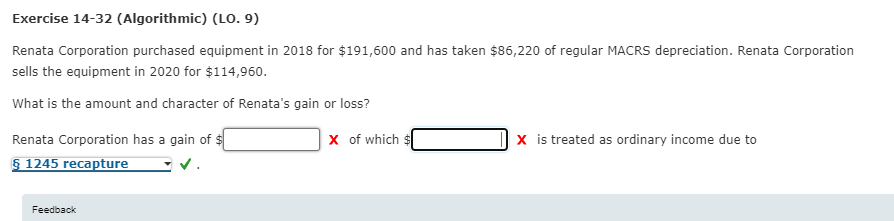

Exercise 14-32 (Algorithmic) (LO. 9) Renata Corporation purchased equipment in 2018 for $191,600 and has taken $86,220 of regular MACRS depreciation. Renata Corporation sells the equipment in 2020 for $114,960. What is the amount and character of Renata's gain or loss? Renata Corporation has a gain of $ § 1245 recapture X of which $ X is treated as ordinary income due to Feedback

Exercise 14-32 (Algorithmic) (LO. 9) Renata Corporation purchased equipment in 2018 for $191,600 and has taken $86,220 of regular MACRS depreciation. Renata Corporation sells the equipment in 2020 for $114,960. What is the amount and character of Renata's gain or loss? Renata Corporation has a gain of $ § 1245 recapture X of which $ X is treated as ordinary income due to Feedback

Chapter14: Property Transactions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 32CE

Related questions

Question

please help me resolve correctly

Transcribed Image Text:Exercise 14-32 (Algorithmic) (L0. 9)

Renata Corporation purchased equipment in 2018 for $191,600 and has taken $86,220 of regular MACRS depreciation. Renata Corporation

sells the equipment in 2020 for $114,960.

What is the amount and character of Renata's gain or loss?

Renata Corporation has a gain of $

§ 1245 recapture

x of which $

X is treated as ordinary income due to

Feedback

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College