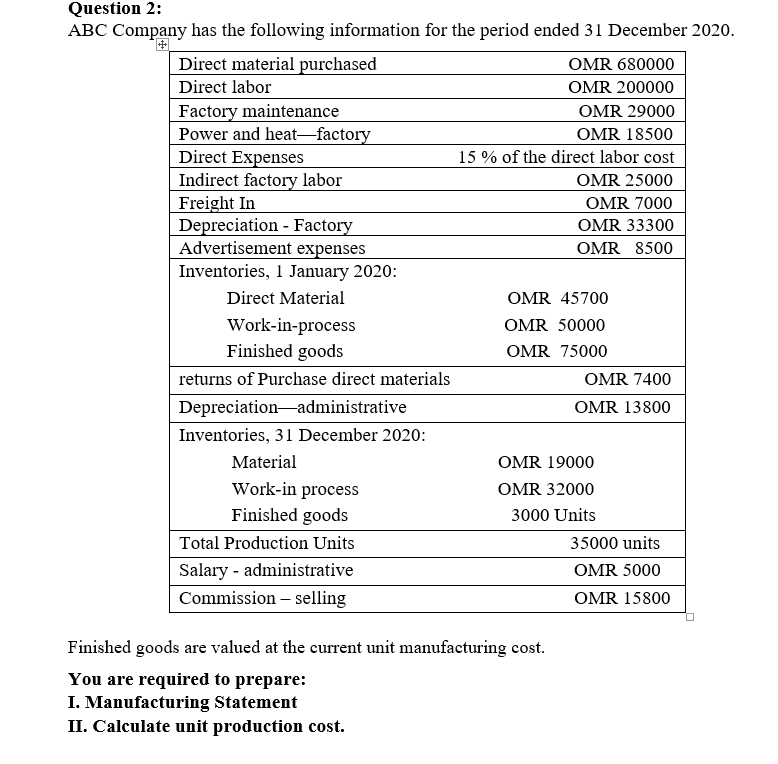

Question 2: ABC Company has the following information for the period ended 31 December 2020. Direct material purchased Direct labor Factory maintenance Power and heat- factory Direct Expenses Indirect factory labor Freight In Depreciation - Factory Advertisement expenses Inventories, 1 January 2020: OMR 680000 OMR 200000 OMR 29000 OMR 18500 15 % of the direct labor cost OMR 25000 OMR 7000 OMR 33300 OMR 8500 Direct Material OMR 45700 Work-in-process Finished goods OMR 50000 OMR 75000 returns of Purchase direct materials OMR 7400 Depreciation-administrative OMR 13800 Inventories, 31 December 2020: Material OMR 19000 Work-in process Finished goods OMR 32000 3000 Units Total Production Units 35000 units Salary - administrative OMR 5000 Commission – selling OMR 15800 Finished goods are valued at the current unit manufacturing cost. You are required to prepare: I. Manufacturing Statement II. Calculate unit production cost.

Question 2: ABC Company has the following information for the period ended 31 December 2020. Direct material purchased Direct labor Factory maintenance Power and heat- factory Direct Expenses Indirect factory labor Freight In Depreciation - Factory Advertisement expenses Inventories, 1 January 2020: OMR 680000 OMR 200000 OMR 29000 OMR 18500 15 % of the direct labor cost OMR 25000 OMR 7000 OMR 33300 OMR 8500 Direct Material OMR 45700 Work-in-process Finished goods OMR 50000 OMR 75000 returns of Purchase direct materials OMR 7400 Depreciation-administrative OMR 13800 Inventories, 31 December 2020: Material OMR 19000 Work-in process Finished goods OMR 32000 3000 Units Total Production Units 35000 units Salary - administrative OMR 5000 Commission – selling OMR 15800 Finished goods are valued at the current unit manufacturing cost. You are required to prepare: I. Manufacturing Statement II. Calculate unit production cost.

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter20: Process Cost Systems

Section: Chapter Questions

Problem 20.1APR: Entries for process cost system Pori Ormond Carpel Company manufactures carpets. Fiber is placed in...

Related questions

Question

100%

Transcribed Image Text:Question 2:

ABC Company has the following information for the period ended 31 December 2020.

「中

Direct material purchased

Direct labor

OMR 680000

OMR 200000

Factory maintenance

Power and heat-factory

Direct Expenses

Indirect factory labor

Freight In

Depreciation - Factory

Advertisement expenses

Inventories, 1 January 2020:

OMR 29000

OMR 18500

15 % of the direct labor cost

OMR 25000

OMR 7000

OMR 33300

OMR 8500

Direct Material

OMR 45700

Work-in-process

Finished goods

OMR 50000

OMR 75000

returns of Purchase direct materials

OMR 7400

Depreciation-administrative

OMR 13800

Inventories, 31 December 2020:

Material

OMR 19000

Work-in process

Finished goods

OMR 32000

3000 Units

Total Production Units

35000 units

Salary - administrative

OMR 5000

Commission – selling

OMR 15800

Finished goods are valued at the current unit manufacturing cost.

You are required to prepare:

I. Manufacturing Statement

II. Calculate unit production cost.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning