Question - 1 Indicate whether each of the following expenditures should De improvements (LI), buildings (B), equipment (E), or none of these (X). I 1. Parking lots X 2. Electricity used by a machine B 3. Excavation costs B 4. Interest on building construction loan E 5. Cost of trial runs for machinery I 6. Drainage costs 7. Cost to install a machine 4 8. Fences k 9. Unpaid (past) property taxes assumed 10. Cost of tearing down a building when land and a building on it are purchased

Question - 1 Indicate whether each of the following expenditures should De improvements (LI), buildings (B), equipment (E), or none of these (X). I 1. Parking lots X 2. Electricity used by a machine B 3. Excavation costs B 4. Interest on building construction loan E 5. Cost of trial runs for machinery I 6. Drainage costs 7. Cost to install a machine 4 8. Fences k 9. Unpaid (past) property taxes assumed 10. Cost of tearing down a building when land and a building on it are purchased

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 42E

Related questions

Question

Transcribed Image Text:Question - 1

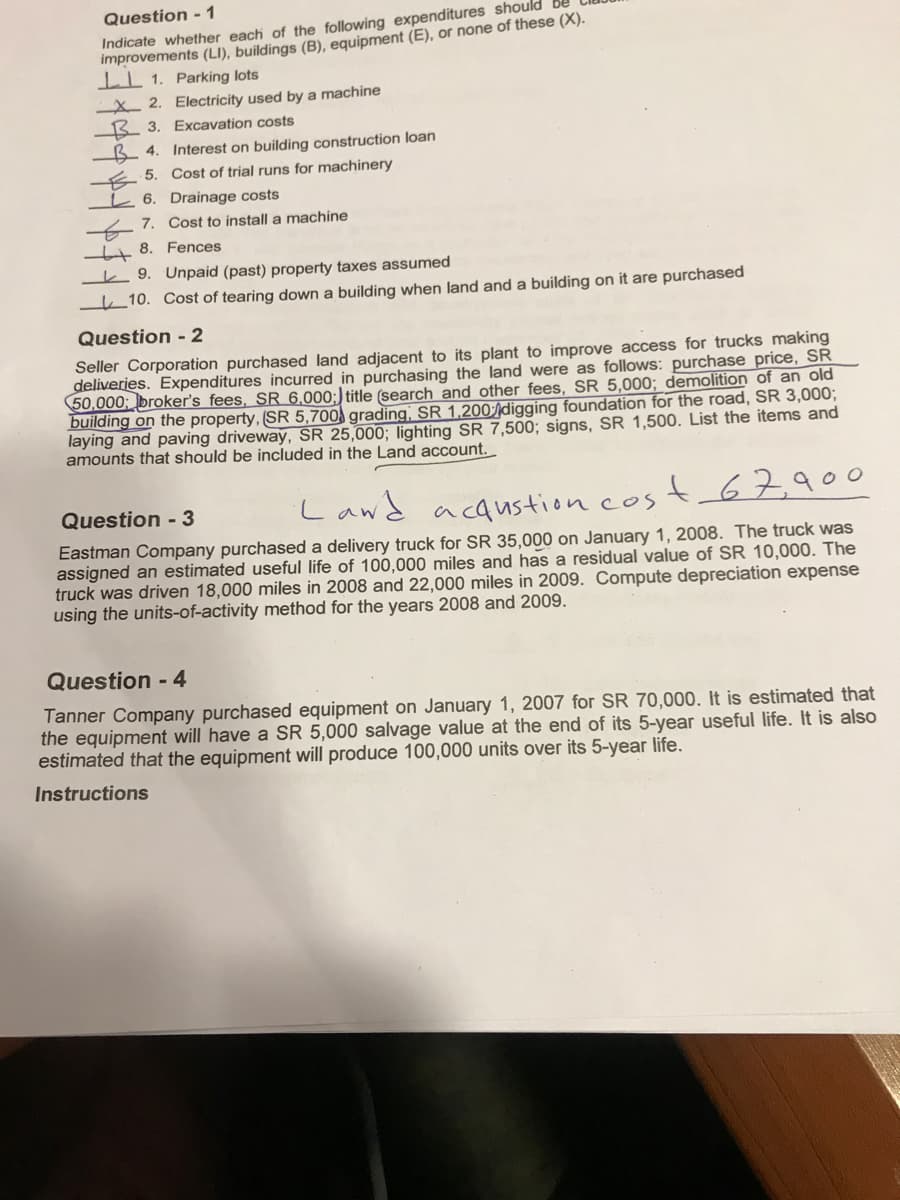

Indicate whether each of the following expenditures should

Improvements (LI), buildings (B), equipment (E), or none of these (X).

IL 1. Parking lots

X 2. Electricity used by a machine

B 3. Excavation costs

B 4. Interest on building construction loan

E 5. Cost of trial runs for machinery

L 6. Drainage costs

7. Cost to install a machine

4 8. Fences

k 9. Unpaid (past) property taxes assumed

10. Cost of tearing down a building when land and a building on it are purchased

Question - 2

Seller Corporation purchased land adjacent to its plant to improve access for trucks making

deliveries. Expenditures incurred in purchasing the land were as follows: purchase price, SR

50,000; broker's fees, SR 6.000;) title (search and other fees, SR 5,000; demolition of an old

building on the property, (SR 5,700 grading, SR 1,200digging foundation for the road, SR 3,000;

laying and paving driveway, SR 25,000; lighting SR 7,500; signs, SR 1,500. List the items and

amounts that should be included in the Land account.

Lawd acaustion cos

t67900

Question - 3

Eastman Company purchased a delivery truck for SR 35,000 on January 1, 2008. The truck was

assigned an estimated useful life of 100,000 miles and has a residual value of SR 10,000. The

truck was driven 18,000 miles in 2008 and 22,000 miles in 2009. Compute depreciation expense

using the units-of-activity method for the years 2008 and 2009.

Question - 4

Tanner Company purchased equipment on January 1, 2007 for SR 70,000. It is estimated that

the equipment will have a SR 5,000 salvage value at the end of its 5-year useful life. It is also

estimated that the equipment will produce 100,000 units over its 5-year life.

Instructions

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning