WACC AND OPTIMAL CAPITAL STRUCTURE Elliott Athletics is trying to determine its optimal capital structure, which now consists of only debt and common equity. The firm dots not currently use

Elliott uses the

- a. What is the firm's optimal capital structure, and what would be its WACC at the optimal capital structure?

- b. If Elliott's managers anticipate that the company's business risk will increase in the future, what effect would this likely have on the firm's target capital structure?

- c. If Congress were to dramatically increase the corporate tax rate, what effect would this likely have on Elliott's target capital structure?

- d. Plot a graph of the after-tax cost of debt, the

cost of equity , and the WACC versus (1) - e. the debt/capital ratio and (2) the debt /equity ratio.

Trending nowThis is a popular solution!

Chapter 14 Solutions

Fundamentals of Financial Management (MindTap Course List)

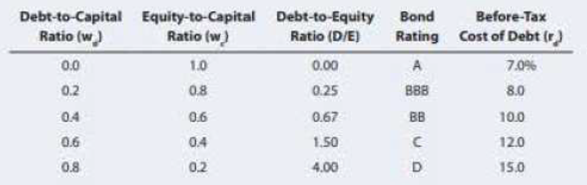

- WACC and Optimal Capital Structure F. Pierce Products Inc. is considering changing its capital structure. F. Pierce currently has no debt and no preferred stock, but it would like to add some debt to take advantage of low interest rates and the tax shield. Its investment banker has indicated that the pre-tax cost of debt under various possible capital structures would be as follows: F. Pierce uses the CAPM to estimate its cost of common equity, rs and at the time of the analysis the risk-free rate is 5%, the market risk premium is 6%, and the companys tax rate is 40%. F. Pierce estimates that its beta now (which is unlevered because it currently has no debt) is 0.8. Based on this information, what is the firms optimal capital structure, and what would be the weighted average cost of capital at the optimal capital structure?arrow_forwardWACC AND OPTIMAL CAPITAL STRUCTURE Elliott Athletics is trying to determine its optimal capital structure, which now consists of only debt and common equity. The firm does not currently use preferred stock in its capital structure, and it does not plan to do so in the future. Its treasury staff has consulted with investment bankers. On the basis of those discussions, the staff has created the following table showing the firm's debt cost at different debt levels: Elliott uses the CAPM to estimate its cost of common equity, rs, and estimates that the risk-free rate is 5%, the market risk premium is 6%, and its tax rate is 40%. Elliott estimates that if it had no debt, its unlevered beta, bU, would be 1.2. a. What is the firm's optimal capital structure, and what would be its WACC at the optimal capital structure? b. If Elliott's managers anticipate that the company's business risk will increase in the future, what effect would this likely have on the firm's target capital structure? c. If Congress were to dramatically increase the corporate tax rate, what effect would this likely have on Elliott's target capital structure? d. Plot a graph of the after-tax cost of debt, the cost of equity, and the WACC versus (1) the debt/capital ratio and (2) the debt/equity ratio.arrow_forwardAs a first step, we need to estimate what percentage of MMMs capital comes from debt, preferred stock, and common equity. This information can be found on the firms latest annual balance sheet. (As of year end 2014, MMM had no preferred stock.) Total debt includes all interest-bearing debt and is the sum of short-term debt and long-term debt. a. Recall that the weights used in the WACC are based on the companys target capital structure. If we assume that the company wants to maintain the same mix of capital that it currently has on its balance sheet, what weights should you use to estimate the WACC for MMM? b. Find MMMs market capitalization, which is the market value of its common equity. Using the sum of its short-term debt and long-term debt from the balance sheet (we assume that the market value of its debt equals its book value) and its market capitalization, recalculate the firms debt and common equity weights to be used in the WACC equation. These weights are approximations of market-value weights. Be sure not to include accruals in the debt calculation.arrow_forward

- The Rivoli Company has no debt outstanding, and its financial position is given by the following data: What is Rivoli’s intrinsic value of operations (i.e., its unlevered value)? What is its intrinsic stock price? Its earnings per share? Rivoli is considering selling bonds and simultaneously repurchasing some of its stock. If it moves to a capital structure with 30% debt based on market values, its cost of equity, rs, will increase to 12% to reflect the increased risk. Bonds can be sold at a cost, rd, of 7%. Based on the new capital structure, what is the new weighted average cost of capital? What is the levered value of the firm? What is the amount of debt? Based on the new capital structure, what is the new stock price? What is the remaining number of shares? What is the new earnings per share?arrow_forwardOPTIMAL CAPITAL STRUCTURE Jackson Trucking Company is the process of setting its target capital structure. The CFO belives that the optimal debt to capital ratio is somewhere between 20% and 50% and her staff has compiled the following projections for EPS and the stock price at various debt levels: Debt/Capital Ratio Projected EPS Projected Stock Price 20% $3.20 $35.00 30 3.45 36.50 40 3.75 36.25 50 3.50 35.50 Assuming that the firm uses only debt and common equity, what is Jackson's Optimal Capital structure? At what debt-to-capital ratio is the company's WACC Minimized?arrow_forwardOPTIMAL CAPITAL STRUCTURE Terrell Trucking Company is in the process of setting its target capital structure. The CFO believes that the optimal debt-to-capital ratio is somewhere between 20% and 50%, and her staff has compiled the following projections for EPS and the stock price at various debt levels: Debt/Capital Ratio Projected EPS Projected Stock Price20% $3.10 $34.2530 3.55 36.0040 3.70 35.5050 3.55 34.00Assuming that the firm uses only debt and common equity, what is Terrell’s optimal capital structure? At what debt-to-capital ratio is the company’s WACC minimized?arrow_forward

- Which of the following statements regarding the capital structure is CORRECT? Group of answer choices: According to the M&M theory under perfect market assumptions, the value of a firm with no debt is the same as that with 100% debt. A firm's optimal capital structure is one that maximizes both its expected EPS and stock price. The pecking order model predicts that the equity financing is more preferred to debt financing. According to the M&M theory, if only corporate taxes are considered, the optimal capital structure is one with 0% debt financing. According to the static tradeoff model, a firm's optimal capital structure can be obtained by considering the debt-related costs only.arrow_forwardThe Cost of Capital: Cost of New Common Stock If a firm plans to issue new stock, flotation costs (investment bankers' fees) should not be ignored. There are two approaches to use to account for flotation costs. The first approach is to add the sum of flotation costs for the debt, preferred, and common stock and add them to the initial investment cost. Because the investment cost is increased, the project's expected return is reduced so it may not meet the firm's hurdle rate for acceptance of the project. The second approach involves adjusting the cost of common equity as follows:The difference between the flotation-adjusted cost of equity and the cost of equity calculated without the flotation adjustment represents the flotation cost adjustment. Quantitative Problem: Barton Industries expects next year's annual dividend, D1, to be $1.80 and it expects dividends to grow at a constant rate g = 4.2%. The firm's current common stock price, P0, is $20.60. If it needs to issue new common…arrow_forwardF. Pierce Products Inc. is considering changing its capital structure. F. Pierce currentlyhas no debt and no preferred stock, but it would like to add some debt to takeadvantage of low interest rates and the tax shield. Its investment banker has indicatedthat the pre-tax cost of debt under various possible capital structures would be asfollows:Market Debt-to-Value Ratio (wd) 0.0 0.2 0.4 0.6 0.8 Market Equity-to-Value Ratio (ws) 1.0 0.8 0.6 0.4 0.2 Market Debt-to-Equity Ratio (D/S) 0.00 0.25 0.67 1.50 4.00 Before-Tax Costof Debt (rd) 6.0% 7.0 8.0 9.0 10.0 F. Pierce uses the CAPM to estimate its cost of common equity, rs and at the time of theanalysis the risk-free rate is 5%, the market risk premium is 6%, and the company’s taxrate is 40%. F. Pierce estimates that its beta now (which is “unlevered” because itcurrently has no debt) is 0.8. Based on this information, what is the firm’s optimalcapital structure, and what would be the weighted average cost of capital at the optimalcapital…arrow_forward

- North Star is trying to determine its optimal capital structure, which now consists of only common equity. The firm will add debt to its capital structure if it minimizes its WACC, but the firm has no plans to use preferred stock in its capital structure. In addition, the firm’s size will remain the same, so funds obtained from debt issued will be used to repurchase stock. The percentage of shares repurchased will be equal to the percentage of debt added to the firm’s capital structure. (In other words, if the firm’s debt-to-capital ratio increases from 0 to 25%, then 25% of the shares outstanding will be repurchased.) North Star is a small firm with average sales of $25 million or less during the past 3 years, so it is exempt from the interest deduction limitation. Its treasury staff has consulted with investment bankers. On the basis of those discussions, the staff has created the following table showing the firm’s debt cost at different debt levels: Debt-to-Capital Ratio (Wd)…arrow_forwardNorth Star is trying to determine its optimal capital structure, which now consists of only common equity. The firm will add debt to its capital structure if it minimizes its WACC, but the firm has no plans to use preferred stock in its capital structure. In addition, the firm’s size will remain the same, so funds obtained from debt issued will be used to repurchase stock. The percentage of shares repurchased will be equal to the percentage of debt added to the firm’s capital structure. (In other words, if the firm’s debt-to-capital ratio increases from 0 to 25%, then 25% of the shares outstanding will be repurchased.) North Star is a small firm with average sales of $25 million or less during the past 3 years, so it is exempt from the interest deduction limitation. Its treasury staff has consulted with investment bankers. On the basis of those discussions, the staff has created the following table showing the firm’s debt cost at different debt levels: Debt-to-Capital Ratio (Wd)…arrow_forwardNorth Star is trying to determine its optimal capital structure, which now consists of only common equity. The firm will add debt to its capital structure if it minimizes its WACC, but the firm has no plans to use preferred stock in its capital structure. In addition, the firm’s size will remain the same, so funds obtained from debt issued will be used to repurchase stock. The percentage of shares repurchased will be equal to the percentage of debt added to the firm’s capital structure. (In other words, if the firm’s debt-to-capital ratio increases from 0 to 25%, then 25% of the shares outstanding will be repurchased.) North Star is a small firm with average sales of $25 million or less during the past 3 years, so it is exempt from the interest deduction limitation. Its treasury staff has consulted with investment bankers. On the basis of those discussions, the staff has created the following table showing the firm’s debt cost at different debt levels: Debt-to-Capital Ratio (Wd)…arrow_forward

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning