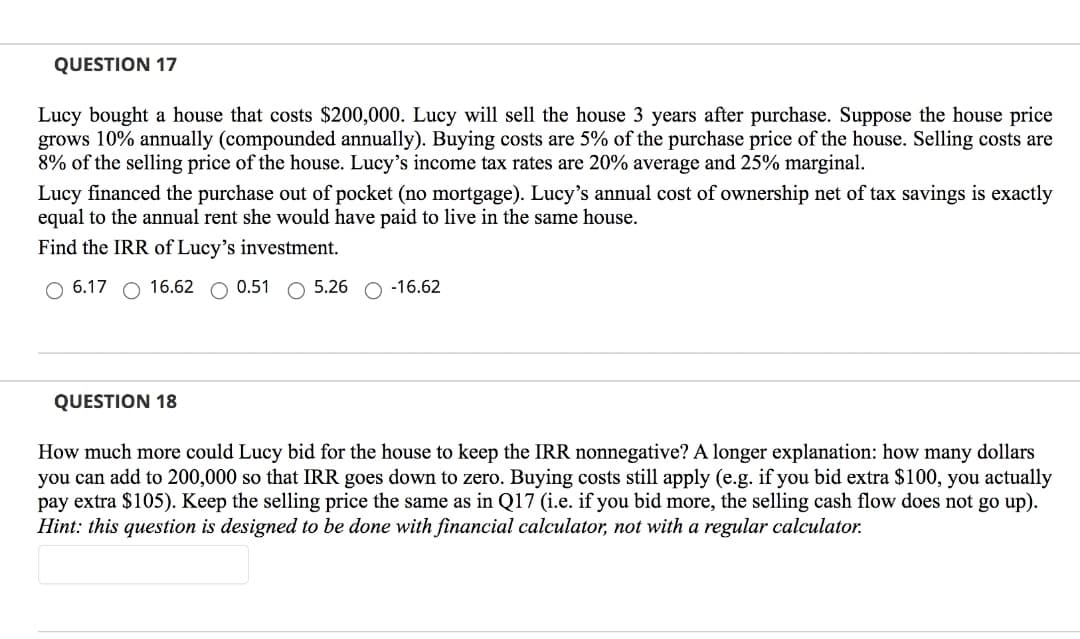

QUESTION 17 Lucy bought a house that costs $200,000. Lucy will sell the house 3 years after purchase. Suppose the house price grows 10% annually (compounded annually). Buying costs are 5% of the purchase price of the house. Selling costs are 8% of the selling price of the house. Lucy's income tax rates are 20% average and 25% marginal. Lucy financed the purchase out of pocket (no mortgage). Lucy's annual cost of ownership net of tax savings is exactly equal to the annual rent she would have paid to live in the same house. Find the IRR of Lucy's investment. O 6.17 16.62 O 0.51 O 5.26 O -16.62

QUESTION 17 Lucy bought a house that costs $200,000. Lucy will sell the house 3 years after purchase. Suppose the house price grows 10% annually (compounded annually). Buying costs are 5% of the purchase price of the house. Selling costs are 8% of the selling price of the house. Lucy's income tax rates are 20% average and 25% marginal. Lucy financed the purchase out of pocket (no mortgage). Lucy's annual cost of ownership net of tax savings is exactly equal to the annual rent she would have paid to live in the same house. Find the IRR of Lucy's investment. O 6.17 16.62 O 0.51 O 5.26 O -16.62

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.12AMCP

Related questions

Question

Transcribed Image Text:QUESTION 17

Lucy bought a house that costs $200,000. Lucy will sell the house 3 years after purchase. Suppose the house price

grows 10% annually (compounded annually). Buying costs are 5% of the purchase price of the house. Selling costs are

8% of the selling price of the house. Lucy's income tax rates are 20% average and 25% marginal.

Lucy financed the purchase out of pocket (no mortgage). Lucy's annual cost of ownership net of tax savings is exactly

equal to the annual rent she would have paid to live in the same house.

Find the IRR of Lucy's investment.

O 6.17

16.62 O 0.51 O 5.26 O -16.62

QUESTION 18

How much more could Lucy bid for the house to keep the IRR nonnegative? A longer explanation: how many dollars

you can add to 200,000 so that IRR goes down to zero. Buying costs still apply (e.g. if you bid extra $100, you actually

pay extra $105). Keep the selling price the same as in Q17 (i.e. if you bid more, the selling cash flow does not go up).

Hint: this question is designed to be done with financial calculator, not with a regular calculator.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning