Question 1 Dialex Watches completed the following selected transactions during 2007 & 2008: 2007 Dec. 31 Estimated that uncollectible-account (bad-debt) expense for the year was 1% of credit sales of $400,000 and recorded the amount as expense. Use the allowance method. Dec. 31 Made the closing entry for uncollectible-account expense. 2008 Jan. 17 Sold inventory to Mitch Vanez, $600, on account. Ignore cost of goods sold. Wrote off Mitch Vanez's account as uncollectible after repeated effort to collect from him. June. 29 Received $600 from Mitch Vanez, along with a letter apologizing for being so late. Reinstated Vanez 's account in full and recorded the cash receipt. Made a compound entry to write off the following accounts as uncollectible: Bernard Klaus, $1,700; Marie Moner, $1,300. Aug. 6 Dec. 31 Dес. 31 Estimated that uncollectible expense for the year was 1% of credit sales of $480,000, and recorded that amount as expense Made the closing entry for uncollectible-account expense. Dес. 31 Pequirements: )Open general ledger accounts for Allowance for Uncollectible Accounts and Uncolle Accounts Expense. Keep running balances. All accounts begin with zero balance. tronsactions in the general journal and post to the two ledger accounts. C120 000 Show how

Question 1 Dialex Watches completed the following selected transactions during 2007 & 2008: 2007 Dec. 31 Estimated that uncollectible-account (bad-debt) expense for the year was 1% of credit sales of $400,000 and recorded the amount as expense. Use the allowance method. Dec. 31 Made the closing entry for uncollectible-account expense. 2008 Jan. 17 Sold inventory to Mitch Vanez, $600, on account. Ignore cost of goods sold. Wrote off Mitch Vanez's account as uncollectible after repeated effort to collect from him. June. 29 Received $600 from Mitch Vanez, along with a letter apologizing for being so late. Reinstated Vanez 's account in full and recorded the cash receipt. Made a compound entry to write off the following accounts as uncollectible: Bernard Klaus, $1,700; Marie Moner, $1,300. Aug. 6 Dec. 31 Dес. 31 Estimated that uncollectible expense for the year was 1% of credit sales of $480,000, and recorded that amount as expense Made the closing entry for uncollectible-account expense. Dес. 31 Pequirements: )Open general ledger accounts for Allowance for Uncollectible Accounts and Uncolle Accounts Expense. Keep running balances. All accounts begin with zero balance. tronsactions in the general journal and post to the two ledger accounts. C120 000 Show how

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter8: Revenue Recognition, Receivables, And Advances From Customers

Section: Chapter Questions

Problem 30E

Related questions

Question

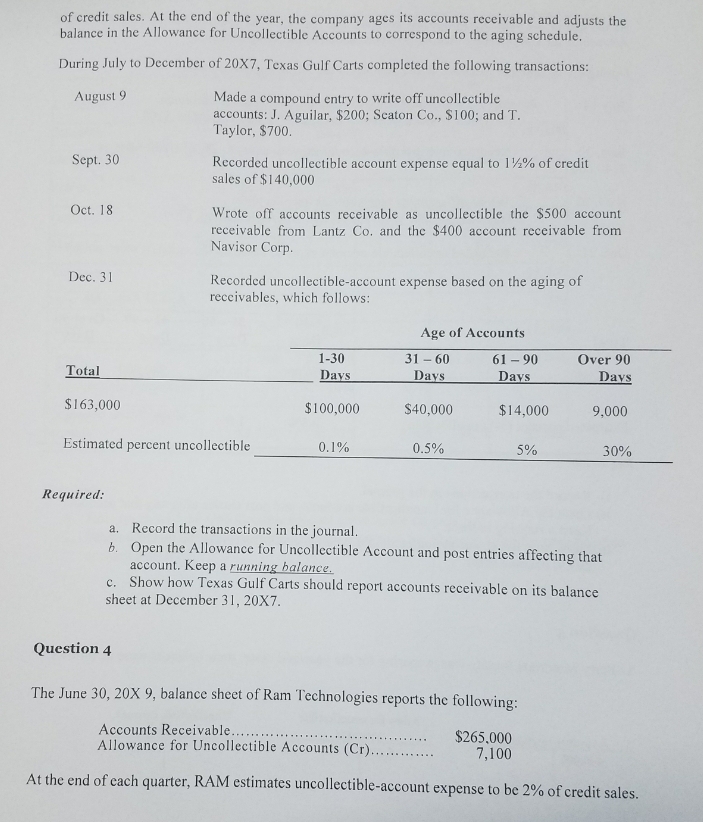

Transcribed Image Text:of credit sales. At the end of the year, the company ages its accounts receivable and adjusts the

balance in the Allowance for Uncollectible Accounts to correspond to the aging schedule.

During July to December of 20X7, Texas Gulf Carts completed the following transactions:

August 9

Made a compound entry to write off uncollectible

accounts: J. Aguilar, $200; Scaton Co., $100; and T.

Taylor, $700.

Sept. 30

Recorded uncollectible account expense equal to 1%% of credit

sales of $140,000

Oct. 18

Wrote off accounts receivable as uncollectible the $500 account

receivable from Lantz Co. and the $400 ac

unt receivable from

Navisor Corp.

Dec. 31

Recorded uncollectible-account expense based on the aging of

reccivables, which follows:

Age of Accounts

1-30

31 - 60

61 – 90

Over 90

Total

Days

Days

Days

Days

$163,000

$100,000

$40,000

$14,000

9,000

Estimated percent uncollectible

0.1%

0.5%

5%

30%

Required:

a. Record the transactions in the journal.

b. Open the Allowance for Uncollectible Account and post entries affecting that

account. Keep a running balance.

c. Show how Texas Gulf Carts should report accounts receivable on its balance

sheet at December 31, 20X7.

Question 4

The June 30, 20X 9, balance sheet of Ram Technologies reports the following:

Accounts Receivable...

Allowance for Uncollectible Accounts (Cr).....

$265,000

7,100

At the end of each quarter, RAM estimates uncollectible-account expense to be 2% of credit sales.

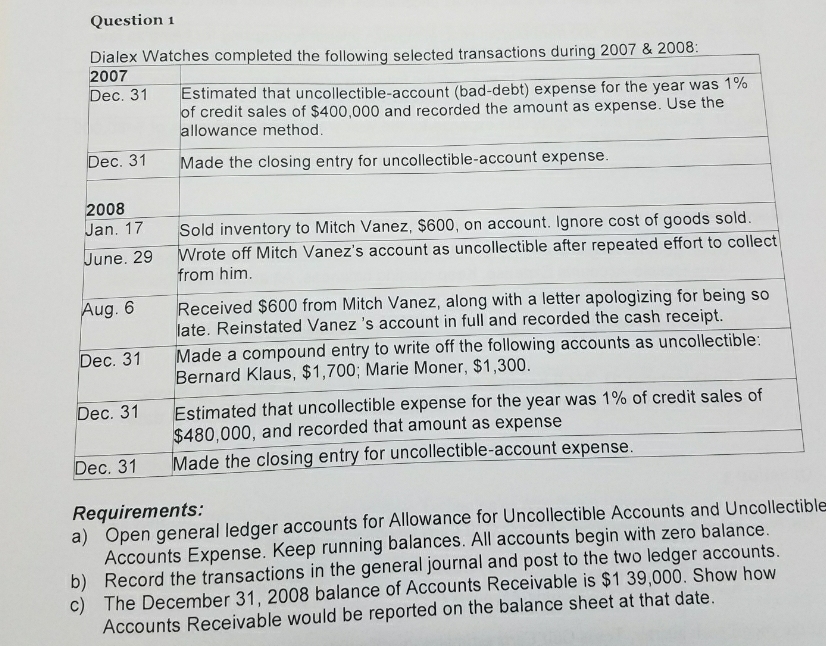

Transcribed Image Text:Question 1

Dialex Watches completed the following selected transactions during 2007 & 2008:

2007

Dec. 31

Estimated that uncollectible-account (bad-debt) expense for the year was 1%

of credit sales of $400,000 and recorded the amount as expense. Use the

allowance method.

Dec. 31

Made the closing entry for uncollectible-account expense.

2008

Jan. 17

Sold inventory to Mitch Vanez, $600, on account. Ignore cost of goods sold.

Wrote off Mitch Vanez's account as uncollectible after repeated effort to collect

from him.

June. 29

Aug. 6

Received $600 from Mitch Vanez, along with a letter apologizing for being so

late. Reinstated Vanez 's account in full and recorded the cash receipt.

Made a compound entry to write off the following accounts as uncollectible:

Bernard Klaus, $1,700; Marie Moner, $1,300.

Dec. 31

Dec. 31

Estimated that uncollectible expense for the year was 1% of credit sales of

$480,000, and recorded that amount as expense

Made the closing entry for uncollectible-account expense.

Dec. 31

Requirements:

a) Open general ledger accounts for Allowance for Uncollectible Accounts and Uncollectible

Accounts Expense. Keep running balances. All accounts begin with zero balance.

b) Record the transactions in the general journal and post to the two ledger accounts.

c) The December 31, 2008 balance of Accounts Receivable is $1 39,000. Show how

Accounts Receivable would be reported on the balance sheet at that date.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 5 images

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning