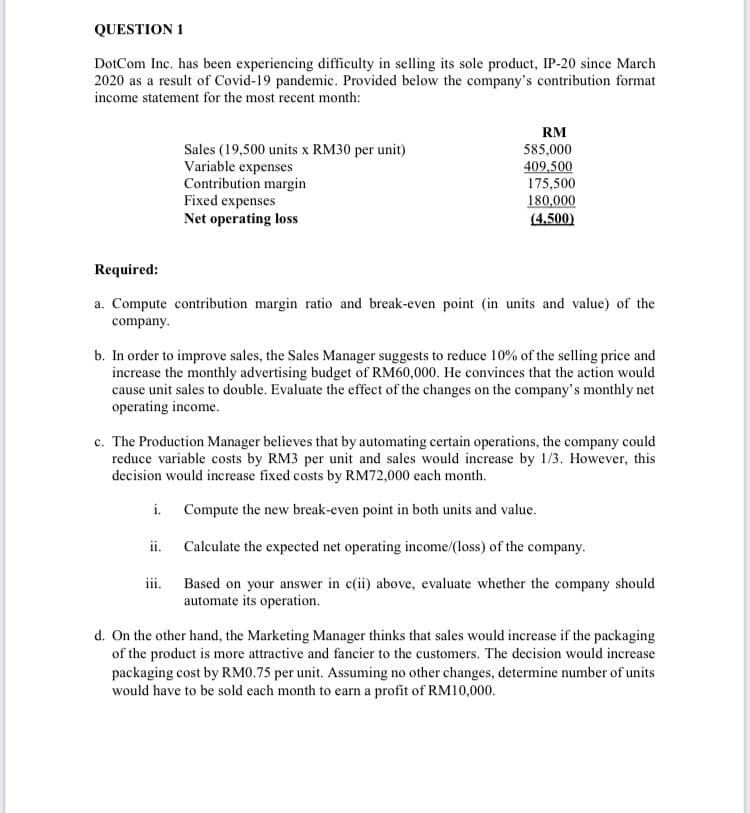

QUESTION 1 DotCom Inc. has been experiencing difficulty in selling its sole product, IP-20 since March 2020 as a result of Covid-19 pandemic. Provided below the company's contribution format income statement for the most recent month: RM Sales (19,500 units x RM30 per unit) Variable expenses Contribution margin Fixed expenses Net operating loss 585,000 409,500 175,500 180,000 (4.500) Required: a. Compute contribution margin ratio and break-even point (in units and value) of the company. b. In order to improve sales, the Sales Manager suggests to reduce 10% of the selling price and increase the monthly advertising budget of RM60,000. He convinces that the action would cause unit sales to double. Evaluate the effect of the changes on the company's monthly net operating income. c. The Production Manager believes that by automating certain operations, the company could reduce variable costs by RM3 per unit and sales would increase by 1/3. However, this decision would increase fixed costs by RM72,000 each month. i. Compute the new break-even point in both units and value. ii. Calculate the expected net operating income/(loss) of the company. iii. Based on your answer in c(ii) above, evaluate whether the company should automate its operation.

QUESTION 1 DotCom Inc. has been experiencing difficulty in selling its sole product, IP-20 since March 2020 as a result of Covid-19 pandemic. Provided below the company's contribution format income statement for the most recent month: RM Sales (19,500 units x RM30 per unit) Variable expenses Contribution margin Fixed expenses Net operating loss 585,000 409,500 175,500 180,000 (4.500) Required: a. Compute contribution margin ratio and break-even point (in units and value) of the company. b. In order to improve sales, the Sales Manager suggests to reduce 10% of the selling price and increase the monthly advertising budget of RM60,000. He convinces that the action would cause unit sales to double. Evaluate the effect of the changes on the company's monthly net operating income. c. The Production Manager believes that by automating certain operations, the company could reduce variable costs by RM3 per unit and sales would increase by 1/3. However, this decision would increase fixed costs by RM72,000 each month. i. Compute the new break-even point in both units and value. ii. Calculate the expected net operating income/(loss) of the company. iii. Based on your answer in c(ii) above, evaluate whether the company should automate its operation.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter25: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 2BE

Related questions

Question

Transcribed Image Text:QUESTION 1

DotCom Inc. has been experiencing difficulty in selling its sole product, IP-20 since March

2020 as a result of Covid-19 pandemic. Provided below the company's contribution format

income statement for the most recent month:

RM

Sales (19,500 units x RM30 per unit)

Variable expenses

Contribution margin

Fixed expenses

Net operating loss

585,000

409,500

175,500

180,000

(4.500)

Required:

a. Compute contribution margin ratio and break-even point (in units and value) of the

company.

b. In order to improve sales, the Sales Manager suggests to reduce 10% of the selling price and

increase the monthly advertising budget of RM60,000. He convinces that the action would

cause unit sales to double. Evaluate the effect of the changes on the company's monthly net

operating income.

c. The Production Manager believes that by automating certain operations, the company could

reduce variable costs by RM3 per unit and sales would increase by 1/3. However, this

decision would increase fixed costs by RM72,000 each month.

i. Compute the new break-even point in both units and value.

ii.

Calculate the expected net operating inconme/(loss) of the company.

ii.

Based on your answer in c(ii) above, evaluate whether the company should

automate its operation.

d. On the other hand, the Marketing Manager thinks that sales would increase if the packaging

of the product is more attractive and fancier to the customers. The decision would increase

packaging cost by RM0.75 per unit. Assuming no other changes, determine number of units

would have to be sold each month to earn a profit of RMI0,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning