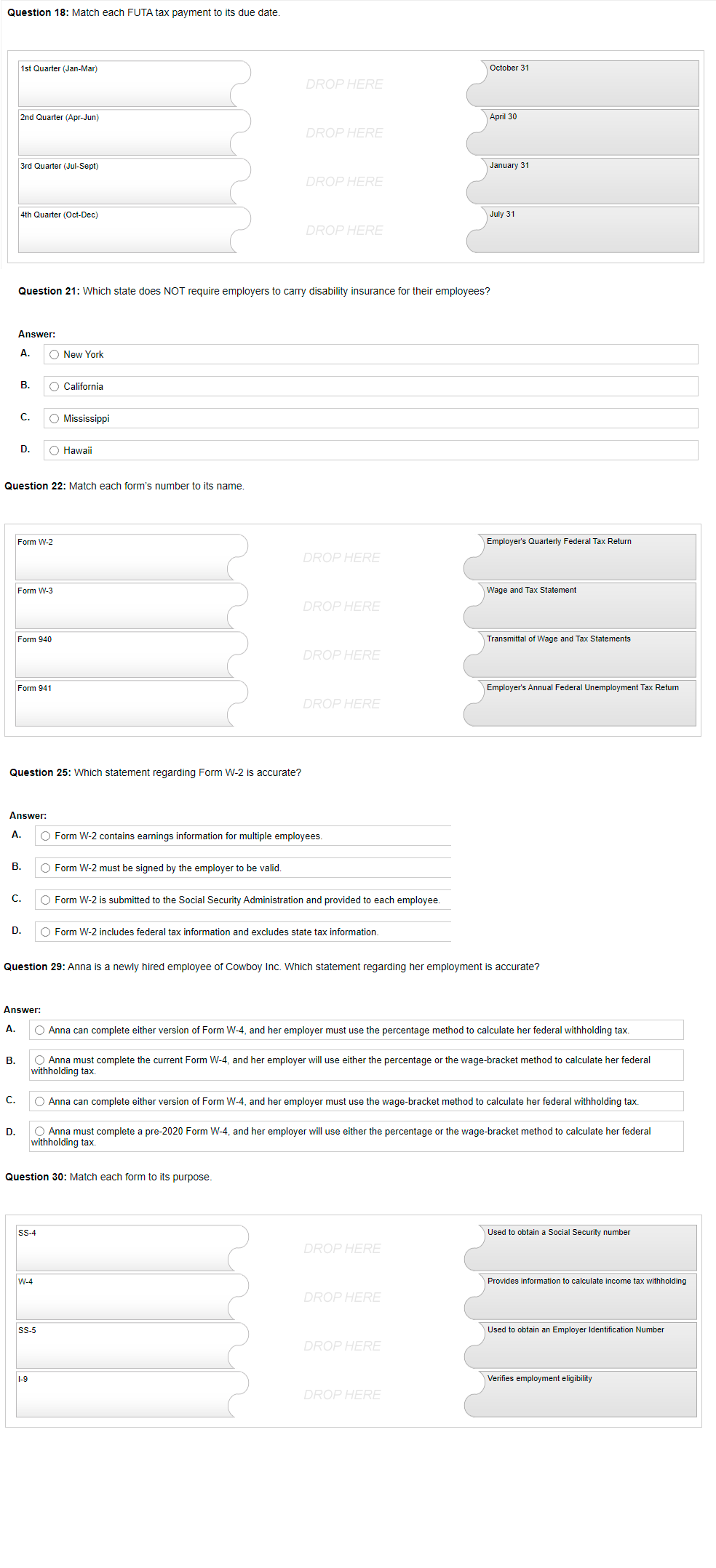

Question 18: Match each FUTA tax payment to its due date. 1st Quarter (Jan-Mar) October 31 DROP HERE 2nd Quarter (Apr-Jun) April 30 DROP HERE 3rd Quarter (Jul-Sept) January 31 DROP HERE 4th Quarter (Oct-Dec) July 31 DROP HERE

Question 18: Match each FUTA tax payment to its due date. 1st Quarter (Jan-Mar) October 31 DROP HERE 2nd Quarter (Apr-Jun) April 30 DROP HERE 3rd Quarter (Jul-Sept) January 31 DROP HERE 4th Quarter (Oct-Dec) July 31 DROP HERE

Chapter3: Social Security Taxes

Section: Chapter Questions

Problem 1MQ: _____1. Employees FICA tax rates A. Severance pay _____2. Form SS-4 B. By the 15th day of the...

Related questions

Question

Transcribed Image Text:Question 18: Match each FUTA tax payment to its due date.

1st Quarter (Jan-Mar)

October 31

DROP HERE

2nd Quarter (Apr-Jun)

April 30

DROP HERE

3rd Quarter (Jul-Sept)

January 31

DROP HERE

4th Quarter (Oct-Dec)

July 31

DROP HERE

Question 21: Which state does NOT require employers to carry disability insurance for their employees?

Answer:

A.

O New York

В.

O California

C.

O Mississippi

D.

O Hawaii

Question 22: Match each form's number to its name.

Form W-2

Employer's Quarterly Federal Tax Return

DROP HERE

Form W-3

Wage and Tax Statement

DROP HERE

Form 940

Transmittal of Wage and Tax Statements

DROP HERE

Form 941

Employer's Annual Federal Unemployment Tax Return

DROP HERE

Question 25: Which statement regarding Form W-2 is accurate?

Answer:

A.

O Form W-2 contains earnings information for multiple employees.

В.

O Form W-2 must be signed by the employer to be valid.

C.

O Form W-2 is submitted to the Social Security Administration and provided to each employee.

D.

O Form W-2 includes federal tax information and excludes state tax information.

Question 29: Anna is a newly hired employee of Cowboy Inc. Which statement regarding her employment is accurate?

Answer:

A.

O Anna can complete either version of Form W-4, and her employer must use the percentage method to calculate her federal withholding tax.

O Anna must complete the current Form W-4, and her employer will use either the percentage or the wage-bracket method to calculate her federal

withholding tax.

В.

C.

O Anna can complete either version of Form W-4, and her employer must use the wage-bracket method to calculate her federal withholding tax.

D.

O Anna must complete a pre-2020 Form W-4, and her employer will use either the percentage or the wage-bracket method to calculate her federal

withholding tax.

Question 30: Match each form to its purpose.

SS-4

Used to obtain a Social Security number

DROP HERE

W-4

Provides information to calculate income tax withholding

DROP HERE

SS-5

Used to obtain an Employer Identification Number

DROP HERE

1-9

Verifies employment eligibility

DROP HERE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage