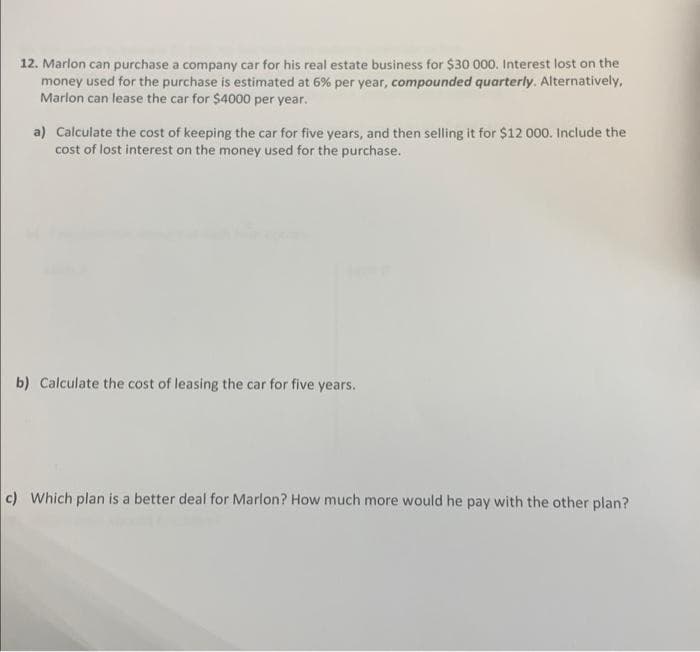

12. Marlon can purchase a company car for his real estate business for $30 000. Interest lost on the money used for the purchase is estimated at 6% per year, compounded quarterly. Alternatively, Marlon can lease the car for $4000 per year. a) Calculate the cost of keeping the car for five years, and then selling it for $12 000. Include the cost of lost interest on the money used for the purchase. b) Calculate the cost of leasing the car for five years. c) Which plan is a better deal for Marlon? How much more would he pay with the other plan?

12. Marlon can purchase a company car for his real estate business for $30 000. Interest lost on the money used for the purchase is estimated at 6% per year, compounded quarterly. Alternatively, Marlon can lease the car for $4000 per year. a) Calculate the cost of keeping the car for five years, and then selling it for $12 000. Include the cost of lost interest on the money used for the purchase. b) Calculate the cost of leasing the car for five years. c) Which plan is a better deal for Marlon? How much more would he pay with the other plan?

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 7EB: Kenzie purchased a new 3-D printer for $450,000. Although this printer is expected to last for ten...

Related questions

Question

Transcribed Image Text:12. Marlon can purchase a company car for his real estate business for $30 000. Interest lost on the

money used for the purchase is estimated at 6% per year, compounded quarterly. Alternatively,

Marlon can lease the car for $4000 per year.

a) Calculate the cost of keeping the car for five years, and then selling it for $12 000. Include the

cost of lost interest on the money used for the purchase.

b) Calculate the cost of leasing the car for five years.

c) Which plan is a better deal for Marlon? How much more would he pay with the other plan?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT