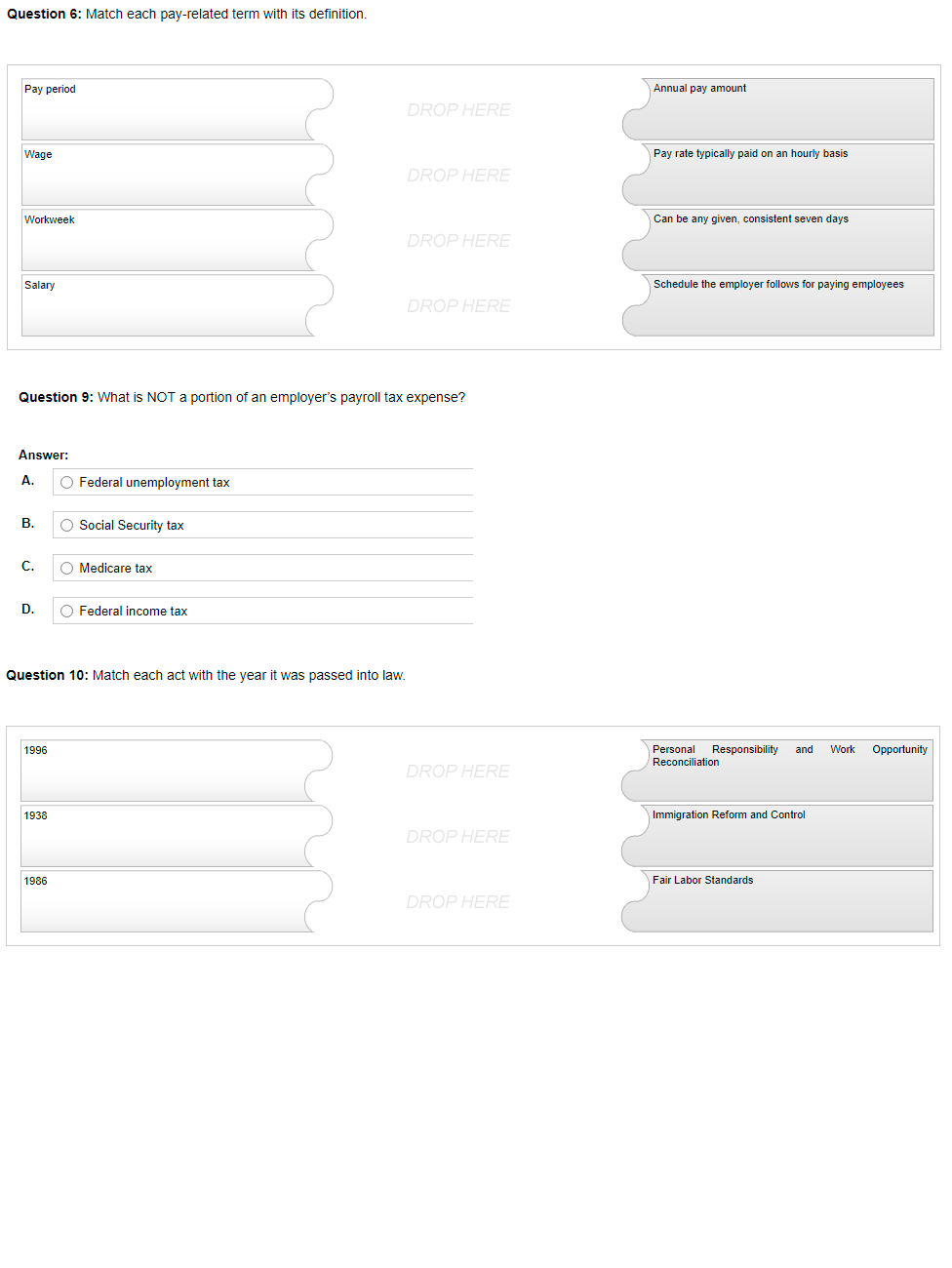

Question 6: Match each pay-related term with its definition. Pay period Annual pay amount DROP HERE Wage Pay rate typically paid on an hourly basis DROP HERE Workweek Can be any given, consistent seven days DROP HERE Salary Schedule the employer follows for paying employees DROP HERE

Question 6: Match each pay-related term with its definition. Pay period Annual pay amount DROP HERE Wage Pay rate typically paid on an hourly basis DROP HERE Workweek Can be any given, consistent seven days DROP HERE Salary Schedule the employer follows for paying employees DROP HERE

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 12EB: Reference Figure 12.15 and use the following information to complete the requirements. A. Determine...

Related questions

Question

Transcribed Image Text:Question 6: Match each pay-related term with its definition.

Pay period

Annual pay amount

DROP HERE

Wage

Pay rate typically paid on an hourly basis

DROP HERE

Workweek

Can be any given, consistent seven days

DROP HERE

Salary

Schedule the employer follows for paying employees

DROP HERE

Question 9: What is NOT a portion of an employer's payroll tax expense?

Answer:

A.

O Federal unemployment tax

В.

O Social Security tax

C.

O Medicare tax

D.

O Federal income tax

Question 10: Match each act with the year it was passed into law.

1996

Personal

Responsibility

and

Work

Opportunity

Reconciliation

DROP HERE

1938

Immigration Reform and Control

DROP HERE

1986

Fair Labor Standards

DROP HERE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning