Question 12 Part II: Prepares the closing entries and performs thepost-closing trial balance Adjusted trial balance Слеnta (Account) Balance 119,000 | 20,500 3,850 145,450 35,000 45,000 42,800 69,000 20,000 835,000 24,500 620,000 3,500 (asseunts receixakle) (Rrenaid insurance) (suRplies) (cash) (eauirment) (asceunts, pAvakle) (notes pavable) Juan del Pueblo, capital Juan del Pueblo,(drawings) (fee sarmed) (utilities expense) (salary expense) (advertising expense)

Question 12 Part II: Prepares the closing entries and performs thepost-closing trial balance Adjusted trial balance Слеnta (Account) Balance 119,000 | 20,500 3,850 145,450 35,000 45,000 42,800 69,000 20,000 835,000 24,500 620,000 3,500 (asseunts receixakle) (Rrenaid insurance) (suRplies) (cash) (eauirment) (asceunts, pAvakle) (notes pavable) Juan del Pueblo, capital Juan del Pueblo,(drawings) (fee sarmed) (utilities expense) (salary expense) (advertising expense)

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter5: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 5.32EX: Closing entries On July 31, the close of the fiscal year, the balances of the accounts appearing in...

Related questions

Question

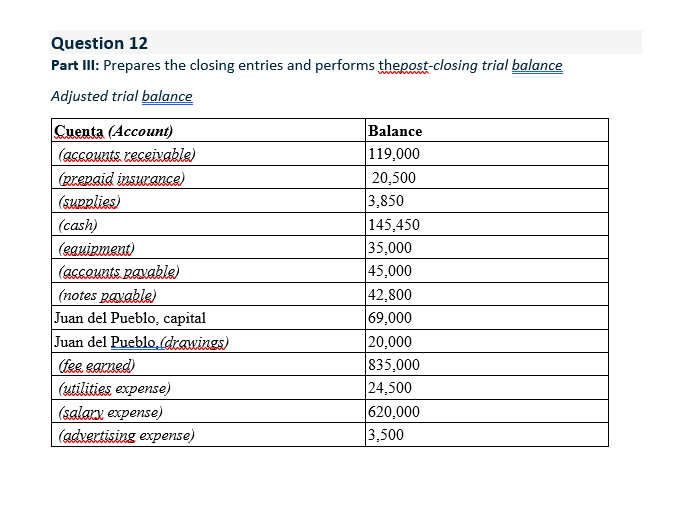

Transcribed Image Text:Question 12

Part III: Prepares the closing entries and performs thepost-closing trial balance

wwwh

Adjusted trial balance

Cuenta (Account)

(acceunts receivakle)

(prepaid insurance)

Balance

119,000

20,500

3,850

145,450

35,000

45,000

42,800

69,000

20,000

835,000

24,500

620,000

3,500

(supplies)

(cash)

(eauinment)

(acceunts RANakle)

(notes pavable)

Juan del Pueblo, capital

Juan del Pueblo,ldrawings)

(fee eamed)

(utilities expense)

(salary expense)

(advertising expense)

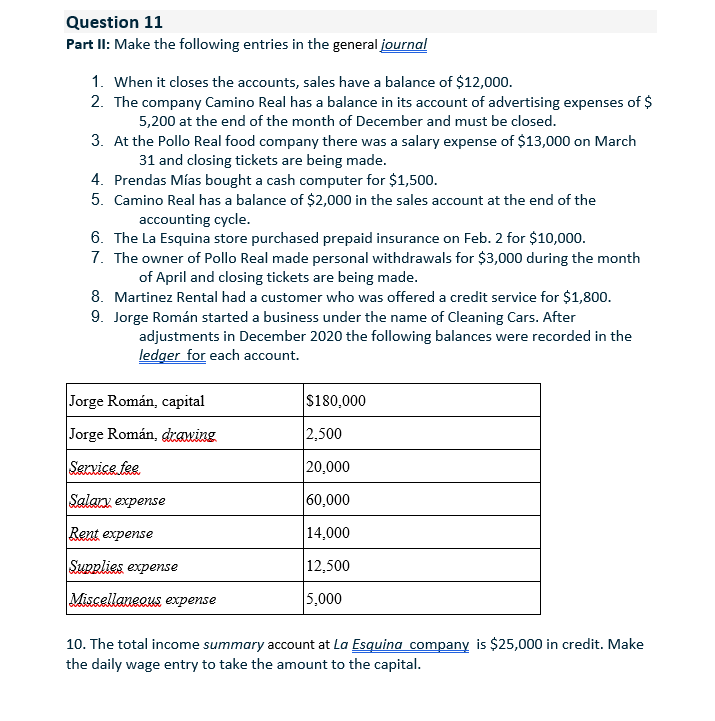

Transcribed Image Text:Question 11

Part II: Make the following entries in the general journal

1. When it closes the accounts, sales have a balance of $12,000.

2. The company Camino Real has a balance in its account of advertising expenses of $

5,200 at the end of the month of December and must be closed.

3. At the Pollo Real food company there was a salary expense of $13,000 on March

31 and closing tickets are being made.

4. Prendas Mías bought a cash computer for $1,500.

5. Camino Real has a balance of $2,000 in the sales account at the end of the

accounting cycle.

6. The La Esquina store purchased prepaid insurance on Feb. 2 for $10,000.

7. The owner of Pollo Real made personal withdrawals for $3,000 during the month

of April and closing tickets are being made.

8. Martinez Rental had a customer who was offered a credit service for $1,800.

9. Jorge Román started a business under the name of Cleaning Cars. After

adjustments in December 2020 the following balances were recorded in the

ledger for each account.

Jorge Román, capital

$180,000

Jorge Román, drawing

2,500

Service fee

20,000

Salary expense

60,000

Rent expense

14,000

Supplies expense

12,500

Miscellaneous expense

5,000

10. The total income summary account at La Esquina company is $25,000 in credit. Make

the daily wage entry to take the amount to the capital.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning