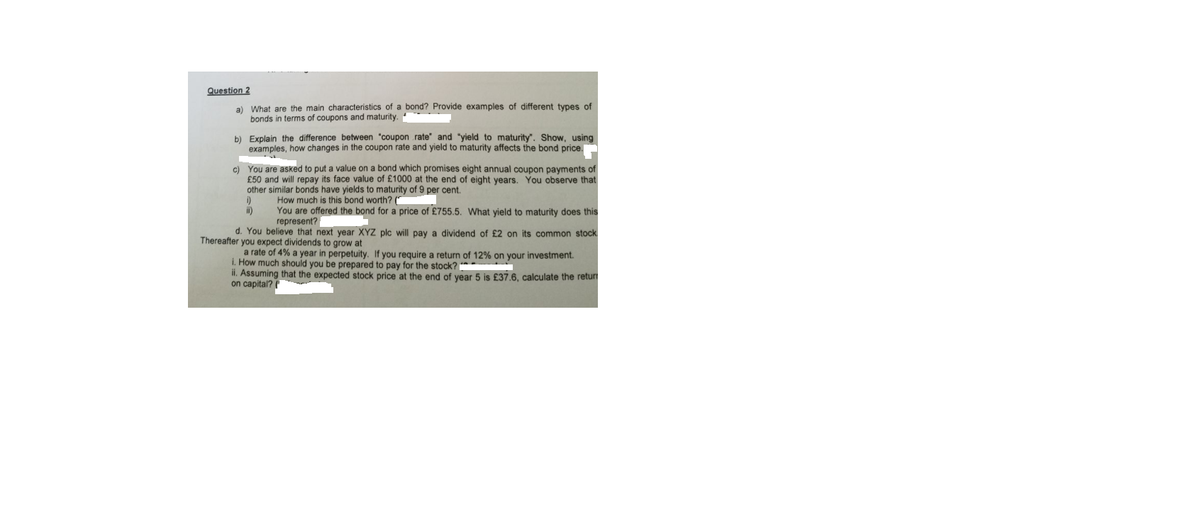

Question 2 a) What are the main characteristics of a bond? Provide examples of different types of bonds in terms of coupons and maturity. b) Explain the difference between "coupon rate" and "yield to maturity", Show, using examples, how changes in the coupon rate and yield to maturity affects the bond price. c) You are asked to put a value on a bond which promises eight annual coupon payments of £50 and will repay its face value of £1000 at the end of eight years. You observe that other similar bonds have yields to maturity of 9 per cent. i) i) How much is this bond worth? (" You are offered the bond for a price of £755.5. What yield to maturity does this represent? d. You believe that next year XYZ plc will pay a dividend of £2 on its common stock Thereafter you expect dividends to grow at a rate of 4% a year in perpetuity. If you require a return of 12% on your investment. i. How much should you be prepared to pay for the stock? ii. Assuming that the expected stock price at the end of year 5 is £37.6, calculate the retur on capital? (

Question 2 a) What are the main characteristics of a bond? Provide examples of different types of bonds in terms of coupons and maturity. b) Explain the difference between "coupon rate" and "yield to maturity", Show, using examples, how changes in the coupon rate and yield to maturity affects the bond price. c) You are asked to put a value on a bond which promises eight annual coupon payments of £50 and will repay its face value of £1000 at the end of eight years. You observe that other similar bonds have yields to maturity of 9 per cent. i) i) How much is this bond worth? (" You are offered the bond for a price of £755.5. What yield to maturity does this represent? d. You believe that next year XYZ plc will pay a dividend of £2 on its common stock Thereafter you expect dividends to grow at a rate of 4% a year in perpetuity. If you require a return of 12% on your investment. i. How much should you be prepared to pay for the stock? ii. Assuming that the expected stock price at the end of year 5 is £37.6, calculate the retur on capital? (

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter11: Notes, Bonds, And Leases

Section: Chapter Questions

Problem 31P

Related questions

Question

Transcribed Image Text:Question 2

a) What are the main characteristics of a bond? Provide examples of different types of

bonds in terms of coupons and maturity.

b) Explain the difference between "coupon rate" and "yield to maturity", Show, using

examples, how changes in the coupon rate and yield to maturity affects the bond price.

c) You are asked to put a value on a bond which promises eight annual coupon payments of

£50 and will repay its face value of £1000 at the end of eight years. You observe that

other similar bonds have yields to maturity of 9 per cent.

i)

i)

How much is this bond worth? ("

You are offered the bond for a price of £755.5. What yield to maturity does this

represent?

d. You believe that next year XYZ plc will pay a dividend of £2 on its common stock

Thereafter you expect dividends to grow at

a rate of 4% a year in perpetuity. If you require a return of 12% on your investment.

i. How much should you be prepared to pay for the stock?

ii. Assuming that the expected stock price at the end of year 5 is £37.6, calculate the retur

on capital? (

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning