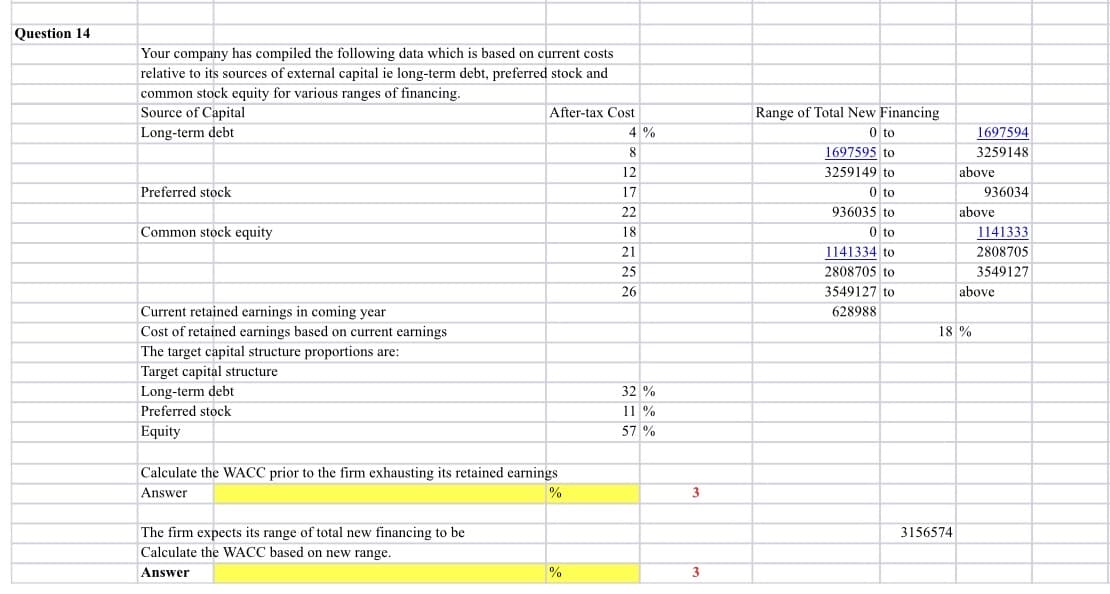

Question 14 Your company has compiled the following data which is based on current costs relative to its sources of external capital ie long-term debt, preferred stock and common stock equity for various ranges of financing. Source of Capital After-tax Cost Range of Total New Financing 0 to Long-term debt 4 % 1697594 8 1697595 to 3259148 12 3259149 to above Preferred stock 17 0 to 936034 22 936035 to above Common stock equity 18 0 to 1141333 21 1141334 to 2808705 25 2808705 to 3549127 26 3549127 to above Current retained earnings in coming year Cost of retained earnings based on current earnings 628988 18 % The target capital structure proportions are: Target capital structure Long-term debt 32 % Preferred stock 11 % Equity 57 %

Question 14 Your company has compiled the following data which is based on current costs relative to its sources of external capital ie long-term debt, preferred stock and common stock equity for various ranges of financing. Source of Capital After-tax Cost Range of Total New Financing 0 to Long-term debt 4 % 1697594 8 1697595 to 3259148 12 3259149 to above Preferred stock 17 0 to 936034 22 936035 to above Common stock equity 18 0 to 1141333 21 1141334 to 2808705 25 2808705 to 3549127 26 3549127 to above Current retained earnings in coming year Cost of retained earnings based on current earnings 628988 18 % The target capital structure proportions are: Target capital structure Long-term debt 32 % Preferred stock 11 % Equity 57 %

Fundamentals of Financial Management, Concise Edition (with Thomson ONE - Business School Edition, 1 term (6 months) Printed Access Card) (MindTap Course List)

8th Edition

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter13: Capital Structure And Leverage

Section: Chapter Questions

Problem 14SP: WACC AND OPTIMAL CAPITAL STRUCTURE Elliott Athletics is trying to determine its optimal capital...

Related questions

Question

100%

Transcribed Image Text:Question 14

Your company has compiled the following data which is based on current costs

relative to its sources of external capital ie long-term debt, preferred stock and

common stock equity for various ranges of financing.

Source of Capital

Long-term debt

After-tax Cost

Range of Total New Financing

4 %

0 to

1697594

8

1697595 to

3259148

12

3259149 to

above

Preferred stock

17

0 to

936034

22

936035 to

above

Common stock equity

18

0 to

1141333

21

1141334 to

2808705

25

2808705 to

3549127

26

3549127 to

above

Current retained earnings in coming year

Cost of retained earnings based on current earnings

628988

18 %

The target capital structure proportions are:

Target capital structure

Long-term debt

32 %

Preferred stock

11 %

Equity

57 %

Calculate the WACC prior to the firm exhausting its retained earnings

Answer

3

The firm expects its range of total new financing to be

Calculate the WACC based on new range.

3156574

Answer

3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning