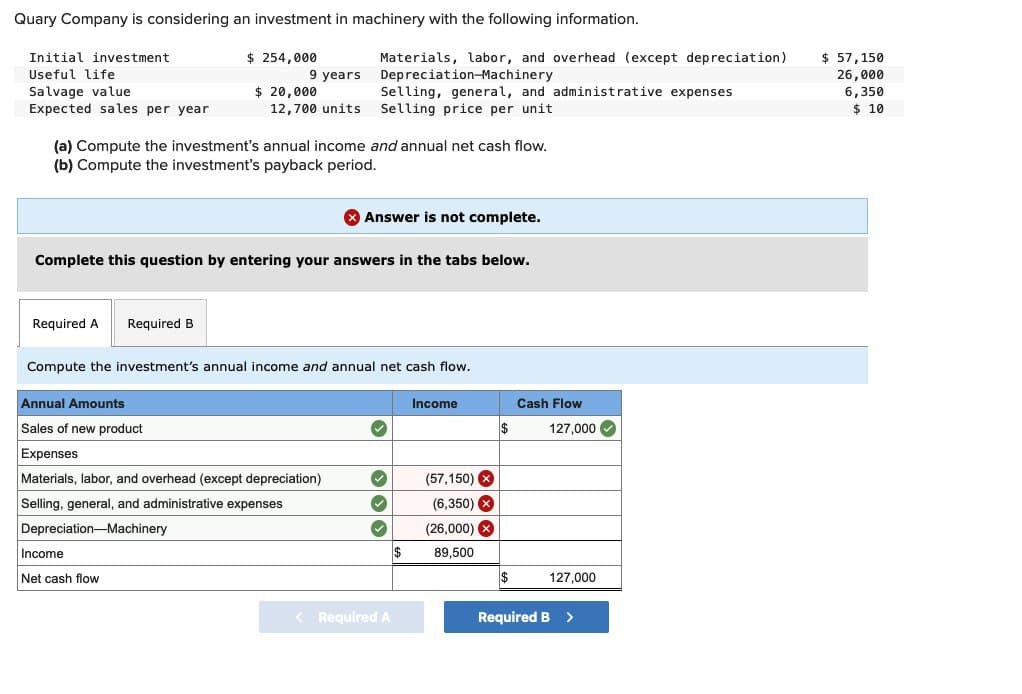

Quary Company is considering an investment in machinery with the following information. Initial investment Useful life Materials, labor, and overhead (except depreciation) Depreciation-Machinery $ 254,000 9 years Salvage value Expected sales per year $ 20,000 12,700 units Selling, general, and administrative expenses Selling price per unit $ 57,150 26,000 6,350 $ 10 (a) Compute the investment's annual income and annual net cash flow. (b) Compute the investment's payback period. Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Compute the investment's annual income and annual net cash flow. Annual Amounts Sales of new product Expenses Materials, labor, and overhead (except depreciation) Selling, general, and administrative expenses Depreciation-Machinery Income Net cash flow Income Cash Flow $ 127,000 (57,150) (6,350) (26,000) $ 89,500 $ 127,000 < Required A Required B >

Quary Company is considering an investment in machinery with the following information. Initial investment Useful life Materials, labor, and overhead (except depreciation) Depreciation-Machinery $ 254,000 9 years Salvage value Expected sales per year $ 20,000 12,700 units Selling, general, and administrative expenses Selling price per unit $ 57,150 26,000 6,350 $ 10 (a) Compute the investment's annual income and annual net cash flow. (b) Compute the investment's payback period. Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Compute the investment's annual income and annual net cash flow. Annual Amounts Sales of new product Expenses Materials, labor, and overhead (except depreciation) Selling, general, and administrative expenses Depreciation-Machinery Income Net cash flow Income Cash Flow $ 127,000 (57,150) (6,350) (26,000) $ 89,500 $ 127,000 < Required A Required B >

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter9: Depreciation (deprec)

Section: Chapter Questions

Problem 1R: Dunedin Drilling Company recently acquired a new machine at a cost of 350,000. The machine has an...

Related questions

Question

Transcribed Image Text:Quary Company is considering an investment in machinery with the following information.

Initial investment

Useful life

Materials, labor, and overhead (except depreciation)

Depreciation-Machinery

$ 254,000

9 years

Salvage value

Expected sales per year

$ 20,000

12,700 units

Selling, general, and administrative expenses

Selling price per unit

$ 57,150

26,000

6,350

$ 10

(a) Compute the investment's annual income and annual net cash flow.

(b) Compute the investment's payback period.

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Required A Required B

Compute the investment's annual income and annual net cash flow.

Annual Amounts

Sales of new product

Expenses

Materials, labor, and overhead (except depreciation)

Selling, general, and administrative expenses

Depreciation-Machinery

Income

Net cash flow

Income

Cash Flow

$

127,000

(57,150)

(6,350)

(26,000)

$

89,500

$

127,000

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub