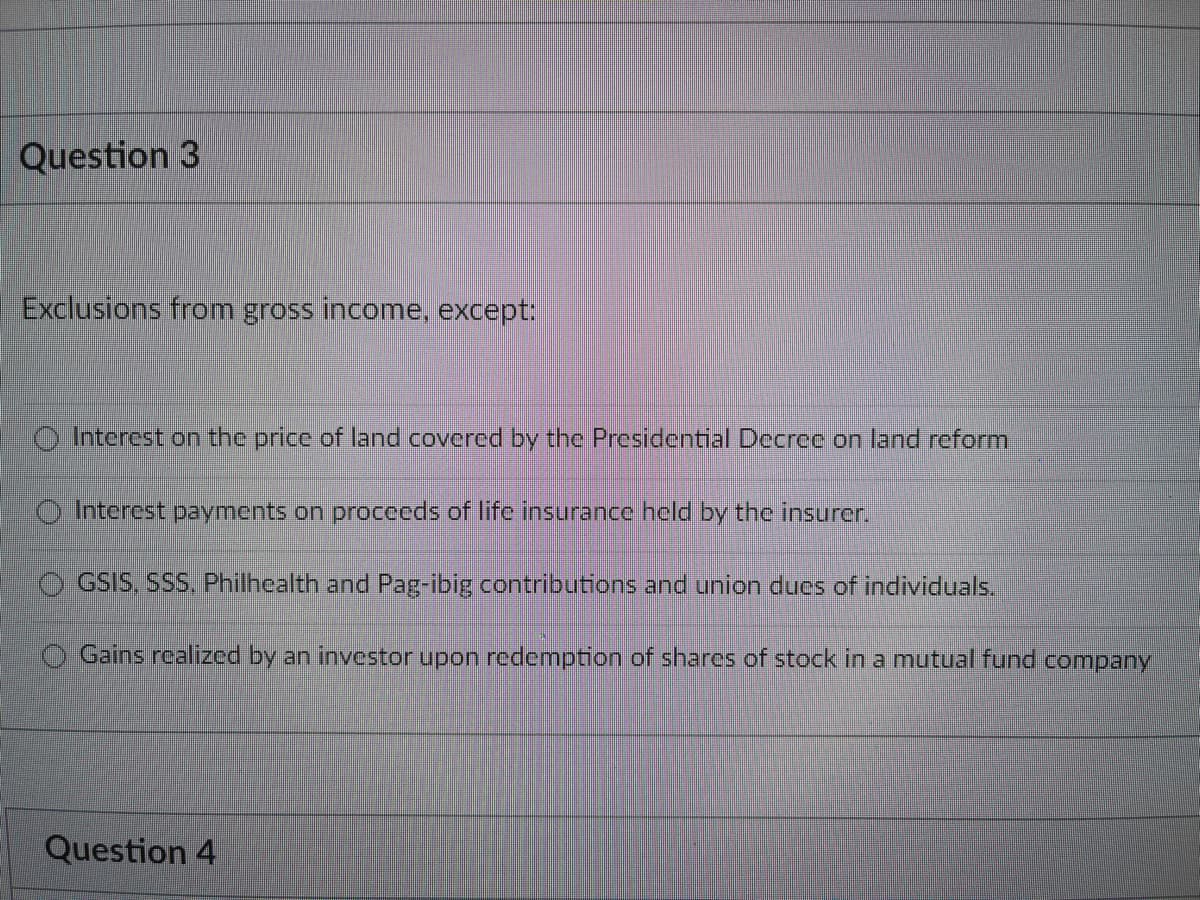

Exclusions from gross income, except: O Interest on the price of land covered by the Presidential Decree on land reform Interest payments on proceeds of life insurance held by the insurer. OGSIS, SSS. Philhealth and Pag-ibig contributions and union dues of individuals. Gains realized by an investor upon redemption of shares of stock in a mutual fund company

Q: An American Depositary Receipt (ADR) is defined as a security: (a) that has been deposited in an…

A: Depository receipts negotiable instruments held by depository on behalf of investors. ADR and GDR…

Q: QUESTION 12 Members of the Federal Reserve System may include: commercial banks with a national…

A: The Federal Reserve System (FRS) is the central bank of the US. It controls all the financial…

Q: Two-year Treasury securities yield 6.7 percent, while 1-year Treasury securities yield 6.3 percent.…

A: The long-term interest rate, according to the expectations theory of the term structure, is a…

Q: 3. Avicorp has a $12.3 million debt issue outstanding, with a 6.1% coupon rate. The debt has…

A: Bonds: Bonds are the liabilities of the company which is issued to raise the funds required to…

Q: Calculate the tax rate if the tax amount is $ 64.50 on a purchase of $780?

A: Tax amount = $64.50 Purchase = $780

Q: Construct a depreciation schedule using the straight line method for a new lorry that costs $80,000…

A: Basic Introduction:- Depriciation is allocation of total cost of assest over its useful life or in…

Q: result of winning the Gates Energy Innovation Award, you are awarded a growing perpetuity. The…

A: Present value of the growing perpetuity = Cash Flows / ( Discount Rate - Growth Rate

Q: A tax exempt municipality is considering the construction of a new municipal waste water treatment…

A: Incremental benefit/cost ratio helps in ascertaining the amount by which the other projects are…

Q: accumulate P24,500 at 9% compounded monthly? 16. How much monthly deposit must be made for 7 years…

A: A stream of equal cash flows (CF) paid or received periodically is termed as annuity. Annuity is…

Q: n 2017. Blue Bank announced a Returm on Equity (ROE) of 15% and a Returm on Assets (ROA) of 2%. The…

A: First we need to use two ratios to calculate unknown values. Return on Equity (ROE) =net…

Q: Q2: The initial investment in project is $ 2550 from now with interest 11.5%, it received yearly…

A: Net Present Value(NPV) is one of the modern techniques of capital budgeting which considers the time…

Q: BrightLine Medical Products delivers medical supplies to small offices across the metro area. The…

A: The churn rate indicate that how much is the amount of customers lost during the given period of…

Q: n all-equity firm currently has 1,000,000 shares of stock outstanding and is considering…

A: The earning per share is important factor for shareholders and if the EPS is increasing than it is…

Q: Marie and Danny Would like to buy a house for $220,000. The down payment for the mortgage is 30% of…

A: “Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: To minimize systemic risk in the banking system, which prudential measure has been put in place in…

A: A breach of this fiduciary responsibility might result in the misbehaving bank being held…

Q: Od. 115,400

A: Variance refers to the measurement of volatility. It should be calculated by taking the average of…

Q: Given the following portfolio: Buy one call option on the stock XYZ with a strike price of $52.8 at…

A: Call option strike price = $52.8 Call option premium = $2 Put option strike price = $57.9 Put option…

Q: Stock W has the following returns for various states of the economy: State of the Economy…

A: Expected Return and Standard deviation of the Stock is determined using the below formula: Expected…

Q: Internal rate of return and modified internal rate of return For the project shown in the following…

A: Concept. 1. IRR. IRR means internal rate of return. It is rate at which the sum of discounted cash…

Q: A couple bought some stock for $30 per share that pays an annual dividend of $0.60 per share. After…

A: Share price: Share price is the current market price of the share. It is the price of the share at…

Q: Directions: Compute the Customer lifetime value (CLV) for the following situation. Follow/Use the…

A: Concept. Customer lifetime value (CLV) = PV × RP × RT Where PV = purchase value RP = Repeat…

Q: How much is the present value of a perpetuity of P1,000 payable semi-annually if money is worth 5%…

A: Present value of perpetuity is calculated for those securities from which keeps generating cash…

Q: What is the IRR for Machine D over a 4-year project life with the following details: Machine D…

A: Internal rate of return refers to the cost of capital that makes a net present value of project is…

Q: WHY THE FORECAST INCOME HSVE DEACLINE IN THE 2022 AND 2023 OF APPLE COMPANY

A: Companies and analysts often forecast their financial statements. Here the income statement of Apple…

Q: dnd can také önly öne. Your cost of capital is 10.7%. The cash flows for the two projects are as…

A: To find the IRR in excel, We will first put the values in excel spreadsheet as shown below NOTE:…

Q: Here is Dan's credit card statement for the month of March. Transaction Date Transaction amount…

A: Note: No intermediate rounding is done in the calculation Given:

Q: Which of the following presumption is correct about the reliability of audit evidence

A: Reliability of audit evidence :- Evidence from sources outside an entity is more reliable than…

Q: Question 4 Anne Murray is planning to buy a rental property, in addition to the family home she and…

A: Return on investment is the financial analysis , which helps to determine the profitability in the…

Q: A four-year discount bond has a face value of $1,000 and a price of $925. What is the yield to…

A: We need to use RATE function in excel in to calculate yield to maturity. Yield to maturity(YTM)…

Q: 11.1 Expected Return and Standard Deviation This problem will give you some practice calculating…

A: Portfolio management is the branch of finance that deals with managing multiple assets and…

Q: Investor Dan has $740,000 to invest in a CD and a mutual fund. The CD yields 3.6% and the mutual…

A: Profit maximization is the process of finding out the maximum returns for an investment based on the…

Q: Based on the net present value method of capital budgeting, should management undertake this…

A: Net present value (NPV) of an alternative/project refers to the variance between the initial…

Q: 5. Dewyco has preferred stock trading at $54 per share. The next preferred dividend of $5 is due in…

A: Annual dividend = $5 Price of preferred stock = $54

Q: A Moving to another question will save this response. Question 5 When evaluating mutually exclusive…

A: The question is related to Capital Budgeting. Mutually exclusive projects are those projects in…

Q: The following information relates to the acquisition of M plc by D plc: Recent dividend of M…

A: The Dividend Growth Model refers to a model that helps in calculating the intrinsic value of a stock…

Q: Find the present value PV of the annuity account necessary to fund the withdrawal given. (Assume…

A: Present value can be calculated as total of present value of annuity amount along with present value…

Q: The company expected to pay dividend of $4 at end of the coming year (December 2022). The…

A:

Q: Suppose the 1-year domestic interest rate is 0.28, keeping in mind that means (100\times×0.28)%.…

A: Domestic Interest rate = 28% Expected exchange rate = 59 Current spot exchange rate = 50

Q: Question 23 $900 is due at the end of 5 years and $700 at the end of 10 years. If money is worth 6%…

A: Amount due at the end of year 5 (C5) = $900 Amount due at the end of year 10 (C10) = $700 Quarterly…

Q: Gordon Rosel went to his bank to find out how long it will take for $1,300 to amount to $1,720 at…

A: Present value = $1,300 Future value = $1,720 Interest rate = 0.12

Q: A loan of R30 000 is secured at an interest rate of 25% p.a. (cq) and will be paid back with monthly…

A: We need to use monthly amortisation formula to calculate monthly payment R =P*i1-1(1+i)n where…

Q: ries of 6 year-end payments of $400,000. If Simes has a cost of capital of 9%, which form of payment…

A: Present value of money today of the future payments should be more than cash amount today to justify…

Q: Find a recent merger transaction that failed due to regulatory concerns over market share…

A: Many a times regulators block a M&A (mergers and acquisitions) deal on the basis that it will…

Q: Juniper Corporation is considering two alternative investment proposals with the following data:…

A: Accounting rate of return (%) =( Average annual profit/initial investment) ×100

Q: hen hopes to eventually replace his old bicycle with a new one. The type of bicyclehe wants has a…

A: Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: Keys Corporation's 5-year bonds yield 5.10% and 5-year T-bonds yield 4.40%. The real risk-free rate…

A: The DRP (Default Risk Premium) is a payment made to financial lenders or investors in the event that…

Q: QUESTION 1 - The Bond Market NAR a) A bond portfolio manager is contemplating the purchase of a…

A: Given, Bond's current price= $98.4321Bond's face value= 100 Bond's Coupon rate = 11%( annual) and…

Q: Mr. Smith is purchasing a $90000 hoyse. The down payment is 20% of the price of the house. He is…

A: A mortgage is a loan that is repaid by equal installments over a period of time. The installments…

Q: On the Milan bourse, Fiat Chrysler stock recently traded at €13.82 per share. Fiat Chrysler also…

A: Given: Price of Fiat Chrysler = €13.82 1 share = 1 ADR Current spot rate $/€ = $1.12/EUR1.00

Q: Explain the advantage of saving early?

A: Money received today is worth more than money due at a later date, according to the time value of…

Step by step

Solved in 2 steps

- 49.The redeemable cash value of a life insurance policy (cash surrender value) where the insured is the president of the Corporation and the beneficiary is the same Corporation, is presented in the Statement of Financial Position as Select one: a.Cash. b. Long-term investment c. Investment in negotiable securities. d. Insurance paid in advance1.Which of the following is a permanent difference? Dividends from a domestic corporation Property insurance premiums paid Commissions from consignment sales Donations received Interest on savings depositWhich of the following may be ordinary income? Salary Government pension Lottery winnings Rent from an investment property a. 1, 2, and 4 only b. 1 only c. 1 and 2 only d. 1, 2, 3, and 4

- Statement 1: The value of property acquired by gift, bequest, devise, or descent, as well as the income from such property, shall be excluded from the gross taxable income of the recipient. Statement 2: Gains realized from the sale or exchange or retirement of bonds, debentures, or other certificates of indebtedness with a maturity of at least 5 years, shall not be taxable to the investor-seller. a. Statement 1 is trueb. Statement 2 is truec. Both Statements are falsed. Both statements are trueMatch term to the correct definition. The balance on which interest is paid. Interest paid both on the original investment and on all interest that has been added to the original investment. An investment that gives you a share of ownership in a company. An investment that represents a promise of future cash. Usually issued by either a government or a corporation. The issuer pays you back your initial investment as well as simple interest earned on that investment.…33. Multiple Choices. Which one of the following is not a current liability? a. Property dividends payable b. Bonus obligations to employees c. Share dividends issuable d. Estimated income taxes payable e. Advances from customers

- Statement 1: Life insurance premiums shall be reported as a deductible expense for financial reporting purposes if the company paying it is the beneficiary. Statement 2: Life insurance premiums shall be reported as a deductible expense for taxation purposes if the company paying it is the beneficiary. Statement 3: The total income tax expense can be computed as financial income multiplied by the tax rate. Statement 4: Future taxable amounts should be deducted in determining the taxable income which will yield the deferred tax asset. Statement 5: Future deductible amounts should be deducted in determining the taxable income. Which statement/s are true?1. An example of a permanent difference is: a. Funds received from officers' life insurance. b. Interest expense on money borrowed to invest in municipal bonds. c. Insurance expense incurred when paying for a life insurance policy for Officers. d. They are all examples of permanent differences. 2. The Balance Sheet of Unruh Corporation, as of December 31, 2011, reports an accumulated Receivable for financial information purposes, but not for income tax purposes. When this asset is recovered in 2012, a future taxable amount will occur and: a. Financial income before contributions will be greater than income subject to tax in 2011. b. Unruh must recognize a decrease in deferred tax debt during 2011. c. Total tax expense for 2011 will exceed current tax expense for 2011. d. Unruh should record an increase in deferred tax assets during 2011.a. The purchase of mutual fund shares. b. Depositing in a credit union. c. Borrowing from a friend or relative. d. Employee contribution to a pension fund. Which ones of the above are examples of indirect financing? a and b a, b and c a, b and d a, c and d all of the above.

- 1. The imputed interest rules apply to which of the following type of loan? a.Coercion-related loans b.Loans from one employee to another c.Shareholder-corporation loans made from a shareholder to a corporation d.Gift loans made out of love or affection e.Loans made between two objective parties at the market rate of interest 2. In December 2022, Bellamy collected the December 2022 and January 2023 rent from a tenant. Bellamy is a cash basis taxpayer. The amount collected in December 2022 for the 2023 rent should be included in the 2023 gross income. True FalseStatement 1: If an insured outlived his policy and received from the insurance company an amount equivalent to the total premiums paid, such amount is taxable. Statement 2: If the insured dies and the beneficiary receives payment from the insurance company, the amount received in excess of the total premiums paid shall be taxable. A. Both statements are true B. Both statements are false C. Only statement 1 is true D. Only statement 2 is trueFINANCING DECISIONS What are the advantages and examples of Internal Financing (at least 2 for Sole Proprietorship, Partnership and Corporation)? How does depreciation gives tax benefit? REFERENCES: https://www.youtube.com/watch?v=WQbK-hNRWvA&t=3702s https://www.youtube.com/watch?v=-OUAu-2-MV8