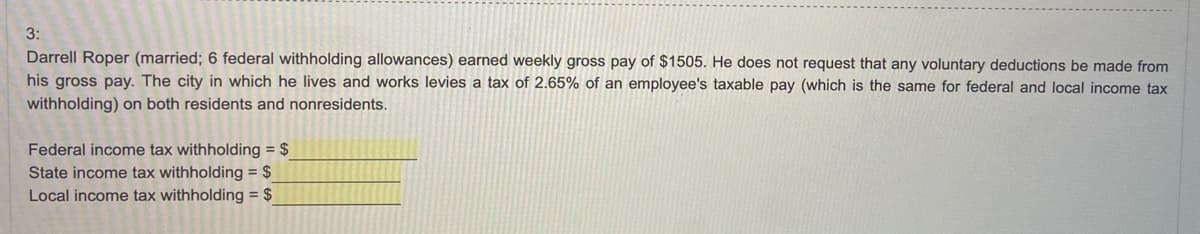

3: Darrell Roper (married; 6 federal withholding allowances) earned weekly gross pay of $1505. He does not request that any voluntary deductions be made from his gross pay. The city in which he lives and works levies a tax of 2.65% of an employee's taxable pay (which is the same for federal and local income tax withholding) on both residents and nonresidents. Federal income tax withholding = $ State income tax withholding = $ Local income tax withholding = $

3: Darrell Roper (married; 6 federal withholding allowances) earned weekly gross pay of $1505. He does not request that any voluntary deductions be made from his gross pay. The city in which he lives and works levies a tax of 2.65% of an employee's taxable pay (which is the same for federal and local income tax withholding) on both residents and nonresidents. Federal income tax withholding = $ State income tax withholding = $ Local income tax withholding = $

Chapter9: Payroll, Estimated Payments, And Retirement Plans

Section: Chapter Questions

Problem 13P

Related questions

Question

I need help getting the answers to #3!!

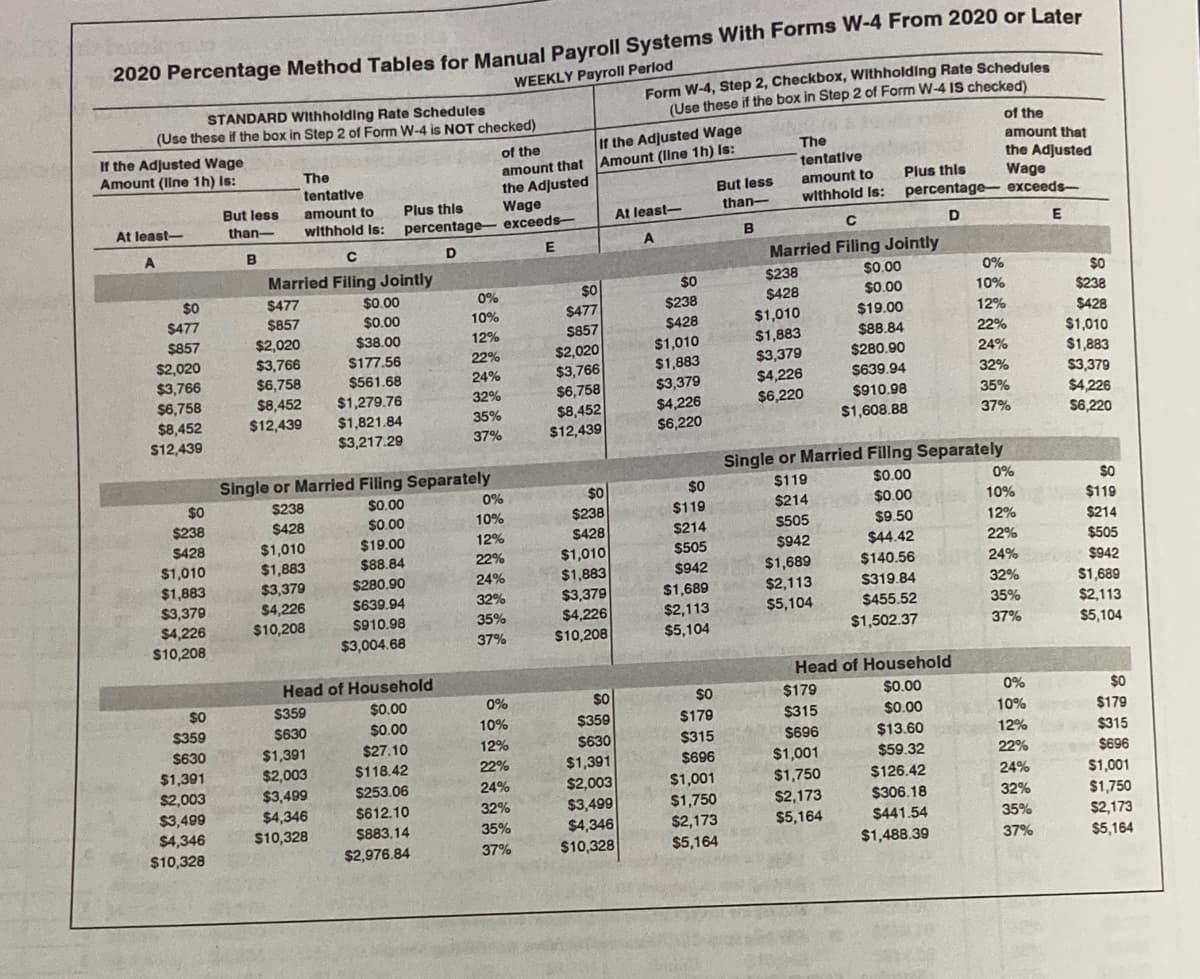

Transcribed Image Text:2020 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later

WEEKLY Payroll Perlod

STANDARD Withholding Rate Schedules

(Use these if the box in Step 2 of Form W-4 is NOT checked)

Form W-4, Step 2, Checkbox, Withholding Rate Schedules

(Use these if the box in Step 2 of Form W-4 IS checked)

of the

If the Adjusted Wage

Amount (Ilne 1h) Is:

If the Adjusted Wage

Amount (Ilne 1h) Is:

amount that

the Adjusted

Wage

of the

The

amount that

the Adjusted

Wage

The

tentative

tentative

Plus this

But less

than-

amount to

withhold Is:

But less

amount to

Plus this

percentage- exceeds-

At least-

than-

withhold Is:

At least-

percentage- exceeds-

C

E

B

D

Married Filing Jointly

Married Filing Jointly

$0.00

0%

$238

$428

$0

sO

$0

$477

$0.00

0%

$0

$238

$0.00

10%

$238

$477

$857

$2,020

$3,766

$6,758

$8,452

$12,439

$477

$857

$0.00

10%

$19.00

$1,010

$1,883

$3,379

$4,226

$6,220

$428

12%

$428

$857

$2,020

$3,766

$6,758

$8,452

$12,439

$38.00

12%

$88.84

22%

$1,010

$1,883

$3,379

$4,226

$6,220

$1,010

$1,883

$3,379

$4,226

S6,220

$2,020

$177.56

22%

$280.90

24%

$3,766

$561.68

24%

S639.94

32%

$6,758

$1,279.76

32%

$910.98

35%

$8,452

$1,821.84

35%

$1,608.88

37%

S12,439

$3,217.29

37%

Single or Married Filing Separately

Single or Married Filing Separately

$0.00

$0

$0

$119

$0.00

0%

$0

$0

$238

0%

$214

$0.00

10%

$119

$238

S428

$1,010

$1,883

$3,379

$4,226

$238

$428

$0.00

10%

$119

$428

$19.00

12%

$214

S505

$9.50

12%

$214

$1,010

$1,883

$3,379

$4,226

$10,208

$1,010

$88.84

22%

$505

$942

$44.42

22%

$505

$1,689

$2,113

$5,104

24%

$942

$140.56

24%

$942

$1,883

$3,379

$4,226

$10,208

$280.90

32%

$1,689

$2,113

$5,104

$319.84

$1,689

$2,113

$639.94

32%

$910.98

35%

$455.52

35%

$3,004.68

37%

$10,208

$1,502.37

37%

$5,104

Head of Household

Head of Household

$359

$0.00

0%

$0

$0

$179

$0.00

0%

$0

$359

$630

$1,391

$2,003

$3,499

$4,346

$359

$630

$0.00

10%

$179

$315

$0.00

10%

$179

$630

$315

$696

$13.60

$1,391

$2,003

$3,499

$4,346

$10,328

$27.10

12%

12%

$315

$1,001

$1,750

$696

$59.32

$1,391

$2,003

$3,499

$4,346

$10,328

$118.42

22%

22%

$696

$1,001

$1,750

$2,173

$5,164

$253.06

24%

$126.42

24%

$1,001

$2,173

$5,164

$612.10

32%

$306.18

32%

$1,750

$2,173

$883,14

35%

$441.54

35%

$2,976.84

37%

$10,328

$1,488.39

37%

$5,164

Transcribed Image Text:3:

Darrell Roper (married; 6 federal withholding allowances) earned weekly gross pay of $1505. He does not request that any voluntary deductions be made from

his gross pay. The city in which he lives and works levies a tax of 2.65% of an employee's taxable pay (which is the same for federal and local income tax

withholding) on both residents and nonresidents.

Federal income tax withholding = $

State income tax withholding = $

Local income tax withholding = $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT