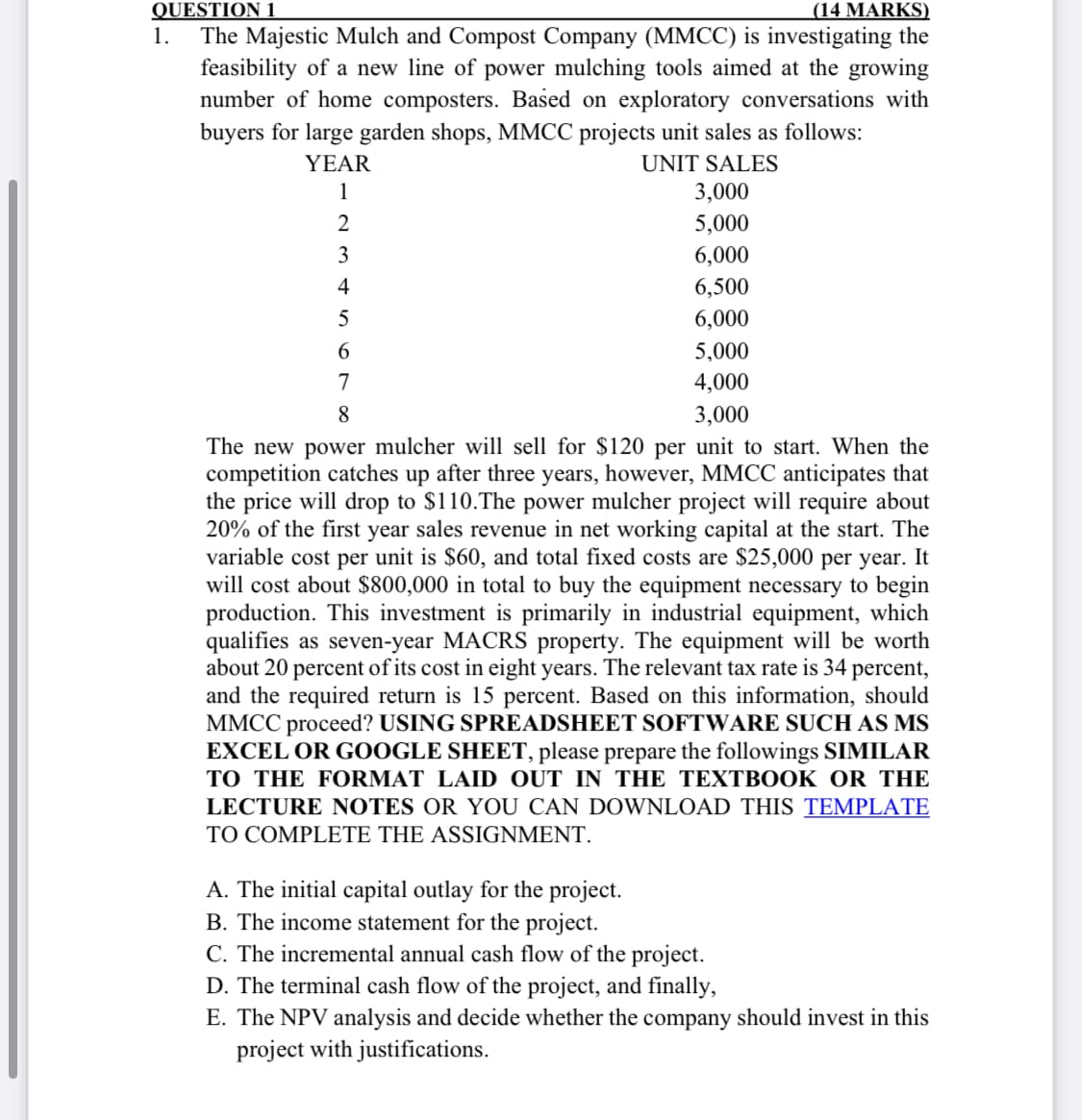

QUESTION 1 1. (14 MARKS) The Majestic Mulch and Compost Company (MMCC) is investigating the feasibility of a new line of power mulching tools aimed at the growing number of home composters. Based on exploratory conversations with buyers for large garden shops, MMCC projects unit sales as follows: UNIT SALES YEAR 1 2 3 4 5 6 3,000 5,000 6,000 6,500 6,000 5,000 4,000 3,000 7 8 The new power mulcher will sell for $120 per unit to start. When the competition catches up after three years, however, MMCC anticipates that the price will drop to $110.The power mulcher project will require about 20% of the first year sales revenue in net working capital at the start. The variable cost per unit is $60, and total fixed costs are $25,000 per year. It will cost about $800,000 in total to buy the equipment necessary to begin production. This investment is primarily in industrial equipment, which qualifies as seven-year MACRS property. The equipment will be worth about 20 percent of its cost in eight years. The relevant tax rate is 34 percent, and the required return is 15 percent. Based on this information, should MMCC proceed? USING SPREADSHEET SOFTWARE SUCH AS MS EXCEL OR GOOGLE SHEET, please prepare the followings SIMILAR TO THE FORMAT LAID OUT IN THE TEXTBOOK OR THE LECTURE NOTES OR YOU CAN DOWNLOAD THIS TEMPLATE TO COMPLETE THE ASSIGNMENT. A. The initial capital outlay for the project. B. The income statement for the project. C. The incremental annual cash flow of the project. D. The terminal cash flow of the project, and finally, E. The NPV analysis and decide whether the company should invest in this project with justifications.

QUESTION 1 1. (14 MARKS) The Majestic Mulch and Compost Company (MMCC) is investigating the feasibility of a new line of power mulching tools aimed at the growing number of home composters. Based on exploratory conversations with buyers for large garden shops, MMCC projects unit sales as follows: UNIT SALES YEAR 1 2 3 4 5 6 3,000 5,000 6,000 6,500 6,000 5,000 4,000 3,000 7 8 The new power mulcher will sell for $120 per unit to start. When the competition catches up after three years, however, MMCC anticipates that the price will drop to $110.The power mulcher project will require about 20% of the first year sales revenue in net working capital at the start. The variable cost per unit is $60, and total fixed costs are $25,000 per year. It will cost about $800,000 in total to buy the equipment necessary to begin production. This investment is primarily in industrial equipment, which qualifies as seven-year MACRS property. The equipment will be worth about 20 percent of its cost in eight years. The relevant tax rate is 34 percent, and the required return is 15 percent. Based on this information, should MMCC proceed? USING SPREADSHEET SOFTWARE SUCH AS MS EXCEL OR GOOGLE SHEET, please prepare the followings SIMILAR TO THE FORMAT LAID OUT IN THE TEXTBOOK OR THE LECTURE NOTES OR YOU CAN DOWNLOAD THIS TEMPLATE TO COMPLETE THE ASSIGNMENT. A. The initial capital outlay for the project. B. The income statement for the project. C. The incremental annual cash flow of the project. D. The terminal cash flow of the project, and finally, E. The NPV analysis and decide whether the company should invest in this project with justifications.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter14: The Balanced Scorecard And Corporate Social Responsibility

Section: Chapter Questions

Problem 2PB: Strategic initiatives and CSR Blue Skies Inc. is a retail gardening company that is piloting a new...

Related questions

Question

Transcribed Image Text:QUESTION 1

1.

(14 MARKS)

The Majestic Mulch and Compost Company (MMCC) is investigating the

feasibility of a new line of power mulching tools aimed at the growing

number of home composters. Based on exploratory conversations with

buyers for large garden shops, MMCC projects unit sales as follows:

UNIT SALES

YEAR

1

2

3

4

5

6

3,000

5,000

6,000

6,500

6,000

5,000

4,000

3,000

7

8

The new power mulcher will sell for $120 per unit to start. When the

competition catches up after three years, however, MMCC anticipates that

the price will drop to $110.The power mulcher project will require about

20% of the first year sales revenue in net working capital at the start. The

variable cost per unit is $60, and total fixed costs are $25,000 per year. It

will cost about $800,000 in total to buy the equipment necessary to begin

production. This investment is primarily in industrial equipment, which

qualifies as seven-year MACRS property. The equipment will be worth

about 20 percent of its cost in eight years. The relevant tax rate is 34 percent,

and the required return is 15 percent. Based on this information, should

MMCC proceed? USING SPREADSHEET SOFTWARE SUCH AS MS

EXCEL OR GOOGLE SHEET, please prepare the followings SIMILAR

TO THE FORMAT LAID OUT IN THE TEXTBOOK OR THE

LECTURE NOTES OR YOU CAN DOWNLOAD THIS TEMPLATE

TO COMPLETE THE ASSIGNMENT.

A. The initial capital outlay for the project.

B. The income statement for the project.

C. The incremental annual cash flow of the project.

D. The terminal cash flow of the project, and finally,

E. The NPV analysis and decide whether the company should invest in this

project with justifications.

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,