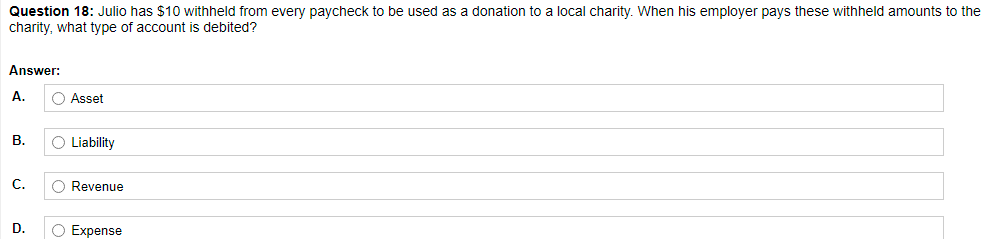

Question 18: Julio has $10 withheld from every paycheck to be used as a donation to a local charity. When his employer pays these withheld amounts to the charity, what type of account is debited? Answer: A. O Asset В. O Liability C. O Revenue D. O Expense

Question 18: Julio has $10 withheld from every paycheck to be used as a donation to a local charity. When his employer pays these withheld amounts to the charity, what type of account is debited? Answer: A. O Asset В. O Liability C. O Revenue D. O Expense

Chapter1: Federal Income Taxation—an Overview

Section: Chapter Questions

Problem 51P: Darrell is an employee of Whitneys. During the current year, Darrells salary is 136,000. Whitneys...

Related questions

Question

100%

Transcribed Image Text:Question 18: Julio has $10 withheld from every paycheck to be used as a donation to a local charity. When his employer pays these withheld amounts to the

charity, what type of account is debited?

Answer:

A.

O Asset

В.

O Liability

C.

O Revenue

D.

O Expense

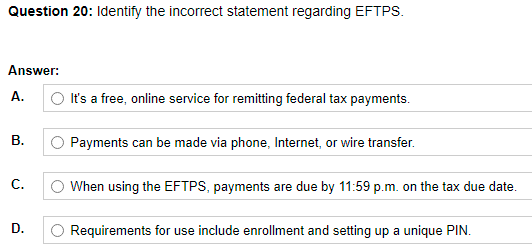

Transcribed Image Text:Question 20: Identify the incorrect statement regarding EFTPS.

Answer:

А.

O It's a free, online service for remitting federal tax payments.

В.

O Payments can be made via phone, Internet, or wire transfer.

С.

When using the EFTPS, payments are due by 11:59 p.m. on the tax due date.

D.

O Requirements for use include enrollment and setting up a unique PIN.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you