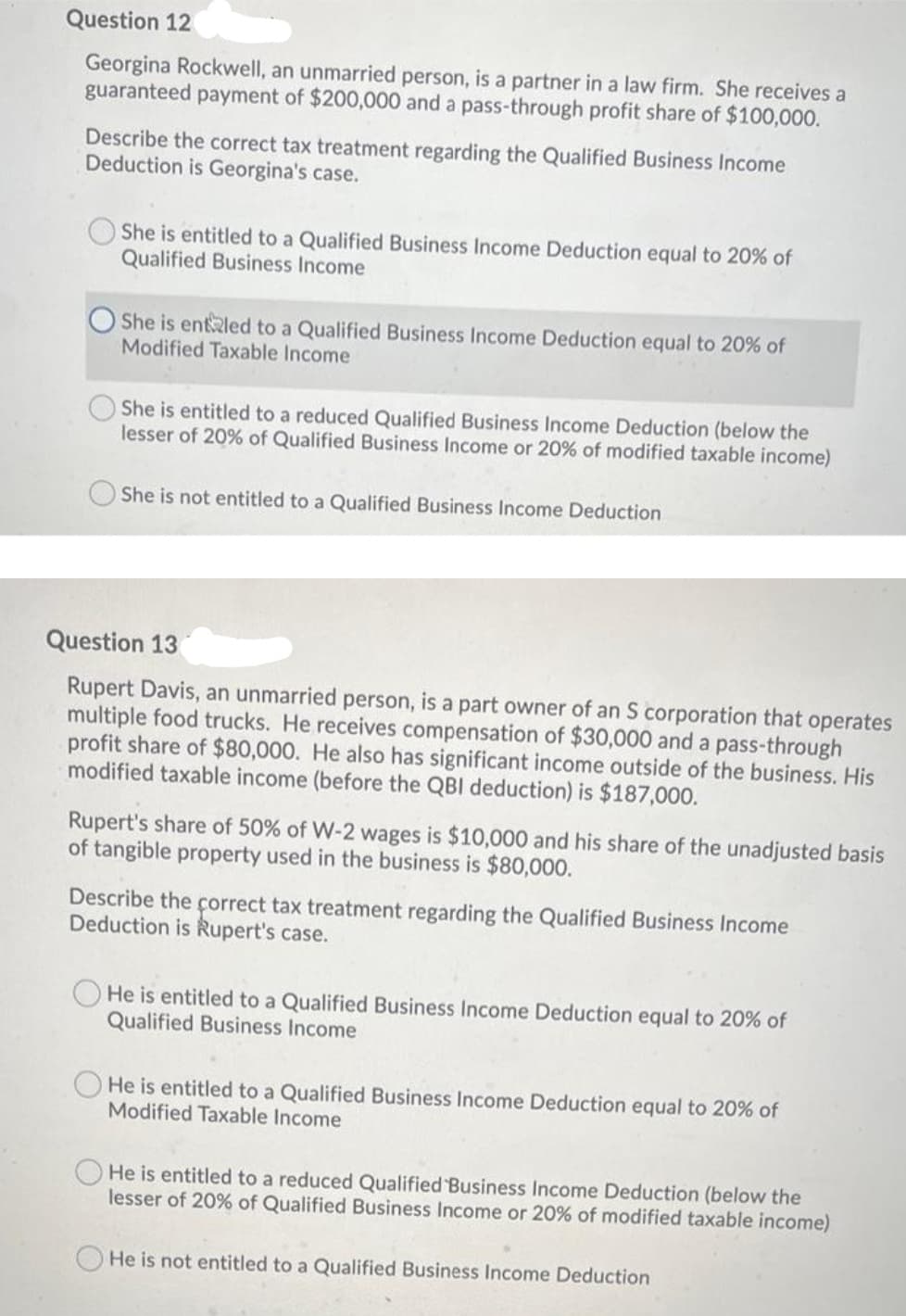

Question 12 Georgina Rockwell, an unmarried person, is a partner in a law firm. She receives a guaranteed payment of $200,000 and a pass-through profit share of $100,000. Describe the correct tax treatment regarding the Qualified Business Income Deduction is Georgina's case. She is entitled to a Qualified Business Income Deduction equal to 20% of Qualified Business Income She is entled to a Qualified Business Income Deduction equal to 20% of Modified Taxable Income She is entitled to a reduced Qualified Business Income Deduction (below the lesser of 20% of Qualified Business Income or 20% of modified taxable income) She is not entitled to a Qualified Business Income Deduction

Question 12 Georgina Rockwell, an unmarried person, is a partner in a law firm. She receives a guaranteed payment of $200,000 and a pass-through profit share of $100,000. Describe the correct tax treatment regarding the Qualified Business Income Deduction is Georgina's case. She is entitled to a Qualified Business Income Deduction equal to 20% of Qualified Business Income She is entled to a Qualified Business Income Deduction equal to 20% of Modified Taxable Income She is entitled to a reduced Qualified Business Income Deduction (below the lesser of 20% of Qualified Business Income or 20% of modified taxable income) She is not entitled to a Qualified Business Income Deduction

Chapter21: Partnerships

Section: Chapter Questions

Problem 35P

Related questions

Question

Transcribed Image Text:Question 12

Georgina Rockwell, an unmarried person, is a partner in a law firm. She receives a

guaranteed payment of $200,000 and a pass-through profit share of $100,000.

Describe the correct tax treatment regarding the Qualified Business Income

Deduction is Georgina's case.

She is entitled to a Qualified Business Income Deduction equal to 20% of

Qualified Business Income

She is entled to a Qualified Business Income Deduction equal to 20% of

Modified Taxable Income

She is entitled to a reduced Qualified Business Income Deduction (below the

lesser of 20% of Qualified Business Income or 20% of modified taxable income)

She is not entitled to a Qualified Business Income Deduction

Question 13

Rupert Davis, an unmarried person, is a part owner of an S corporation that operates

multiple food trucks. He receives compensation of $30,000 and a pass-through

profit share of $80,000. He also has significant income outside of the business. His

modified taxable income (before the QBI deduction) is $187,000.

Rupert's share of 50% of W-2 wages is $10,000 and his share of the unadjusted basis

of tangible property used in the business is $80,000.

Describe the çorrect tax treatment regarding the Qualified Business Income

Deduction is Rupert's case.

O He is entitled to a Qualified Business Income Deduction equal to 20% of

Qualified Business Income

He is entitled to a Qualified Business Income Deduction equal to 20% of

Modified Taxable Income

He is entitled to a reduced Qualified Business Income Deduction (below the

lesser of 20% of Qualified Business Income or 20% of modified taxable income)

He is not entitled to a Qualified Business Income Deduction

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning