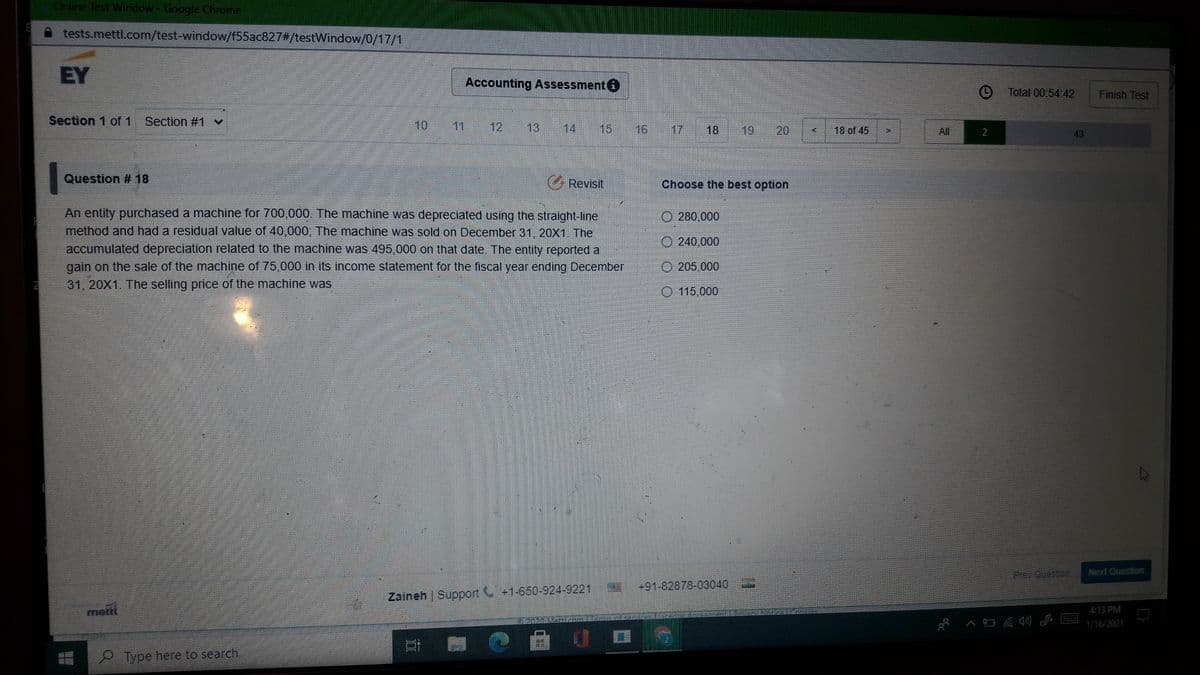

Question # 18 G Revisit Choose the best option An entity purchased a machine for 700,000. The machine was depreciated using the straight-line method and had a residual value of 40,000; The machine was sold on December 31, 20X1. The O 280,000 O 240,000 accumulated depreciation related to the machine was 495,000 on that date. The entity reported a gain on the sale of the machine of 75,000 in its income statement for the fiscal year ending December O 205.000 31, 20X1. The selling price of the machine was O 115,000

Question # 18 G Revisit Choose the best option An entity purchased a machine for 700,000. The machine was depreciated using the straight-line method and had a residual value of 40,000; The machine was sold on December 31, 20X1. The O 280,000 O 240,000 accumulated depreciation related to the machine was 495,000 on that date. The entity reported a gain on the sale of the machine of 75,000 in its income statement for the fiscal year ending December O 205.000 31, 20X1. The selling price of the machine was O 115,000

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 4.7C

Related questions

Question

Transcribed Image Text:Online Test Window- Google Chrome

tests.mettl.com/test-window/f55ac827#/testWindow/0/17/1

EY

Accounting Assessment O

Total 00:54:42

Finish Test

Section 1 of 1

Section #1 v

10

11

12

13

14 15

16 17

19

18

18 of 45

All

43

Question # 18

G Revisit

Choose the best option

An entity purchased a machine for 700,000. The machine was depreciated using the straight-line

method and had a residual value of 40,000, The machine was sold on December 31, 20X1. The

accumulated depreciation related to the machine was 495,000 on that date. The entity reported a

O 280,000

O 240,000

O 205,000

gain on the sale of the machine of 75,000 in its income statement for the fiscal year ending December

31, 20X1. The selling price of the machine was

O 115,000

Prev Questen

Next Question

+91-82878-03040

Zaineh | Support +1-650-924-9221

metti

4:13 PM

1/16/2021

Type here to search

20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you