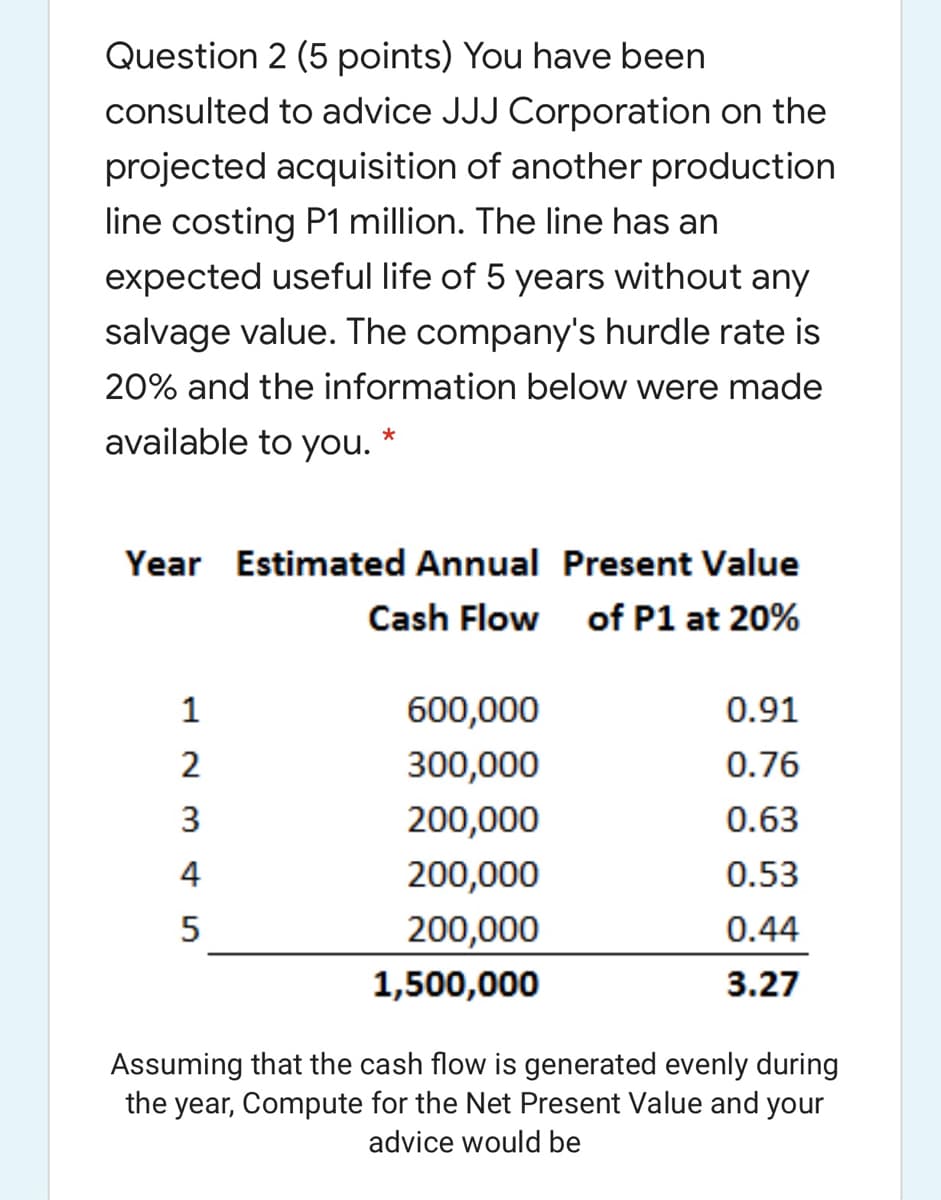

Question 2 (5 points) You have been consulted to advice JJJ Corporation on the projected acquisition of another production line costing P1 million. The line has an expected useful life of 5 years without any salvage value. The company's hurdle rate is 20% and the information below were made available to you. Year Estimated Annual Present Value Cash Flow of P1 at 20% 1 600,000 0.91 2 300,000 0.76 3 200,000 0.63 4 200,000 0.53 5 200,000 0.44 1,500,000 3.27 Assuming that the cash flow is generated evenly during the year, Compute for the Net Present Value and your advice would be

Question 2 (5 points) You have been consulted to advice JJJ Corporation on the projected acquisition of another production line costing P1 million. The line has an expected useful life of 5 years without any salvage value. The company's hurdle rate is 20% and the information below were made available to you. Year Estimated Annual Present Value Cash Flow of P1 at 20% 1 600,000 0.91 2 300,000 0.76 3 200,000 0.63 4 200,000 0.53 5 200,000 0.44 1,500,000 3.27 Assuming that the cash flow is generated evenly during the year, Compute for the Net Present Value and your advice would be

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 7E

Related questions

Question

Transcribed Image Text:Question 2 (5 points) You have been

consulted to advice JJJ Corporation on the

projected acquisition of another production

line costing P1 million. The line has an

expected useful life of 5 years without any

salvage value. The company's hurdle rate is

20% and the information below were made

available to you.

Year Estimated Annual Present Value

Cash Flow of P1 at 20%

1

600,000

0.91

2

300,000

0.76

3

200,000

0.63

200,000

0.53

200,000

0.44

1,500,000

3.27

Assuming that the cash flow is generated evenly during

the year, Compute for the Net Present Value and your

advice would be

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning