Question 1 Consider following two independent scenarios: During the preparation of financial statement for Master Ltd for 2023 it was discovered that an amount of $22,000, incurred in September 2021 and payable to an overseas supplier, was overlooked and not paid or provided for in the financial statement ending 30 June 2022. The amount is considered to be material and will be permitted as a deduction for tax purposes (tax rate 30%). Required: a Prepare the necessary journal entry to correct this error

Question 1 Consider following two independent scenarios: During the preparation of financial statement for Master Ltd for 2023 it was discovered that an amount of $22,000, incurred in September 2021 and payable to an overseas supplier, was overlooked and not paid or provided for in the financial statement ending 30 June 2022. The amount is considered to be material and will be permitted as a deduction for tax purposes (tax rate 30%). Required: a Prepare the necessary journal entry to correct this error

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 6C: Intel-period Tax Allocation Chris Green, CPA, is auditing Rayne Co.s 2019 financial statements. For...

Related questions

Question

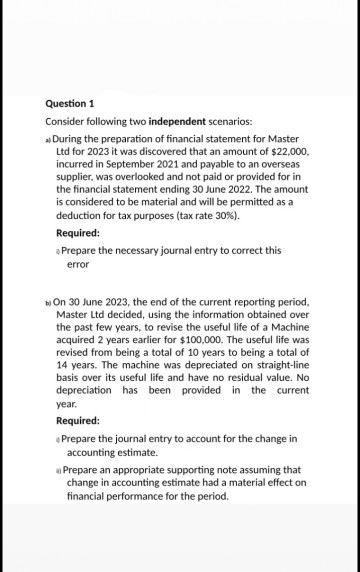

Transcribed Image Text:Question 1

Consider following two independent scenarios:

» During the preparation of financial statement for Master

Ltd for 2023 it was discovered that an amount of $22,000,

incurred in September 2021 and payable to an overseas

supplier, was overlooked and not paid or provided for in

the financial statement ending 30 June 2022. The amount

is considered to be material and will be permitted as a

deduction for tax purposes (tax rate 30%).

Required:

a Prepare the necessary journal entry to correct this

error

On 30 June 2023, the end of the current reporting period,

Master Ltd decided, using the information obtained over

the past few years, to revise the useful life of a Machine

acquired 2 years earlier for $100,000. The useful life was

revised from being a total of 10 years to being a total of

14 years. The machine was depreciated on straight-line

basis over its useful life and have no residual value. No

depreciation has been provided in the current

year.

Required:

Prepare the journal entry to account for the change in

accounting estimate.

Prepare an appropriate supporting note assuming that

change in accounting estimate had a material effect on

financial performance for the period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT