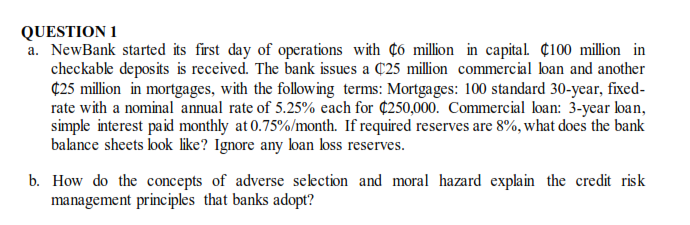

QUESTION 1 a. NewBank started its first day of operations with ¢ó million in capital. ¢100 million in checkable deposits is received. The bank issues a C25 million commercial loan and another ¢25 million in mortgages, with the following terms: Mortgages: 100 standard 30-year, fixed- rate with a nominal annual rate of 5.25% each for ¢250,000. Commercial loan: 3-year lban, simple interest paid monthly at 0.75%/month. If required reserves are 8%, what does the bank balance sheets look like? Ignore any ban koss reserves. b. How do the concepts of adverse selection and moral hazard explain the credit risk management principles that banks adopt?

QUESTION 1 a. NewBank started its first day of operations with ¢ó million in capital. ¢100 million in checkable deposits is received. The bank issues a C25 million commercial loan and another ¢25 million in mortgages, with the following terms: Mortgages: 100 standard 30-year, fixed- rate with a nominal annual rate of 5.25% each for ¢250,000. Commercial loan: 3-year lban, simple interest paid monthly at 0.75%/month. If required reserves are 8%, what does the bank balance sheets look like? Ignore any ban koss reserves. b. How do the concepts of adverse selection and moral hazard explain the credit risk management principles that banks adopt?

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 19P

Related questions

Question

Transcribed Image Text:QUESTION 1

a. NewBank started its first day of operations with ¢ó million in capital. ¢100 million in

checkable deposits is received. The bank issues a C25 million commercial loan and another

¢25 million in mortgages, with the following terms: Mortgages: 100 standard 30-year, fixed-

rate with a nominal annual rate of 5.25% each for ¢250,000. Commercial loan: 3-year lban,

simple interest paid monthly at 0.75%/month. If required reserves are 8%, what does the bank

balance sheets look like? Ignore any ban koss reserves.

b. How do the concepts of adverse selection and moral hazard explain the credit risk

management principles that banks adopt?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning