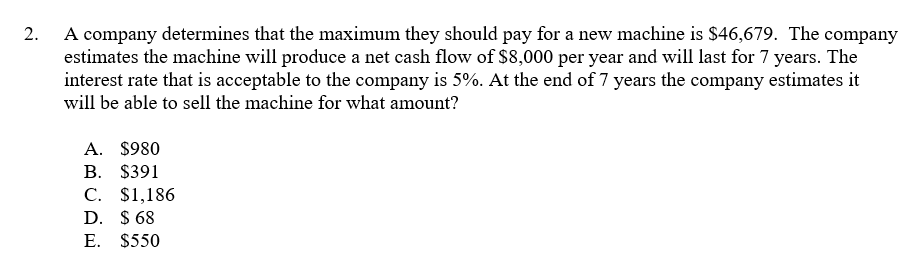

2. A company determines that the maximum they should pay for a new machine is $46,679. The company estimates the machine will produce a net cash flow of $8,000 per year and will last for 7 years. The interest rate that is acceptable to the company is 5%. At the end of 7 years the company estimates it will be able to sell the machine for what amount? A. $980 В. $391 С. S1,186 D. $ 68 E. $550

2. A company determines that the maximum they should pay for a new machine is $46,679. The company estimates the machine will produce a net cash flow of $8,000 per year and will last for 7 years. The interest rate that is acceptable to the company is 5%. At the end of 7 years the company estimates it will be able to sell the machine for what amount? A. $980 В. $391 С. S1,186 D. $ 68 E. $550

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 5PB: Mason, Inc., is considering the purchase of a patent that has a cost of $85000 and an estimated...

Related questions

Question

Please help answer

Transcribed Image Text:A company determines that the maximum they should pay for a new machine is $46,679. The company

estimates the machine will produce a net cash flow of $8,000 per year and will last for 7 years. The

interest rate that is acceptable to the company is 5%. At the end of 7 years the company estimates it

will be able to sell the machine for what amount?

2.

A. $980

В. $391

С. S1,186

D. $ 68

E. $550

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning