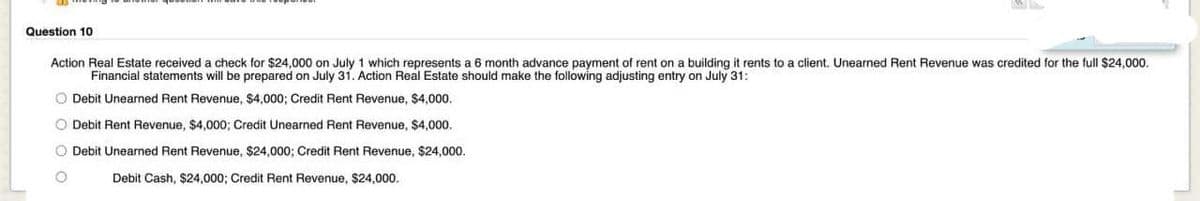

Question 10 Action Real Estate received a check for $24,000 on July 1 which represents a 6 month advance payment of rent on a building it rents to a client. Unearned Rent Revenue was credited for the full $24,000. Financial statements will be prepared on July 31. Action Real Estate should make the following adjusting entry on July 31: O Debit Unearned Rent Revenue, $4,000; Credit Rent Revenue, $4,000. O Debit Rent Revenue, $4,000; Credit Unearned Rent Revenue, $4,000. O Debit Unearned Rent Revenue, $24,000; Credit Rent Revenue, $24,000. O Debit Cash, $24,000; Credit Rent Revenue, $24,000.

Q: Need help with the balance sheet liabilities part and to make sure the assets are correct

A: Balance Sheet An organization's properties, obligations, and capital employed are listed on a…

Q: Thank you for your response, however i am not an accounting student and its quite difficult…

A: This is the follow-up question which is all about the internal rate of return which is the rate…

Q: onEct is a retailer of mobile phones. All of its revenue comes from a percentage of the sales value…

A: The income statement is the one prepared by the company to depict the financial performance of the…

Q: which of the following is an operating avtivity? A. billing customers for services rendered but not…

A: Business activities are defined as those events that result from the workings of an entity in order…

Q: ou buy goods with a list price of $500. You return goods that are defective, having a list price of…

A: Trade Discount is the discount that is calculated on the list price. However, The Cash discount is…

Q: Watsontown Yacht Sales has been selling large power cruisers for 25 years. On January 1, 20X1, the…

A: Given, Opening inventory = $5,950,000. Closing inventory = 7% higher than Opening inventory. Cost of…

Q: an asset purchased for 100000. its estimated life for 5 years. find the salvage value if the total…

A: Sum of digits method is one of the most progressive depreciation methods in which depreciation is…

Q: Determine the correct inventory amount. E6.1 (LO 1), AN Umatilla Bank and Trust is considering…

A: Ending inventory is the pricing of the goods still in stock at the end of a reporting period. The…

Q: In its first month of operation, Splish Brothers Company purchased 94 units of inventory for $6,…

A: First in, first out is referred to as FIFO. The oldest element is treated last and the first item is…

Q: Using the Redwood City Pet Shoppe Unadjusted Trial Balance from July 31st, prepare the followir…

A: Adjusting Entry – Adjusting Entries are the entries that make the accrual principle work for the…

Q: What two IRS Code Sections generally applies to dividends? Give Code Section When are dividends…

A: “Since you have asked multiple questions, we will solve the first question for you. If youwant any…

Q: ignmenty takeAssignmentivan.do?invoker-atakeAssignmentSessionLocator=&inprogress=false eBook…

A: PERPETUAL INVENTORY SYSTEM A perpetual inventory system keeps continual track of your inventory…

Q: Vail Resorts, Inc. is an American mountain resort company headquartered in Broomfield, Colorado.…

A: INTRODUCTION: Revenue is defined as the money generated by carrying out routine business activities…

Q: Bluegill Company sells 15,500 units at $220 per unit. Fixed costs are $170,500, and operating income…

A: Total sales revenue - Variable cost = Contribution margin And Contribution margin - Fixed cost =…

Q: Prepare a journal entry for the purchase of a truck on April 4 for $71,750, paying $5,900 cash and…

A: INTRODUCTION: Every transaction that your company does necessitates the creation of journal entries.…

Q: Michael was a marketing major in college. He believes that sales volume can be increased only by…

A: According to the given question, we are required to compute the net income and break-even point in…

Q: The following is the adjusted trial balance for Stockton Company. Stockton Company Adjusted Trial…

A: Any asset that may be swiftly turned into cash, frequently within a year, is referred to as a…

Q: Robinwood Fixtures manufactures two products, K4 and X7. The company prepares its master budget on…

A: Variable cost means all the costs (material, labor, and overheads) related to production. Fixed…

Q: You have been provided with the following information for Massy Shoe Store (St Lucia) which…

A: Accounting journal entries are moved from the journals and posted to the general ledger in order to…

Q: A bond has 12 years until maturity and a coupon rate of 8.2% payable semi-annually; and sells for…

A: We will have to determine the price at which the bond will be sold after a period of one year. It is…

Q: Required information [The following information applies to the questions displayed below.] O'Brien…

A: Absorption Costing Method :— Under this method, product cost is the sum of direct material, direct…

Q: Wookie Company issues 7%, five-year bonds, on January 1 of this year, with a par value of $101,000…

A: A journal entry records a business transaction in the accounting system of a company. Journal…

Q: 1. When collectibility is reasonably assured, the excess of the subscription price over the stated…

A: There has been various questions which has been asked to answer and all those multiple choice…

Q: Which of the following is NOT a financial transaction? Purchase of inventory Cash receipts…

A: Question 1. Which of the following is NOT a financial transaction? A financial transaction is any…

Q: calculate the following: Principal: 55,000 rate: 6.25% Time in years: simple interst: $5,156.25

A: This question relates to the simple interest concept. Simple Interest = Principal x Rate x Time in…

Q: Diane's Designs purchased a one-year liability insurance policy on March 1 of a year for $3,240 and…

A: Prepaid insurance means the insurance paid in advance. It, basically, represents the amount of…

Q: Auto Lavage is a Canadian company that owns and operates a large automatic carwash facility near…

A: Preparation of flexible budget are as follows

Q: Vail Resorts, Inc. is an American mountain resort company headquartered in Broomfield, Colorado.…

A: The specific conditions under which revenue is recognized are outlined in an accounting concept…

Q: A, B, and C of ABC Partnership have beginning capital balances of P500,000, P300,000, and P200,000…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: Prepare cash budgets for August, September, and October in side-by-side columns. Show how much cash…

A: Cash budget will show the overall cash flows of this company. It will include all forms of cash…

Q: Xavier Brown (32) is filing as a single taxpayer. During the year, he was unhappy with the…

A: ANSWER:- Long-Term Capital Loss Of $1,660 EXPLANATION:- A long term capital gain refers to the gain…

Q: ., had 300 calculators on hand at January 1, 20X1, costing $16 each. Purchases and sales of…

A: Inventory valuation is the cost associated with an entity's inventory at the end of a reporting…

Q: solution

A: The term "present value" (PV) refers to the value at the current time of a quantity of money or…

Q: Peng LLP is auditing the accounts receivable balance of a client. The senior in charge wants to…

A: Balance sheet assertions are the claims made by management related to the financial statements and…

Q: S 9-13 (Algo) Recording warranty repairs LO P4 on December 1, Home Store sells a mower (that costs…

A: Journal entry is the primary step to record the transaction in the books of accounts. A warranty is…

Q: On January 1, 2021, Displays Incorporated had the following account balances: Accounts Debit Cash $…

A: The process of recording business transactions in the books of accounts for the first time is…

Q: BE6.1 (LO 1) Kraft Enterprises owns the following assets at December 31, 2025. Checking account…

A: Cash is considered a liquid asset and it includes cash in the bank, cash on hand, and a checking…

Q: QUESTION 1 a) Diana started her business on 1 July 2021. transactions during July 2021 were as…

A:

Q: December 7 Issued credit memo CM202 to Marshal Motors (10900) for $900 worth of merchandise…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: Question: computers play a significant part in current accounting practice. state two advantages of…

