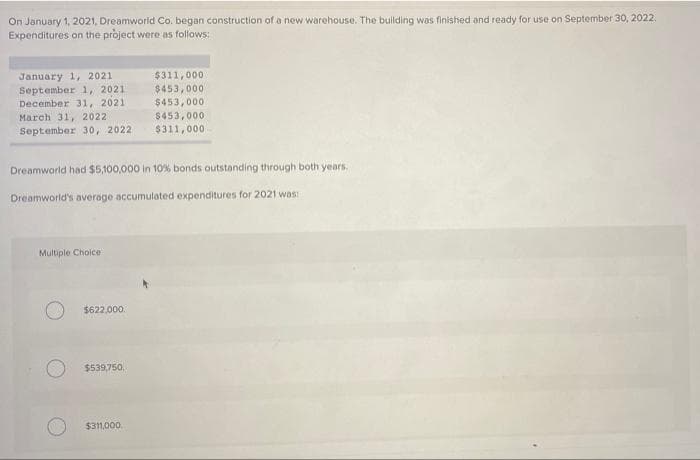

On January 1, 2021, Dreamworld Co. began construction of a new warehouse. The building was finished and ready for use on September 30, 2022. Expenditures on the project were as follows: January 1, 2021 $311,000 September 1, 2021 $453,000 $453,000 December 31, 2021 March 31, 2022 $453,000 September 30, 2022 $311,000 Dreamworld had $5,100,000 in 10% bonds outstanding through both years. Dreamworld's average accumulated expenditures for 2021 was! Multiple Choice

Q: FINANCIAL STATEMENT ANALYSIS AND RATIO ANALYSIS The following are the balance sheet and income…

A: A financial ratio or accounting ratio is a relative magnitude of two selected numerical values taken…

Q: Bruno Inc.'s Financial Statement for years 2014-2015. Compute for the Bruno Inc. Year 2015 Debt to…

A: Financial ratios are those which provide a summary of the accounts of a company and helps an…

Q: A 16 year old student orally entered into a 5-year contract of lease of car at a rent of P500/year…

A: A minor is someone who has not reached the age of majority. In the Philippines, the majority age is…

Q: What is the return on total assets for Diane Company? a.6.3% b.1.4% c.3.4% d.9.8%

A: Return on total assets is the ratio that measures company's EBIT relative to its total assets

Q: CARMINE Company is preparing the interim financial statements for the first quarter ended March 31,…

A: Note: It is given in the question that, advertising expense will be incurred evenly during 2022, so…

Q: S 5. What is the gain or loss on purchasing power for 2021? (if LOSS, put a negative (-) sign before…

A: When a borrowing company holds monetary assets or liabilities in an inflationary situation and the…

Q: CARMINE Company is preparing the interim financial statements for the first quarter ended March 31,…

A: Variable expense = Expenses in first quarter ×25% = P10,000,000 ×25% = P2500000 Fixed expense =…

Q: The ABC Company acquired 90% of the outstanding shares of XYZ Company, a foreign subsidiary, on…

A: The question is mix of currency translation and business combination accounting. The land will…

Q: The balance in the equipment account before adjustment on December 31, 2007 is $60,000 and the…

A: Depreciation is the reduction in the value of an asset over a useful life of the asset. It is an…

Q: A. Cotton serviced for P75,000, on account. She mistakenly recorded the promise to pay as 57,000 to…

A: In the given question, insurance premium of P 576,000 is paid on 1st August 2020. Insurance period…

Q: riton Company provided the following information concerning a defined at the beginning of current…

A: In a company's accounting records, a journal entry is used to memorialize a commercial transaction.…

Q: 6. What should be the basic earnings per share in 2021? a. ₱ 9.00 b. ₱ 10.50 c. ₱ 12.50 d. ₱…

A: Introduction:- Basic earning per share :- Basic earnings per share is the amount of a company's…

Q: le 7,000,000 000 000 4,

A: Profit on Sale of Investment= Sales Proceeds - Cost of Investment = 1250,000-(1750,000-1000,000)…

Q: On January 31, 2022, RUBY Company agreed to pay the former president $300,000 under a deferred…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: Dolce Co. estimates its sales at 180,000 units in the first quarter and that sales will increase by…

A: Cash sales are 30% 65% of credit sales will be received in same quarter. Quarter 2 sales units =…

Q: At December 31, 2020, the cost and fair value trading securities for Crane, Inc. are as follows.…

A: The trading securities were decreased In value from its cost. The unrealized loss = Total Fair…

Q: * 2. What is the diluted earnings per share? (Present answer in 2 decimal places, example: x.xx) At…

A: Basic earnings per share is the income attributable per share based on the weighted average number…

Q: What is the value of revenue to have operating income of $100,000? Units 3,000 Per Unit Revenue…

A: Formula: Revenue to be earned having operating income = ( Fixed cost + Target Income ) / Unit…

Q: The balance sheet data of Randolph Company for two recent years appears below: Assets: Year 2…

A: Financial analysis is widely used by companies to determine the profitability of the business and…

Q: Elliptical Consulting Adjusted Trial Balance For the Year Ended June 30, 2019 Account Title…

A: Basic accounting equation is Total assets = Total liabilities + owners equity

Q: Strong Key Pte. Ltd., manufactures a key for houses with the selling price $7/per unit. Each key has…

A: Breakeven points - are utilized in a variety of commercial and financial situations. It is the level…

Q: INCOME STATEMENTS Net sales COGS (excl. depr.) Depreciation Other operating expenses EBIT Interest…

A: Ratio Analysis - The ratio is the technique used by the prospective investor or an individual or…

Q: Grouper Company has bonds payable outstanding in the amount of $350,000, and the Premium on Bonds…

A: A bond is borrowing security issued by a company to raise funds from the market by making an…

Q: Charlton Company provided the following information concerning a defined benefit plan at the…

A: A diary entry is a type of accounting entry that is used to record a business transaction in the…

Q: BLACK JACK Company purchased an automotive equipment on June 30, 2018 for $3,000,000. At the date of…

A: Depreciation Expenses - Depreciation Expenses are the expense incurred on the wear and tear of the…

Q: Lace Company provided the following information during the current year: 500,000 Dividend received…

A: The statement of cash flows is a part of the financial statement, it is prepared to know the cash…

Q: what are the pro and cons for traditional budgeting?

A: Traditional Budgeting Traditional budgeting which provides the budgetary requirement of the business…

Q: A plant bought a new equipment for P220,000 and used it for 10 years, the life span of the…

A: Depreciation is the expense which takes place due to fact of the use of the fixed asset during the…

Q: What are liabilities that will be due within a short time (usually one year or less) and that are to…

A: Today we are going to discuss the three primary types of liabilities which include: short-term…

Q: Sales P800,000 Cost of goods sold 480,000 Gross Profit 320,000 Operating expenses 40,000 Selling…

A: Formula: Each line item % = ( Each line item value / Sales value ) x 100

Q: Budgeted indirect costs $7,200 Budgeted customer orders 1,200 Budgeted production units 1,800…

A: Budgeted indirect-cost per direct manufacturing labor hour = Budgeted indirect cost/Budgeted Direct…

Q: Outdoor Company expects to sell 6,500 units for $175 each for a total of $1,137,500 in January and…

A: Budgeting - Budgeting is the process of estimating future operations based on past performance. %…

Q: The trial balance prepared before adjusting entries are recorded is called what? Group of answer…

A: An adjusted trial balance lists the general ledger account balances after any adjustments have been…

Q: Play-Disc makes Frisbee-type plastic discs. Each 12-inch diameter plastic disc has the following…

A: Solution:- 1)Preparation of an ending finished goods inventory budget for Play-Disc for the coming…

Q: Elliptical Consulting Adjusted Trial Balance For the Year Ended June 30, 2019 Account Title…

A: Liabilities are the obligation of the company that has to be paid by sacrificing the assets of the…

Q: formation during Lace Company provided the following the current year: 500,000 Dividend received…

A: A cash flow statement is a part of the financial statement. It reconciles the opening cash balance…

Q: 4. What amount does Cadbury’s consolidated balance sheet report for this inventory at December 31,…

A: Disclaimer: “Since you have asked multiple questions, we will solve the first question for you. If…

Q: Ignoring income tax, by what amount should shareholders’ equity be increased for 2021 and 2022 in…

A:

Q: Q6. On April 1, Year 6, Bob the Builder traded in an equipment with a book value of $2,000 (initial…

A: DEPRECIATION MEANS MONETARY VALUE OF AN ASSETS DECREASES OVER TIME DUE TO USE OF WEAR AND TEAR OR…

Q: A series of payments made to partners during partnership liquidation is called a continuous…

A: Installment liquidation involves the selling of some assets, paying the liabilities of the…

Q: Read each problem carefully and choose the CORRECT answer among the choices. PROBLEM: Brooklyn…

A: Lets understand the basics. As per IAS 23 "Borrowing costs", borrowing cost incurred to construct or…

Q: Bank XYZ Balance Sheet LIABILITIES Total reserves Checkable deposits $4,000,000 $3,800,000 $200,000…

A: Given :- Bond dealer deposits - $1,000,000 New deposit - $1,000,000 Required Reserve ratio - 0.15…

Q: Adjusting entries are sorted into two groups, accruals and deferrals. What is the classification…

A: As per the accrual accounting principle, each business transaction should be recorded in the period…

Q: What is the inherent justification underlying the concept of potential ordinary shares or diluters…

A: Introduction:- The following Qualitative characteristics of accounting information as follows…

Q: The following information pertains to Tonton Company for the year ended December 31, 2015: Net…

A: When a borrowing company holds monetary assets or liabilities in an inflationary situation and the…

Q: Ignoring income tax, the accounting change should preferably be reported by the company in its year…

A: Accounting Policy are the principles and guidelines that must be followed consistently in the…

Q: mpany’s cost if it decides to shutdown operations for the next four months c) If, because of strik

A: The cost function of the company C=500000+5Q is given.

Q: A company plans to tighten its credit policy. The new policy will decrease the average number of…

A: In a credit policy if the collection period is reduced, the turnover of the business and accounts…

Q: Taft Technologies has the following relationships: annual sales $1,200,000 current liabilities…

A: On a balance statement, total current assets refers to the total amount of cash, receivables,…

Q: What is the return on investment on the purchase of the new equipment?

A: Return on investment is the return or even the profit which has been earned during the period from…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Calculate the following: The first year of depreciation on a residential rental building costing $250,000 purchased June 2,2019. $_____________ The second year (2020) of depreciation on a computer costing $5,000 purchased in May 2019, using the half-year convention and accelerated depreciation considering any bonus depreciation taken. $______________ The first year of depreciation on a computer costing $2,800 purchased in May 2019, using the half-year convention and straight-line depreciation with no bonus depreciation. $______________ The third year of depreciation on business furniture costing $10,000 purchased in March 2017, using the half-year convention and accelerated depreciation but no bonus depreciation. $______________On March 1, 2019, Elkhart enters into a new contract to build a specialized warehouse for 7 million. The promise to transfer the warehouse is determined to be a performance obligation. The contract states that if the warehouse is usable by November 30, 2019, Elkhart will receive a bonus of 600,000. For every week after November 30 that the warehouse is not usable, the bonus will decrease by 150,000. Elkhart provides the following completion schedule: Required: 1. Assume that Elkhart uses the expected value approach. What amount should Elkhart use for the transaction price? 2. Assume that Elkhart uses the most likely amount approach. What amount should Elkhart use for the transaction price? 3. Next Level What is the purpose of assessing whether a constraint on the variable consideration exists?At the beginning of 2020, Holden Companys controller asked you to prepare correcting entries for the following three situations: 1. Machine X was purchased for 100,000 on January 1, 2015. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 45,000. The estimated residual value remains at 10,000, but the service life is now estimated to be 1 year longer than originally estimated. 2. Machine Y was purchased for 40,000 on January 1, 2018. It had an estimated residual value of 4,000 and an estimated service life of 8 years. It has been depreciated under the sum-of-the-years-digits method for 2 years. Now, the company has decided to change to the straight-line method. 3. Machine Z was purchased for 80,000 on January 1, 2019. Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value is 8,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry for each situation to record the depreciation for 2020. Ignore income taxes.

- During 2019, Ryel Companys controller asked you to prepare correcting journal entries for the following three situations: 1. Machine A was purchased for 50,000 on January 1, 2014. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 25,000. The estimated residual value remains at 5,000, but the service life is now estimated to be 1 year longer than estimated originally. 2. Machine B was purchased for 40,000 on January 1, 2017. It had an estimated residual value of 5,000 and an estimated service life of 10 years. it has been depreciated under the double-declining-balance method for 2 years. Now, at the beginning of the third year, Ryel has decided to change to the straight-line method. 3. Machine C was purchased for 20,000 on January 1, 2018, Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value of the machine is 2,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry necessary for each situation to record depreciation expense for 2019.Hathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual value was 500 and its expected service life was 5 years. Hathaway computes depreciation expense to the nearest whole month. Required: 1. Compute depredation expense (rounded to the nearest dollar) for 2019 and 2020 using the: a. straight-line method b. sum-of-the-years-digits method c. double-declining-balance method 2. Next Level Which method produces the highest book value at the end of 2020? 3. Next Level Which method produces the highest charge to income in 2020? 4. Next Level Over the life of the asset, which method produces the greatest amount of depreciation expense?Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used for deliveries, has the following characteristics: Estimated life: 5 years Estimated residual value: 3,000 Depreciation method for financial statements: straight-line method Depreciation for income tax purposes: MACRS (3-year life) From 2019 through 2023, each year, Hunter had sales of 100,000, cost of goods sold of 60,000, and operating expenses (excluding depreciation) of 15,000. The truck was disposed of on December 31, 2023, for 2,000. Required: 1. Prepare an income statement for financial reporting through pretax accounting income for each of the 5 years, 2019 through 2023. 2. Prepare, instead, an income statement for income tax purposes through taxable income for each of the 5 years, 2019 through 2023. 3. Compare the total income for all 5 years under Requirements 1 and 2.

- On January 1, 2018, the Mason Manufacturing Company began construction of a building to be used as itsoffice headquarters. The building was completed on September 30, 2019. Expenditures on the project were asfollows:January 1, 2018 $1,000,000March 1, 2018 600,000June 30, 2018 800,000October 1, 2018 600,000January 31, 2019 270,000April 30, 2019 585,000August 31, 2019 900,000On January 1, 2018, the company obtained a $3 million construction loan with a 10% interest rate. The loanwas outstanding all of 2018 and 2019. The company’s other interest-bearing debt included two long-termnotes of $4,000,000 and $6,000,000 with interest rates of 6% and 8%, respectively. Both notes were outstanding during all of 2018 and 2019. Interest is paid annually on all debt. The company’s fiscal year-end isDecember 31.Required:1. Calculate the amount of interest that Mason should capitalize in 2018 and 2019 using the specific interestmethod.2. What is the total cost of the building?3. Calculate the amount of…On January 1, 2021, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2022. Expenditures on the project were as follows: January 1, 2021 $ 1,910,000 March 1, 2021 1,620,000 June 30, 2021 1,820,000 October 1, 2021 1,620,000 January 31, 2022 423,000 April 30, 2022 756,000 August 31, 2022 1,053,000 On January 1, 2021, the company obtained a $4,700,000 construction loan with a 12% interest rate. The loan was outstanding all of 2021 and 2022. The company’s other interest-bearing debt included two long-term notes of $6,000,000 and $9,000,000 with interest rates of 8% and 10%, respectively. Both notes were outstanding during all of 2021 and 2022. Interest is paid annually on all debt. The company’s fiscal year-end is December 31.Required:1. Calculate the amount of interest that Mason should capitalize in 2021 and 2022 using the specific…On January 1, 2021, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2022. Expenditures on the project were as follows: January 1, 2021 $ 1,000,000 March 1, 2021 600,000 June 30, 2021 800,000 October 1, 2021 600,000 January 31, 2022 270,000 April 30, 2022 585,000 August 31, 2022 900,000 On January 1, 2021, the company obtained a $3 million construction loan with a 10% interest rate. The loan was outstanding all of 2021 and 2022. The company’s other interest-bearing debt included two long-term notes of $4,000,000 and $6,000,000 with interest rates of 6% and 8%, respectively. Both notes were outstanding during all of 2021 and 2022. Interest is paid annually on all debt. The company’s fiscal year-end is December 31. Required: Calculate the amount of interest that Mason should capitalize in 2021 and 2022 using the specific interest…

- On January 1, 2021, Company A began the construction of a building to be used as its office headquarters. The building was completed on September 30, 2022. Expenditures on the project were as follows: Company A January 1, 2021 $2,000,000 March 1, 2021 1,600,000 June 30, 2021 1,800,000 October 1, 2021 1,600,000 January 31, 2022 1,270,000 April 30, 2022 1,585,000 August 31, 2022 1,900,000 Construction loan amount $4,000,000 Construction loan interest rate 8% Long-term note $5,000,000 Long-term note interest rate 4% Long-term note $7,000,000 Long-term note interest rate 6% On January 1, 2021, the company obtained a $4 million construction loan with a 8% interest rate. The loan was outstanding all of 2021 and 2022. The company's other interest-bearing debt included two long-term notes of $5,000,000 and 7,000,000 with interest rates of 4% and 6%, respectively. Both notes were outstanding during all of 2021 and 2022. Interest is paid annually on all debt. The company's fiscal year-end is…On January 1, 2024, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2025. Expenditures on the project were as follows: January 1, 2024 $ 1,040,000March 1, 2024 810,000June 30, 2024 450,000October 1, 2024 700,000January 31, 2025 1,125,000April 30, 2025 1,440,000August 31, 2025 2,610,000On January 1, 2024, the company obtained a $3 million construction loan with a 10% interest rate. Assume the $3 million loan is not specifically tied to construction of the building. The loan was outstanding all of 2024 and 2025. The company’s other interest-bearing debt included two long-term notes of $5,900,000 and $7,900,000 with interest rates of 7% and 9%, respectively. Both notes were outstanding during all of 2024 and 2025. Interest is paid annually on all debt. The company’s fiscal year-end is December 31. Required:Using the WEIGHTED-AVERAGE INTEREST METHOD, answer the following…On January 1, 2018, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2019. Expenditures on the project were as follows: January 1, 2018 $ 1,710,000 March 1, 2018 1,320,000 June 30, 2018 1,520,000 October 1, 2018 1,320,000 January 31, 2019 378,000 April 30, 2019 711,000 August 31, 2019 1,008,000 On January 1, 2018, the company obtained a $4,200,000 construction loan with a 16% interest rate. The loan was outstanding all of 2018 and 2019. The company’s other interest-bearing debt included two long-term notes of $4,000,000 and $6,000,000 with interest rates of 12% and 14%, respectively. Both notes were outstanding during all of 2018 and 2019. Interest is paid annually on all debt. The company’s fiscal year-end is December 31. Required:1. Calculate the amount of interest that Mason should capitalize in 2018 and 2019 using the…