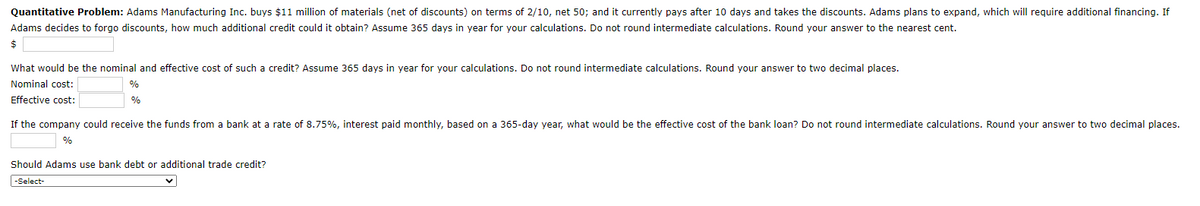

Quantitative Problem: Adams Manufacturing Inc. buys $11 million of materials (net of discounts) on terms of 2/10, net 50; and it currently pays after 10 days and takes the discounts. Adams plans to expand, which will require additional financing. If Adams decides to forgo discounts, how much additional credit could it obtain? Assume 365 days in year for your calculations. Do not round intermediate calculations. Round your answer to the nearest cent. What would be the nominal and effective cost of such a credit? Assume 365 days in year for your calculations. Do not round intermediate calculations. Round your answer to two decimal places. Nominal cost: % Effective cost: If the company could receive the funds from a bank at a rate of 8.75%, interest paid monthly, based on a 365-day year, what would be the effective cost of the bank loan? Do not round intermediate calculations. Round your answer to two decimal places. Should Adams use bank debt or additional trade credit? -Select-

Quantitative Problem: Adams Manufacturing Inc. buys $11 million of materials (net of discounts) on terms of 2/10, net 50; and it currently pays after 10 days and takes the discounts. Adams plans to expand, which will require additional financing. If Adams decides to forgo discounts, how much additional credit could it obtain? Assume 365 days in year for your calculations. Do not round intermediate calculations. Round your answer to the nearest cent. What would be the nominal and effective cost of such a credit? Assume 365 days in year for your calculations. Do not round intermediate calculations. Round your answer to two decimal places. Nominal cost: % Effective cost: If the company could receive the funds from a bank at a rate of 8.75%, interest paid monthly, based on a 365-day year, what would be the effective cost of the bank loan? Do not round intermediate calculations. Round your answer to two decimal places. Should Adams use bank debt or additional trade credit? -Select-

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter22: Providing And Obtaining Credit

Section: Chapter Questions

Problem 2MC

Related questions

Question

Practice Pack

Please solve for all sub-parts of the question displayed on image.

Transcribed Image Text:Quantitative Problem: Adams Manufacturing Inc. buys $11 million of materials (net of discounts) on terms of 2/10, net 50; and it currently pays after 10 days and takes the discounts. Adams plans to expand, which will require additional financing. If

Adams decides to forgo discounts, how much additional credit could it obtain? Assume 365 days in year for your calculations. Do not round intermediate calculations. Round your answer to the nearest cent.

$

What would be the nominal and effective cost of such a credit? Assume 365 days in year for your calculations. Do not round intermediate calculations. Round your answer to two decimal places.

Nominal cost:

%

Effective cost:

%

If the company could receive the funds from a bank at a rate of 8.75%, interest paid monthly, based on a 365-day year, what would be the effective cost of the bank loan? Do not round intermediate calculations. Round your answer to two decimal places.

%

Should Adams use bank debt or additional trade credit?

|-Select-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College