A: Computerized accounting system It is system under which the accounting information are recorded…

Q: On January 1, 2023, Monty Corp. had 206,000 common shares outstanding. On April 1, 2023, 20,600…

A: Earnings per Share can be referred to as a measure which is used to indicate the profit which is…

Q: GL901 (Algo)-Based on Problem 09-1A LO P1 The January 1, Year 1 trial balance for the Lewis Company…

A: Golden Rules of Accounting: Account Debit Credit Personal Accounts The Receiver The…

Q: Maziarz Corporation produces and selis a single product. Data concerning that product appear below:…

A: Contribution = Selling price - variable cost = $220 - $72.60 = $147.40

Q: 1 of 4 Required information [The following information applies to the questions displayed below.]…

A: VARIABLE COSTING INCOME STATEMENT Variable Costing Income Statement is also Known as Marginal…

Q: On December 31, it was estimated that a goodwill of $6,000,000 was impaired. In addition, on April…

A: Patent Acquired at cost = $650,000 Estimated Life = 12 years Annual Amortisation = $54,166.67…

Q: What is Sufficient Appropriate Audit Evidence?

A: Introduction: An audit is a thorough, impartial review of financial records, financial statements,…

Q: GL901 (Algo)-Based on Problem 09-1A LO P1 The January 1, Year 1 trial balance for the Lewis Company…

A: Golden Rules of Accounting: Account Debit Credit Personal Accounts The Receiver The…

Q: You have been provided with the following information for Massy Shoe Store (St Lucia) which accounts…

A: Solution A journal is also called the original book of entry in which all business transactions are…

Q: Explain the presentation of a multiple-step income statement,

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: partnership has the following accounting amounts: Sales Cost of Goods Sold General and…

A: The income statement includes all the revenue and expenses. The resulting amount after deducting…

Step by step

Solved in 2 steps

- Exercise 4-54 Operating Cycle and Current Receivables a. Dither and Sly are attorneys-at-law who specialize in federal income tax law. The): complete their typical case in 6 months or less and collect from the typical client within 1 additional month. b. Johnstons Market specializes in fresh meat and fish. All merchandise must be sold within one week of purchase. Almost all sales are for cash and any receivables are generally paid by the end of the following month. c. Mortondos is a womens clothing store specializing in high-style merchandise. Merchandise spends an average of 7 months on the rack following purchase. Most sales are on credit and the typical customer pays within 1 month of sale. d. Trees Inc. grows Christmas trees and sells them to various Christmas tree lots. Most sales are for cash. It takes 6 years to grow a tree. Required: For each of the businesses described above, indicate the length of the operating cycle.Rent Receivable Hudson Corp. has extra space in its warehouse and agrees to rent it out to Stillwater Company at the rate of $2,000 per month. The space was made available to Stillwater beginning on September 1. Under the terms of the agreement, Stillwater pays the months rent on the fifth day after the end of the month. Assume that Hudson prepares adjusting entries at the end of each month. Required How much revenue should Hudson record in September? How much revenue should Hudson record in October? Prepare the necessary entries on Hudsons books during the month of October.Exercise 3-40 Revenue and Expense Recognition Electronic Repair Company repaired a high-definition television for Sarah Merrifield in December 2019. Sarah paid $80 at the time of the repair and agreed to pay Electronic Repair $80 each month for 5 months beginning on January 15, 2020. Electronic Repair used $120 of supplies, which were purchased in November 2020, to repair the television. Assume that Electronic Repair uses accrual-basis accounting. Required: In what month or months should revenue from this service be recorded by Electronic Repaid? In what month or months should the expense related to the repair of the television be recorded by Electronic Repair? CONCEPTUAL CONNECTION Describe the accounting principles used to answer the above questions.

- Exercise 1-39 Current Assets and Current Liabilities Hanson Construction has an operating cycle of '5' months. On December 31. 2019, Hanson has the following assets and liabilities: A note receivable in the amount of $1500 10 be collected in 6 months Cash totaling $1,380 Accounts payable totaling $2,100, all of which will be paid within 2 months Accounts receivable totaling $12,000, including an account for $7,000 that will be paid in 2 months and an account for $5,000 that will be paid in 18 months Construction supplies coming $6,200, all of which will be used in construction within the next 12 months Construction equipment costing $60,000 on which depreciation of $22,400 has accumulated A note payable to the bank in the amount of $6,800 is to be paid within the next year Required: Calculate the amounts of current assets and current liabilities reported on Hansons balance sheet at December 31, 2019. CONCEPTUAL CONNECTION Comment on Hansons liquidity.Exercise 3-46 Identification and Analysis of Adjusting Entries Medina Motor Service is preparing adjusting entries for the year ended December 31, 2019. The following items describe Medina s continuous transactions during 2019: Medinas salaried employees are paid on the last day of every month. Medinas hourly employees are paid every other Friday for the 2 weeks' work. The next payday falls on January 5, 2020. In November 2019, Medina borrowed $600,000 from Bank One, giving a 9% note payable with interest due in January 2020. The note was properly recorded. Medina rents a portion of its parking lot to the neighboring business under a long-term lease agreement that requires payment of rent 6 months in advance on April 1 and October 1 of each year. The October 1, 2019, payment was made and recorded as prepaid rent. Medinas department recognizes the entire revenue on every auto service job when the job is complete. At December 31, several service jobs are in process. Medina recognizes depreciation on shop equipment annually at the end of each year. Medina purchases all of its office supplies from Office Supplies Inc. All purchases are recorded in the supplies account. Supplies expense is calculated and recorded annually at the end of each year. Required: Indicate whether or not each item requires an adjusting entry at December 31, 2019. If an item requires an adjusting entry, indicate which accounts are increased by the adjustment and which are decreased.Unearned Revenue Jennifers Landscaping Services signed a $400-per-month contract on November 1, 2019, to provide plant watering services for Lola Inc.s office buildings. Jennifers received 4 months' service fees in advance on signing the contract. Required: 1. Prepare Jennifers journal entry to record the cash receipt for the first 4 months. 2. Prepare Jennifers adjusting entry at December 31, 2019. 3. CONCEPTUAL CONNECTION How would the advance payment (account(s) and amounts(s)] be reported in Jennifers December 31, 2019, balance sheet? How would the advance payment [account(s) and amount(s)] be reported in Lolas December 31, 2019, balance sheet?

- Case 3-72 Cash- or Accrual-Basis Accounting Karen Ragsdale owns a business that rents parking spots to students at the local university. Karens typical rental contract requires the student to pay the years rent of $450 ($50 per month) on September 1. When Karen prepares financial statements at the end of December, her accountant requires that Karen spread the $450 over the 9 months that each parking Spot is rented. Therefore, Karen can recognize only $200 of revenue (4 months) from each parking spot rental contract in the year the cash is collected and must defer (delay) recognition of the remaining $250 (5 months) to the next year. Karen argues that getting students to agree to rent the parking Spot is the most difficult part of the activity so she Ought to be able to recognize all $450 as revenue when the cash is received from a student. Required: Why do generally accepted accounting principles require the use of accrual accounting rather than cash-basis accounting for transactions like the one described here?Problem 3-62A Cash-Basis and Accrual-Basis Income George Hathaway, an electrician, entered into an agreement with a real estate management company to perform all maintenance of basic electrical systems and air-conditioning equipment in the apartment buildings under the companys management. The agreement, which is subject to annual renewal, provides for the payment of a fixed fee of S6,600 on January 1 of each year plus amounts for parts and materials billed separately at the end of each month. Amounts billed at the end of I month are collected in the next month. During the first 3 months of 2019, George makes the following additional billings and cash collections: Required: 1. Calculate the amount of cash-basis income reported for each of the first 3 months. 2. Calculate the amount of accrual-basis income reported for each of the first 3 months. 3. CONCEPTUAL CONNECTION Why do decision-makers prefer accrual-basis accounting?Exercise 1-38 Identifying Current Assets and Liabilities Dunn Sporting Goods sells athletic clothing and footwear 10 retail customers. Dunns accountant indicates that the firms operating cycle averages 6 months. At December 31, 2019, Dunn has the following assets and liabilities: Prepaid rent in the amount of 58,500. Dunns rent is $500 per month. A $9,700 account payable due in 45 days. Inventory in the amount of $46,230. Dunn expects to sell $38,000 of the inventory within 3 months. The remainder will be placed in storage until September 2020. The items placed in storage should be sold by November 2020. An investment in marketable securities in the amount of $1,900. Dunn expects to sell $700 of the marketable securities in 6 months. The remainder are not expected to be sold until 2022. Cash in the amount of $1,050. An equipment loan in the amount of $60,000 due in March 2024. Interest of $4,500 is due in March 2020 ($3,750 of the interest relates to 2019. with the remainder relating to the first 3 months of 2020). An account receivable from a local university in the amount of $2,850. The university has promised to pay the full amount in 3 months. Store equipment at a cost of $9,200. Accumulated depreciation has been recorded on the store equipment in the amount of 51,250. Required: Prepare the current asset and current liability portions of Dunns December 31, 20191 balance-sheet. Compute Dunns working capital and current ratio at December 31, 2019. CONCEPTUAL CONNECTION As in investor or creditor. what do these ratios tell you about Dunns liquidity?

- Prepaid Rent—Quarterly Adjustments On September 1, Northhampton Industries signed a six-month lease for office space, which is effective September 1. Northhampton agreed to prepay the rent and mailed a check for $12,000 to the landlord on September 1. Assume that Northhampton prepares adjusting entries only four times a year: on March 31, June 30, September 30, and December 31. Required Compute the rental cost for each full month. Prepare the journal entry to record the payment of rent on September 1. Prepare the adjusting entry on September 30. Assume that the accountant prepares the adjusting entry on September 30 but forgets to record an adjusting entry on December 31. Will net income for the year be understated or overstated? by what amount?Continuing Problem 4.Total of Debit column: 40,750 The transactions completed by PS Music during June 20Y5 were described .it the end of Chapter 1. The following transactions were completed during July, the second month of businesss operations: July 1. Peyton Smith made an additional investment k PS Music in exchange for common stock by depositing 5,000 in PS Mu wet checking account. 1.Instead of continuing to share office space with a local real estate agency. Peyton decided to rent office space near a local musk store, Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft and fire. The policy covers a one year period. 2.Received 1,000 on account 3. On behalf of PS Musk, Peyton signed a contract with a local radio station. KXMD, to provide guest spots for the next three months. The contract requires PS Musk to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 2SO on account 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart. 7,500. 8.Paid for a newspaper advertisement 200. 11.Received 1.000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Pane 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account 850 21.Paid 620 to Upload Musk for use of its current musk demos in making various musk sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500 Received 750, with the remainder due August 4.20YS. 27.Paid electric Ml 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500, Received S00 with the remainder due on August 9. 20Y5. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1.400 royalties (musk expense) to National Musk Clearing for use of various artists music during July. 31. Paid dividends, 1,250. PS Musics chart of accounts and the balance of accounts as of July 1, 20Y5 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts Receivable 1,000 14 Supplies 170 15 Prepaid Insurance 17 Office Equipment 21 Accounts Payable 250 23 Unearned Revenue 31 Common Stock 4.000 33 Dividends 500 41 Fees Earned 6,200 50 Wages Expense 400 51 Office Rent Expense 800 52 Equipment Rent Expense 67S 53 Utilities Expense 300 54 Music Expense 1.590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1. Enter the July 1, 20Y5, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column, and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 20Y5.Cornerstone Exercise 3-12 Accrual- and Cash-Basis Revenue McDonald Music sells used CDs for S4.00 each. During the month of April, McDonald sold 7,650 CDs for cash and 13,220 CDs on credit. McDonalds cash collections in April included $30,600 for the CDs sold for cash, $12,800 for CDs sold on credit during the previous month, and $29,850 for CDs sold on credit during April. Required: Calculate the amount of revenue recognized in April under (1) cash-basis accounting and (2) accrual-basis accounting.