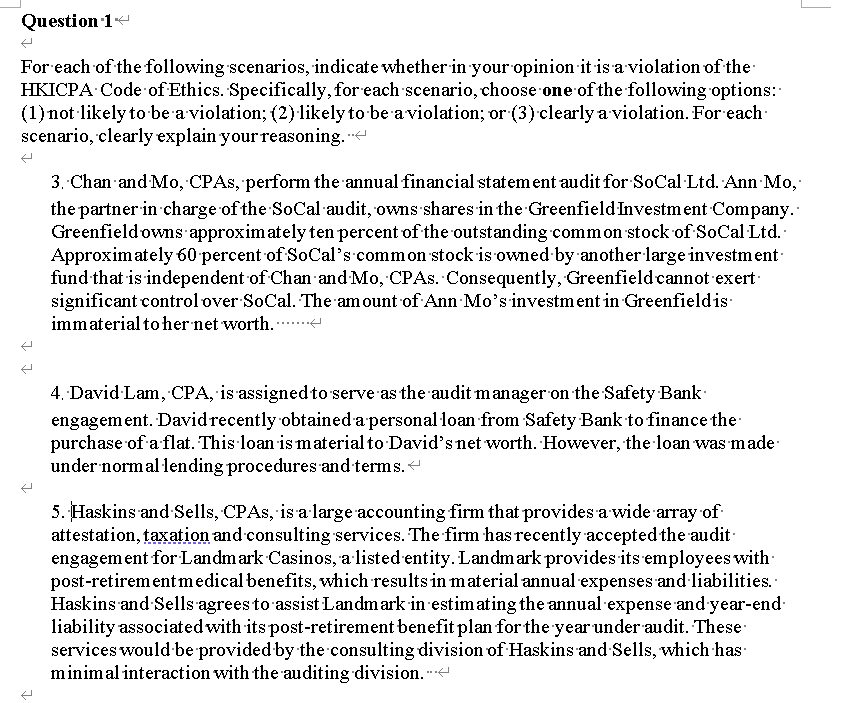

Question 1 For each of the following scenarios, indicate whether in your opinion it is a violation of the- HKICPA Code-of Ethics. Specifically, for each scenario, choose one of the following options: (1)not likely to be a violation; (2) likely to be aviolation; or (3)clearly a violation. For each- scenario, clearly explain your reasoning. e 3. Chan and Mo, CPAS, "perform the annual financial statem ent audit for SoCal·Ltd. Ann Mo, the partner in charge of the SoCal audit, owns shares in the Greenfield Investment Company. Greenfieldowns approximately ten percent of the outstanding common stock of SoCal Ltd. Approximately 60 percent of SoCal's common stock is owned by another large investment fund that is independent of Chan and Mo, CPAS. Consequently, Greenfieldcannot exert significant control over SoCal. The am ount of Ann Mo's investment in Greenfieldis immaterial to her net worth.e 4. David Lam, CPA, is assigned to serve as the audit man ager on the Safety Bank- engagement. David recently obtained a personal loan from Safety Bank to finance the purchase of a flat. This loan is material to David's net worth. However, the loan was made under normal lending procedures and terms. 5. Haskins and Sells, CPAS, is a large accounting firm that provides a wide array of attestation, taxation and consulting services. The firm has recently accepted the audit- engagement for Landmark Casinos, a listed entity. Landmark provides its employees with- post-retirementmedical benefits, which results in material annual expenses and liabilities. Haskins and Sells agrees to assist Landmark in estimating the annual expense and year-end- liability associatedwith its post-retirement benefit plan for the year under audit. These services would -be provided by the consulting division of Haskins and Sells, which has minimal interaction with the auditing division. -

Question 1 For each of the following scenarios, indicate whether in your opinion it is a violation of the- HKICPA Code-of Ethics. Specifically, for each scenario, choose one of the following options: (1)not likely to be a violation; (2) likely to be aviolation; or (3)clearly a violation. For each- scenario, clearly explain your reasoning. e 3. Chan and Mo, CPAS, "perform the annual financial statem ent audit for SoCal·Ltd. Ann Mo, the partner in charge of the SoCal audit, owns shares in the Greenfield Investment Company. Greenfieldowns approximately ten percent of the outstanding common stock of SoCal Ltd. Approximately 60 percent of SoCal's common stock is owned by another large investment fund that is independent of Chan and Mo, CPAS. Consequently, Greenfieldcannot exert significant control over SoCal. The am ount of Ann Mo's investment in Greenfieldis immaterial to her net worth.e 4. David Lam, CPA, is assigned to serve as the audit man ager on the Safety Bank- engagement. David recently obtained a personal loan from Safety Bank to finance the purchase of a flat. This loan is material to David's net worth. However, the loan was made under normal lending procedures and terms. 5. Haskins and Sells, CPAS, is a large accounting firm that provides a wide array of attestation, taxation and consulting services. The firm has recently accepted the audit- engagement for Landmark Casinos, a listed entity. Landmark provides its employees with- post-retirementmedical benefits, which results in material annual expenses and liabilities. Haskins and Sells agrees to assist Landmark in estimating the annual expense and year-end- liability associatedwith its post-retirement benefit plan for the year under audit. These services would -be provided by the consulting division of Haskins and Sells, which has minimal interaction with the auditing division. -

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter1: The Demand For And Supply Of Financial Accounting Information

Section: Chapter Questions

Problem 1C

Related questions

Question

Transcribed Image Text:Question 1

For each of the following scenarios, indicate whether in your opinion it is a violation of the

HKICPA Code of Ethics. Specifically, for each scenario, choose one of the following options:

(1)not likely to ·be a violation; (2) likely to be aviolation; or (3) clearly a violation. For each-

scenario, clearly explain your reasoning.

3. Chan and Mo, CPAS, perform the annual financial statement audit for SoCal Ltd. Ann Mo,

the partner in charge of the SoCal audit, owns shares in the Greenfield Investment Company.

Greenfieldowns approximately ten percent of the outstanding common stock of SoCal·Ltd.

Approximately 60percent of SoCal's common stock is owned by another large investment-

fund that is independent of Chan and Mo, CPAS. Consequently, Greenfieldcannot exert

significant controlover SoCal. The amount of Ann Mo's investment in Greenfieldis

immaterial to her net worth. ..

4. David Lam, CPA, is assignedto serve as the audit manager on the Safety Bank

engagement. Davidrecently obtained a personal loan from Safety Bank to finance the

purchase of a flat. This loan is material to David's net worth. However, the loan was made

under normal 1lending procedures and terms.<

5. Haskins and Sells, CPAS, is alarge accounting firm that provides a wide array of

attestation, taxation and consulting services. The firm has recently accepted the audit-

engagement for Landmark Casinos, a listed entity. Landmark provides its employees with-

post-retirem entmedical benefits, which results in material annual expenses and·liabilities.

Haskins and Sells agrees to assist Landmark in estimating the annual expense and year-end-

liability associated with its post-retirement benefit plan for the year under audit. These

services would be provided by the consulting division of Haskins and Sells, which has

minimal interaction with the auditing division. -

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning